In this edition: Infrastructure-as-a-Service is driving growth in applications contract value. IBM wins five-year finance and procurement BPO extension. Globant acquires a blockchain specialist.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

MARKET TRENDS

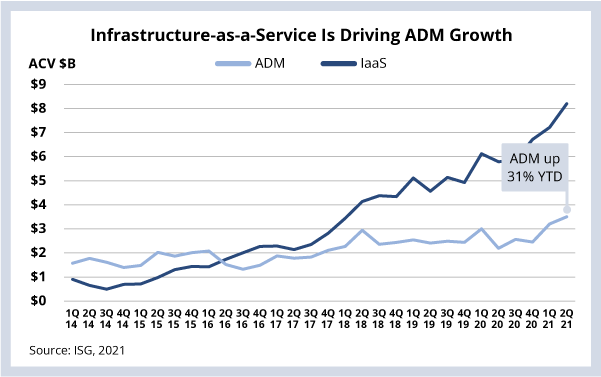

Cloud adoption is at an all-time high. IaaS ACV is growing over 25% CAGR and shows no sign of slowing. At the same time, applications ACV is up 31% year to date, and up 37% against its five-year average (see Data Watch). Through the first half of the year, ADM represented almost 55% of the ITO market.

Why it’s happening: Today we see very few cloud deals that don’t involve application transformation. This is because enterprise technology leaders are recognizing that, to reap the true benefits of cloud, they need to re-think the way they build and manage their applications. This is pushing companies to evaluate their entire application portfolio, which is in turn driving increased spending towards next-generation ADM services.

What’s next: We believe ADM ACV will continue to grow and that cloud will continue to pull ADM ACV along with it. At the same time, traditional infrastructure ACV will stay flat to slightly down, hovering around $1 to $1.5 billion in ACV each quarter as companies progressively modernize their legacy systems.

I hope you’ll join us for the 3Q21 ISG Index call next Tuesday, October 12 at 9 am EST. We’ll be talking about this important growth trend – as well as hot-off-the-press data for the third quarter – so hope to see you there.

DATA WATCH

DEAL ACTIVITY

- Honda Motor Europe and IBM. Automaker extending existing BPO relationship into procurement operations (link).

- Defense Intelligence Agency and CGI. U.S. agency signs five-year $100 million data transformation deal (link).

- State Bank of India and TCS. India’s largest bank signs five-year core banking extension (link).