In this edition: Annual contract value in DACH is returning to historical levels. Swedish capital city signs seven-year full ITO deal. Concentrix makes $1.6 billion bet on customer experience.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

DACH

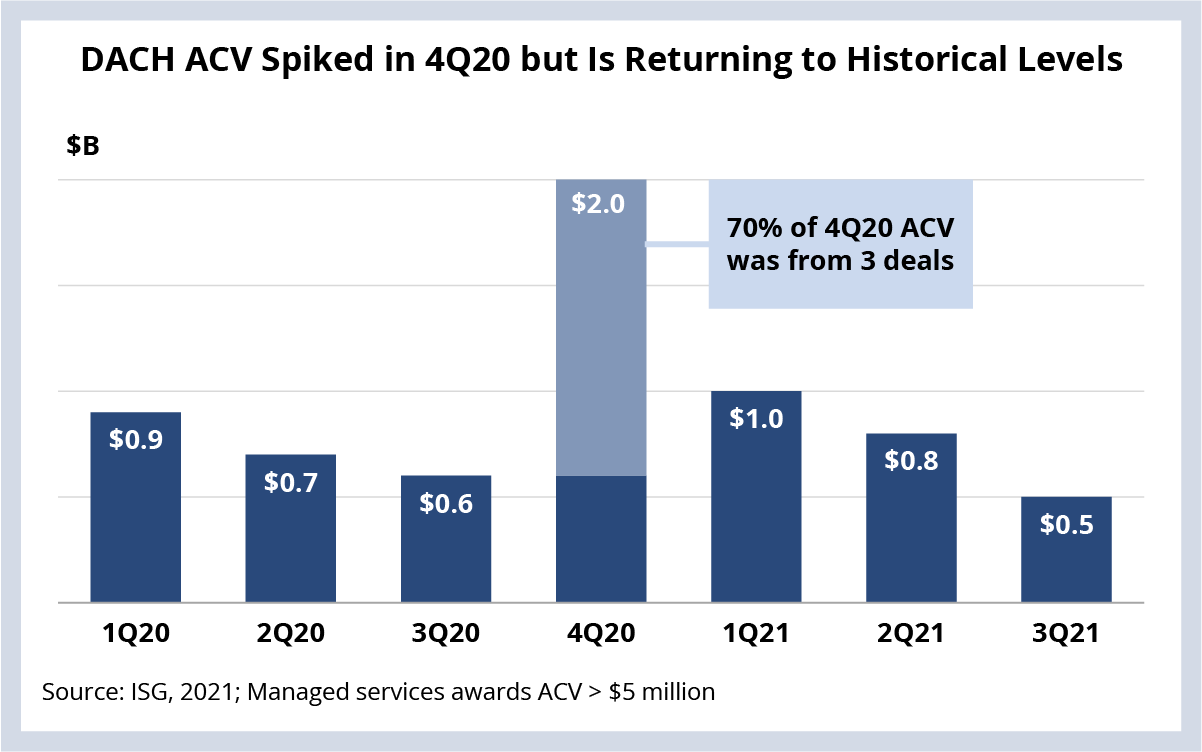

Historically, the DACH region has produced the second most ACV in Europe behind the U.K. On a YTD basis, bookings in DACH are up 10%. But, by the end of the year, the region’s ACV will more than likely be down compared to 2020. This isn’t a sign of weakness in the market – it’s just that ACV is returning to historical levels.

The DACH region had a blowout quarter in 4Q20 (see Data Watch). There was $2 billion of ACV signed that quarter, but nearly 70% of it came from just three deals: Daimler and Infosys, Postbank and TCS, and Siemens and Atos.

The big three industries that drive the majority of the ACV in the region are returning to historical levels as well. BFSI remains at around the same level as 2019, while life sciences, which had a big spike in 2019, and manufacturing, which had a banner year in 2020, have both settled back to their normal levels.

So, while a short-term view may indicate a soft year for a region or an industry, these results remind us of the importance of taking a longer-term view when comparing results in the IT services sector.

DATA WATCH

DEAL ACTIVITY

- City of Stockholm and TietoEVRY. Swedish capital signs seven-year full ITO deal (link).

- Proximus and Infosys. Largest telecom provider in Belgium signs application extension (link).

- South32 and TCS. Australian mining company modernizing applications and infrastructure (link).

- Waka Kotahi and Unisys. New Zealand transportation agency extends application and infrastructure relationship for 10 years (link).