Before we jump into today’s briefing, I’m excited to let you know you can now access select ISG Index™ research for free. This includes presentations and Q&As from previous Index calls, provider leaderboards and Index Insider archives. Head over to the Index site here and click the “register” button if you are new to the site.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CONTACT CENTER

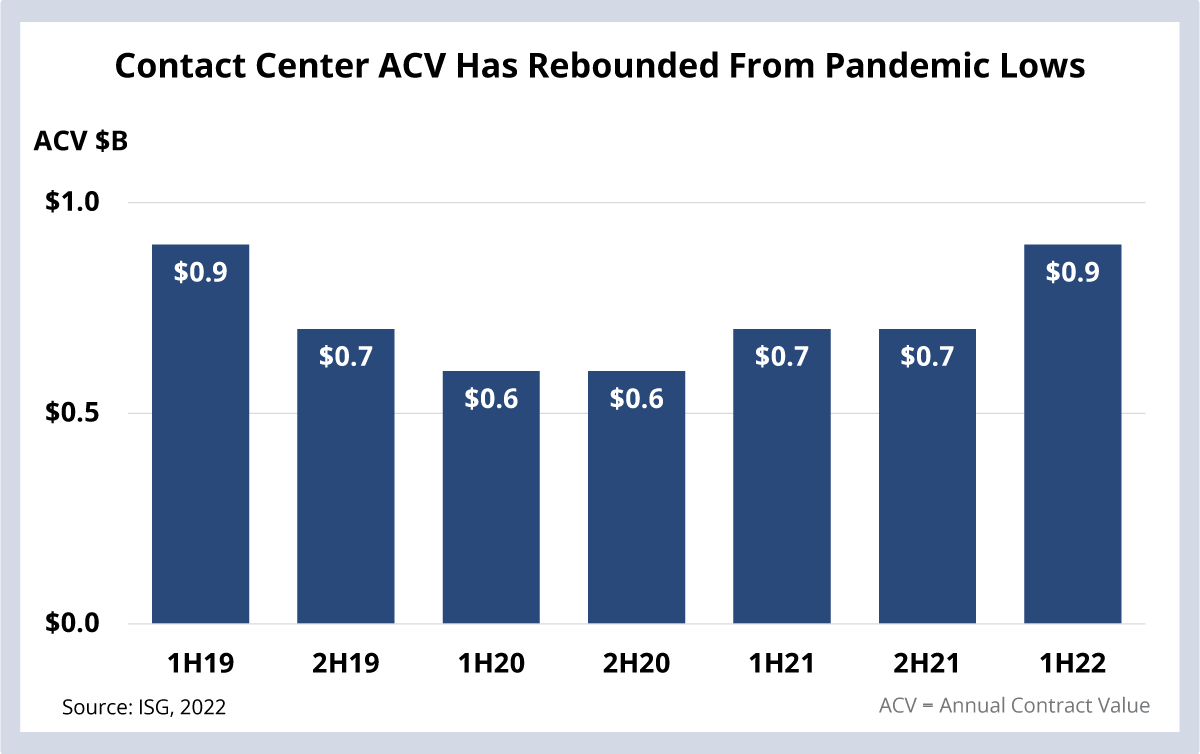

Contact center contracting activity has rebounded sharply from pandemic lows.

Background: The bottom fell out of the contact center sector in 2020 as consumer demand plummeted. ACV in the sector was down almost 25% compared to 2019.

Why It Matters:

Consumer demand returned in a big way in 2021. But switching costs are decreasing in just about every industry, which means companies must work harder to retain and support customers – no matter what channel they are using. Enterprises also need to be able to quickly scale up and down customer support as demand spikes and wanes – especially in today’s unpredictable macroeconomic environment. These factors have led to a surge in demand for customer experience (CX) services, which is in turn pumping up demand for contact center services.

The Details:

- In the first half of 2022, contact center ACV hit $900 million, up 30% YTD.

- There were 77 contact center awards in 1H22, the most since 2015.

- In the U.S., the top five providers by ACV activity are Alorica, Sitel, TTEC, Teleperformance and Telus International.

What's Next:

CX transformation is becoming an essential area of focus for enterprises, and many companies are using service providers to enable this transformation. However, contact center ACV is likely to be choppy as customer demand waxes and wanes across industries.

In response, providers are making big bets in:

- Human-centered AI to handle routine customer requests.

- Cloud-based technology to enable hybrid working models.

- Gig employee structures to address seasonal peaks and valleys.

DATA WATCH

PRICING

Growth in application outsourcing is changing the way providers charge for technology talent.

Background:

Historically, most of the pricing mechanisms used for outsourcing revolved around traditional rate cards or resource units linked to the underlying effort.

This is changing as enterprises do more application outsourcing and less infrastructure outsourcing (recall that ADM is now more than 60% of the ACV in the market). We have seen some providers increasingly use team-based daily rates that mask individual rates in favor of a blended daily rate.

The Details:

- Application outsourcing teams are typically built around application pods or a specific technology domain.

- They often include roles such as team leads, architects, designers and analysts.

- Seniority levels and location can vary greatly within each team.

Why It Matters:

The team-based rate approach aligns with the movement toward globally distributed pods that support products rather than outsourcing towers. Done correctly, this approach helps providers better manage their margins, as it gives them flexibility to mix and match skills, locations and seniority levels.

The team-based daily rate can also be more straightforward for enterprises as it enables them to focus on the outputs of the team rather than the inputs to get the work done. A drawback is that this approach is hard to benchmark. Also, if providers make changes to the makeup of the roles over time without proper management, it can result in lower productivity and quality.

What’s Next:

While using team-based rates is a growing trend, broadly accepted baselines and standard definitions across the sector are still emerging.