In this edition: Managed services is recovering from the COVID-19 dip. Low bids win only 40% of the time. Finnish consumer products company is modernizing with HCL. Capgemini eyes Asia Pacific. Kyndryl announces leadership team.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

MARKET

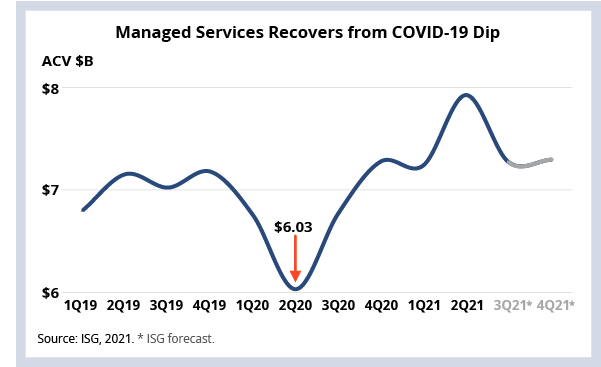

Managed services has recovered from the COVID-19 dip. The market generated nearly $8 billion in managed services ACV in the second quarter of 2021, the biggest managed services quarter in the history of the Index (see Data Watch). That’s up 24% since the same quarter last year, and up 11% against 2Q 2019, which is the better comparison given 2Q20 was when we saw the greatest impact from the pandemic. It’s also up 13% on the historic average.

There are three key trends driving growth in managed services. Pent-up demand from the pandemic is now releasing, especially in the case of BPO, which was up 52% Y/Y. Digital transformation is increasing demand for managed services. Sectors like BFSI, manufacturing and energy historically have generated the most IT services ACV. As they accelerate their transformation due to the pandemic, they are turning to managed services to reduce costs and fund new digital investments. And finally, hyperscale cloud transformation is driving demand for application managed services; applications now make up almost 60% of the ITO market.

You can access the Index slides from the call here. And a video recap from Steve and me is here. And finally, the Q3 Global ISG Index call is October 13. Hope to see you there!

DATA WATCH

ASK THE INSIDERS

We had some fantastic questions during the call this week that we didn't have time to discuss. Here's one from an enterprise, one from a service provider and one from an investor.

Q: Enterprise: We see a large increase in churn – up to 15% from our Indian suppliers currently. Do you see this as a general trend?

A: Insiders: Yes, but it’s not isolated to the Indian heritage providers. The pandemic has created what’s being referred to as the “great resignation” - a record number of employees are leaving or switching jobs. The situation will be particularly acute in the IT services market given how great the demand is for experienced digital talent. In the Index call, we discussed the fact that 37% of digital spending is on people – and the pandemic has dramatically accelerated digital transformation plans – so the market for talent is extremely tight.

Q: Service provider: You indicated that the low bid wins just 40% of the time and that the high bid wins 30% of the time. What’s the average difference between low bids and winning bids?

A: Insiders: For the deals we analyzed, low bids were on average12.5% lower than the winning bids.

Q: Investor: The managed services forecast seems very optimistic given the 2020 dip. What's your overall confidence level in the forecast?

A: Insiders: High confidence. It’s encouraging that the market is no longer dominated by smaller transactions – which has been the case since the onset of the pandemic. Those smaller deals are giving way to larger transformation-led awards, which make healthy growth possible even without mega-deals. However, as we indicated on the call, we see a solid pipeline of mega deals in the market (~7) that have a strong likelihood of closing in the second half of 2021. The combination of these two factors, along with the continued demand for applications, cloud, analytics and ER&D services, give us high confidence in the forecast.

DEAL ACTIVITY

- Fiskars Group and HCL. Finnish consumer products company standardizing and modernizing IT. Link

- Pierre Fabre and Atos. French pharmaceutical and cosmetics company extends existing relationship with a focus on multi-cloud. Link

- Royal London and TCS. U.K.'s largest mutual life and pensions company expands relationship. Link

M&A

- Capgemini makes another Asia Pacific-focused acquisition with Australian SAP firm Acclimation. Link

- IBM acquires Kubernetes specialist BoxBoat to bolster hybrid cloud strategy. Link

- Accenture acquires Swedish cybersecurity firm Sentor (link), Italian SAP firm Ethica Consulting Group (link) and 700 European data and AI resources with Trivadis AG acquisition (link).

- Globant acquires 80% stake in Spanish marketing automation firm Walmeric. Link

- Sopra Steria to acquire Norwegian digital experience firm Labs. Link

PEOPLE AND WORK

- IBM announces Kyndryl global leadership team. Link