Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Banking and Financial Services

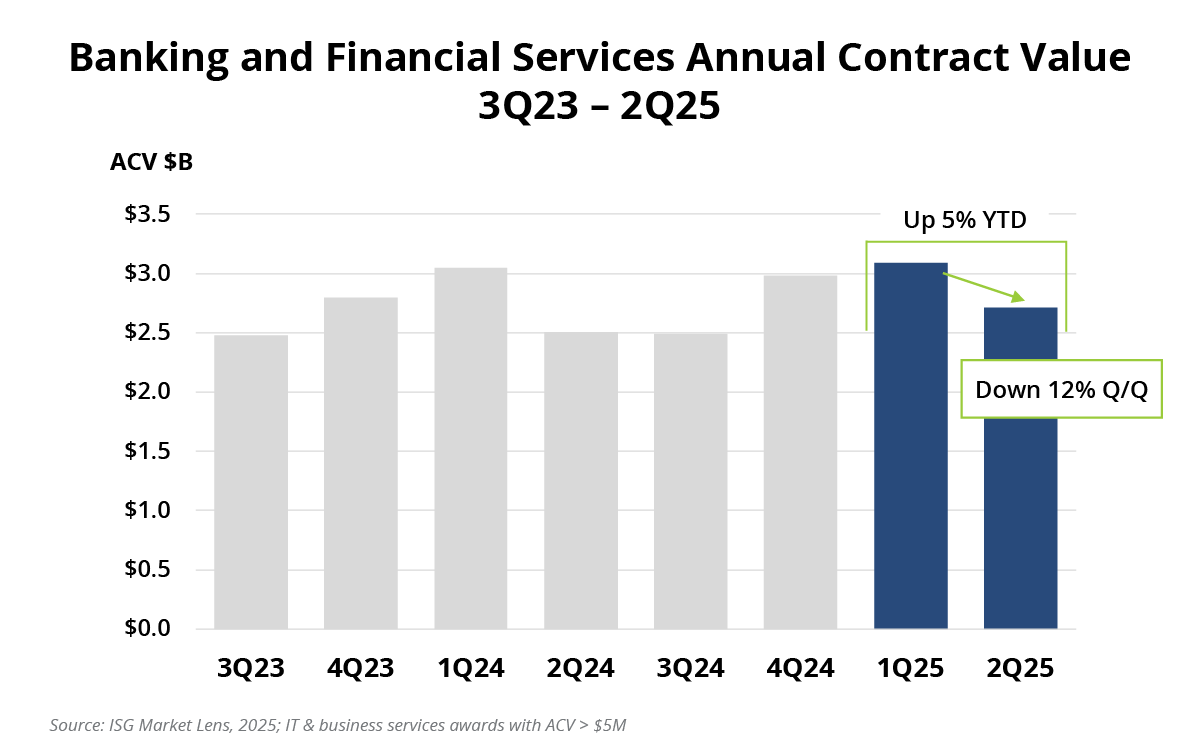

IT and business services bookings in the BFSI sector were back in positive territory through the first half of 2025 after a tough year in 2024. However, contract value was down quarter on quarter as business uncertainty remains elevated.

Data Watch

Background

The Details

- BFSI annual contract value is up 5% YTD, but down 12% Q/Q.

- The Americas region is up 20% YTD, while EMEA and Asia Pacific are down double digits.

- Large deal activity is strong, with ACV for deals of $50M or more up 28%; ACV for deals between $5-$9M is down 13% YTD.

What’s Next

You can see this somewhat mixed message reflected in what service providers are communicating to the market on earnings calls this week.

While only a handful of providers have reported as of this briefing, the consensus point of view could be summarized as something between “confident” and “guarded optimism.” This of course depends on the individual provider and their unique exposure to banking versus insurance, or North America versus other regions.

And while the macro environment has absolutely improved from 90 days ago, uncertainty remains high, which means we’ll likely continue to see a lot of focus on cost optimization and keeping discretionary spending tight.

Large deal activity will likely continue to be strong as BFSI firms roll up work to create more cost leverage and reduce complexity. Within these deals, legacy modernization (core operations, mainframe and contact center) will continue to be where much of the spending happens.

And of course, this will all have a strong AI / data flavor to it, as providers use a combination of intelligent automation – and increasingly simple and model-driven agents – to get this work done faster and at a price point that remains competitive in the hypercompetitive BFSI sector.