If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

SOFTWARE-AS-A-SERVICE

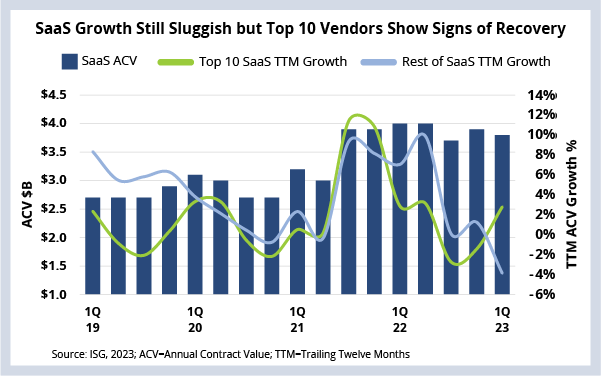

SaaS bookings growth remained soft in the first quarter as enterprises slowed discretionary implementations due to macroeconomic concerns. However, the top 10 SaaS vendors did see ACV growth, which could be an early indicator that enterprises are starting to consolidate their SaaS portfolios.

DATA WATCH

Why Cloud Spending Has Stalled

We continue to see enterprises reprioritizing technology budgets due to macro concerns. This means they are shifting funding to initiatives that will have a significant near-term impact (like cost optimization) and delaying those that may have a longer-term impact (like upgrades and new implementations).

This reprioritization is having an outsized effect on cloud spending. As Alex and I discussed a few weeks ago, IaaS growth has stalled as enterprises focus on using what they already have, rather than committing to new IaaS spending.

And, as you can see in this week’s Data Watch, SaaS growth is also slowing. We’ve seen three consecutive quarters now of either flat or negative ACV trendlines in this segment.

The Details

- SaaS generated $3.9 billion ACV in 1Q23, down 1% on a trailing twelve-month basis.

- That’s compared to 10%-plus growth in 2018 and during the post-pandemic boom.

A Shift in Cloud Strategy?

The reasons we are seeing a SaaS slowdown are a little different than what we are seeing with IaaS. While the IaaS slowdown is more about “use what we already bought,” the SaaS slowdown is about “let’s delay until we have a better view into the macro situation.”

This is an important nuance because something interesting happened in the data this quarter. As you can see, the top 10 SaaS vendors did grow ACV this quarter, unlike the rest of the SaaS sector. It was low single-digit ACV growth, but after three consecutive quarters of flat to declining growth, this could be a signal of change in enterprise technology strategy.

Unlike IaaS, the SaaS segment has an enormous number of participants across dozens of categories like collaboration, analytics, e-commerce, CRM, ITSM, etc. One of the reasons this continues to be such a big and broad sector is that enterprises continue to show a strong preference to retire legacy applications and replace them with SaaS (as opposed to alternatives like building themselves).

The 1Q23 data could indicate the beginning of a shift toward a platform-based strategy as a way to optimize costs (very important right now). Essentially, they are looking to consolidate more functionality into a smaller number of SaaS vendors. This would also likely be a net positive for providers, as many of them have built substantial systems integration practices around the largest SaaS vendors.

As always, we’ll keep a close eye on this data. Make sure to join us on the 2Q23 Index Call on July 13 to get the most up-to-date view of the health and growth of the IT and business services sector.