If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ATOS SEPARATION

This week, Atos announced a plan to split into two companies. It also announced that CEO Rodolphe Belmer is leaving after a nine-month stint at the company. Nourdine Bihmane and Philippe Oliva will take over as Deputy CEOs.

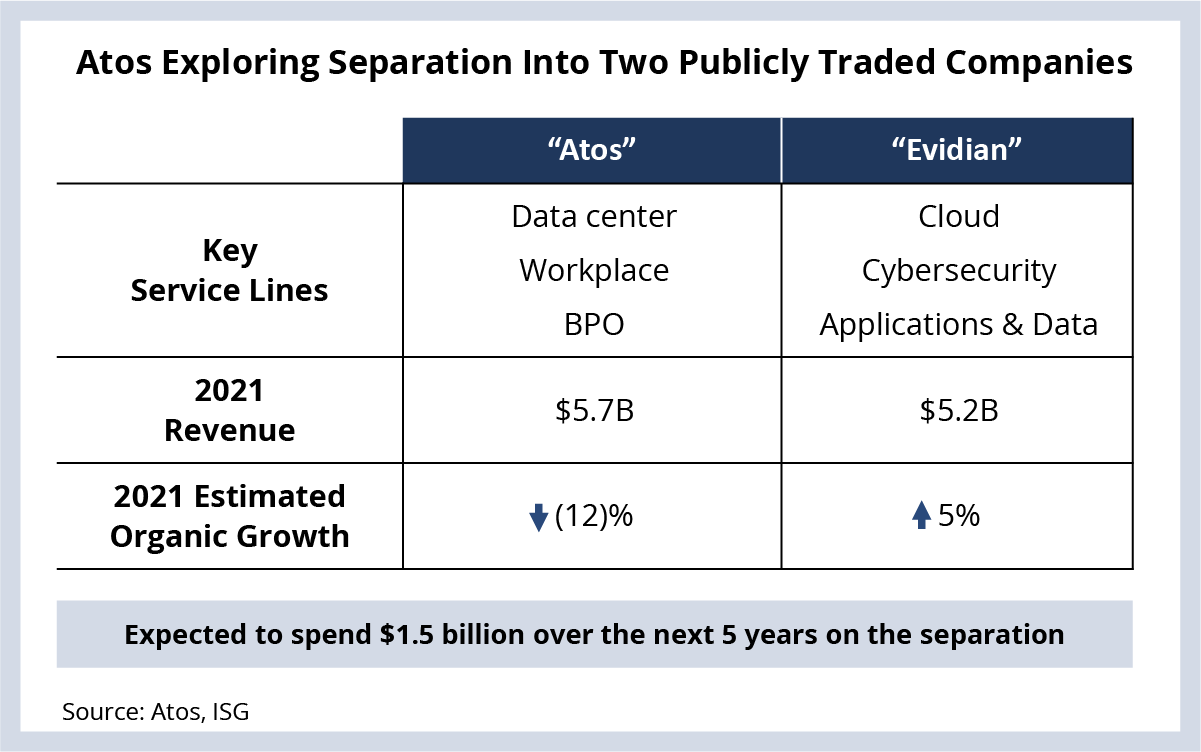

Atos intends to spin out its cloud, cybersecurity and analytics service lines into a new publicly traded company called Evidian. The remaining portion will retain the Atos brand and the ITO and BPO portions of the business with a primary focus on infrastructure – primarily data center and workplace services (see Data Watch).

The Market Evolved Faster than Atos

We’ve talked a lot over the past several years about the exponential growth of cloud. And this growth has come at the expense of many traditional IT services like data center outsourcing. It’s here – in the data center – where Atos thrived for many years.

But demand for data center outsourcing has fallen sharply. In 2021, data center annual contract value was down 11% from the prior year. Projected revenue growth for legacy Atos is following the same pattern – it’s estimated to be down 12% Y/Y.

To its credit, Atos did recognize the mammoth shift in the market. It invested heavily in its OneCloud platform and made a sizable acquisition in multi-cloud company CloudReach. But both of these occurred well after the shift to cloud really started to pick up in the second half of 2016.

Clients are Raising Concerns

Given the turbulence of the last two years, with a change in CEO and the near merger with DXC, Atos delivery quality has declined in some instances. And our most recent customer experience (CX) measurements show Atos’ overall CX score is below the market average. This is raising concerns about how the split may exacerbate existing delivery challenges.

By putting a potential subcontractor-type relationship in place between Atos and Evidian (where much of the digital talent will go), we expect client concerns around access to in-demand talent like cloud engineering and cybersecurity to intensify.

And the lingering possibility of an acquisition of the legacy Atos business sometime between now and 2026 (when Atos says that business will return to growth) will weigh on the minds of potential new clients as they consider the many alternatives available in the market.

A Big Opportunity for Evidian

However, the capabilities that will move with Evidian are in high demand. Atos’ cybersecurity capabilities are strong, and it has consistently ranked as a leader across several categories in our Provider Lens research. The nearly $4 billion of ACV with cybersecurity in scope that is up for renewal in the next two years bodes well for Evidian.

Cloud and apps are also moving with Evidian. We’ve discussed at length the strong relationship between cloud and ADM growth; ADM was up 40% Y/Y in 2021. Much of the growth in applications is due to growth in cloud services. And Evidian is likely to keep the high-performance computing solutions, which are key to its delivery execution.

Given all these capabilities, Evidian is estimating around 5% organic revenue growth, which is consistent with the 5.1% growth we’re projecting for the IT services sector in 2022.

Kyndryl Sets a Precedent

While the announcement of the spinoff is a surprise, and as of right now customer sentiment is generally negative, there is the possibility of more positive news on the horizon. The Kyndryl precedent shows how a spinoff like this can work for clients and employees who remain with the "legacy" part of the separated company.

Similar to Atos clients, IBM clients were deeply concerned upon first learning of the separation, but the Kyndryl spinoff is largely working. Six months after the announcement, layers inside the company have decreased, decisions are getting made faster, and on the whole, clients tell us the company is more transparent and easier to work with than before.

Clients Should Quickly Engage

Existing Atos clients and potential prospects should reach out to executive contacts. This may sound like mom-and-apple-pie advice, but overcommunication is key in these situations. Atos will anticipate many questions but not all of them.

And clients should also weigh the risk of changing providers. Though this can seem like the best course in the short term after a big announcement, staying with a provider that is going through a major transformation can work as the Kyndryl example has shown. The key is that executive leadership commits to making it work for both sides.

DATA WATCH