We held the 74th consecutive ISG Index call this week. If you weren’t able to attend – or just want a quick summary of the headlines – this week’s Insider is for you. We’ll return to our regular format next week. If you attended the call, a reminder to please take two minutes to complete the post-Index survey here.

TOP FINDINGS

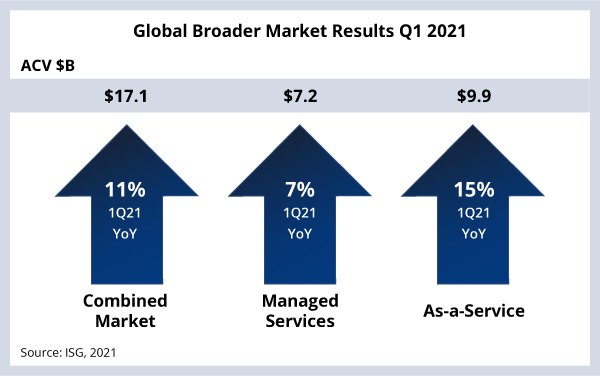

The global economic picture continues to improve. Managed services is returning to pre-pandemic norms. We see sustained strength in the as-a-service economy, and mega-deal activity remains solid.

- Global combined market ACV of $17.1 billion was up 11 percent year over year; this was the first time the combined market exceeded $17 billion.

- Managed services ACV of $7.2 billion was up 7 percent year over year; for the second consecutive quarter, managed services is over $7 billion.

- More than 500 managed services contracts were awarded in Q1, up 12 percent year over year.

- As-a-service ACV had its best quarter ever at $9.9 billion, which was up 15 percent year over year.

DATA WATCH

SERVICE LINES

Despite a record number of contracts awarded in Q1, the ITO market was flat. ADM had its best quarter ever with $3.1 billion in ACV; it now makes up 54 percent of ITO ACV. While IaaS growth slowed, SaaS surpassed $2.5 billion in ACV for the first time ever.

- ITO ACV of $5.8 billion was up 0.8% year over year but was up 19 percent from 2Q20 lows.

- BPO was up 43 percent year over year with most growth in industry-specific BPO and ER&D.

- IaaS ACV surpassed $7 billion for the first time, but year-over-year growth decelerated to 18 percent from 36 percent in Q4.

- SaaS ACV of $2.6 billion was up 7 percent year over year.

AMERICAS

All the gains for Q1 in the Americas came from the as-a-service sector. Contracting activity was up, logging the second best quarter ever in number of awards.

- Combined market ACV of $8.6 billion was up 6 percent year over year and up 18 percent from the previous quarter.

- Managed services ACV of $3.4 billion was down 1 percent year over year but up sequentially by 32 percent.

- As-a-service ACV of $5.2 billion was up 11 percent year over year, making Q1 the first ever $5 billion as-a-service quarter in the Americas.

EMEA

The EMEA market set new highs with back-to-back quarters of $6 billion in ACV – adding over $1.4 billion of ACV from the pandemic lows.

- Combined market ACV of $6 billion was up 20 percent year over year but did see a slight sequential pullback.

- Managed services ACV of $3.5 billion was up 23 percent year over year on the back of a second straight $3 billion quarter.

- As-a-service ACV of $2.5 billion was up 16 percent year over year, a new high for the region.

ASIA PACIFIC

Asia Pacific has become an as-a-service region. Managed services now make up only about 15 percent of the total ACV in the region.

- Combined market ACV of $2.6 billion was up 11 percent year over year but was down 9 percent from Q4 2020.

- Managed services ACV dropped below $390 million and was down 25 percent year over year, with contracting activity the lowest it’s been in five years.

- As-a-service ACV of $2.2 billion was up 22 percent year over year and was on par with the previous quarter.