In this edition: The U.K. is powering ACV growth in EMEA. European electric utility E.ON is migrating its applications to Microsoft’s cloud. Cognizant extends engineering talent network with staffing acquisition.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

REGIONAL FOCUS: U.K.

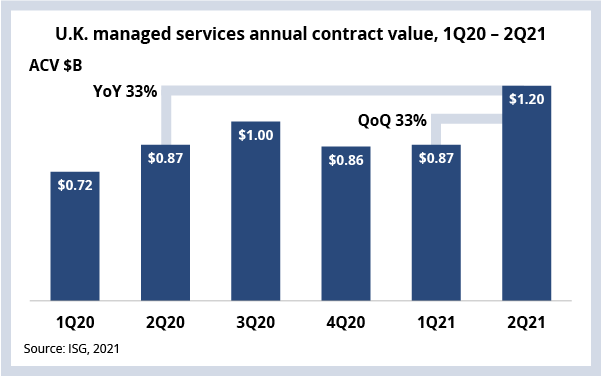

The U.K. is powering contract value growth in EMEA. The region generated $1.2 billion in managed services ACV in 2Q21, which was up 33% Q/Q and 33% Y/Y (see Data Watch). Contracting activity was brisk as well. There were 108 managed services awards above $5 million in ACV in 2Q21 – the best first-half award count since 2018.

The U.K. accounts for a third of the total ACV in EMEA, so it has a big influence on the performance of the region. You might recall from our 2Q21 call that managed services in EMEA was up 23% Y/Y, in large part due to the strong performance in the U.K.

Earlier in the year, we were seeing some significant pent-up demand from COVID. There was a number of significant projects put on hold, as well as a number of contracts that were extended rather than brought to market. Much of this demand was released in Q2. Also, BREXIT issues are resolving, which has eliminated some of the uncertainty between the U.K. and the European Union. Though some degree of uncertainty persists, progress on most fronts is driving investment in technology for U.K. companies.

And much of this investment is focused on digital transformation. We’re seeing large U.K. enterprises take major steps to retool their supply chains and rethink their customer experience. And, of course, all of this is underpinned by a significant uptick in willingness to adopt the as-a-service model across the enterprise. We expect ACV – both managed services and as-a-service – in the U.K. to continue to expand over the next several quarters.

DATA WATCH

M&A SPOTLIGHT

Cognizant announced the acquisition of Atlanta-based staffing and recruiting provider Hunter Technical Resources this week (link). It has been busy on the M&A front this year – especially in the software development space – with recent acquisitions of Magenic and Tin Roof Software, both U.S.-based software development shops. What’s different about this acquisition is that Hunter is a staffing firm, focused on engineering talent.

As we discussed last week, talent is extremely tight. Providers are seeing high levels of turnover, especially young, digital talent. Having access to staffing capability is becoming more important as providers look for new ways to find and secure digital talent. But it’s also a sign of a change in the market, as boundaries between staffing firms and service providers blur. Case in point: European staffing firm Adecco Group’s recent acquisition of engineering firm AKKA Technologies.

DEAL ACTIVITY

- E.ON, Microsoft and Wipro. German electric utility migrating its on-premises applications to Azure; Wipro leading migration (link).

- Wacker Chemie AG and HCL. German chemical company signs five-year workplace services deal (link).

- Siemens Smart Infrastructure and Atos. German multinational firm migrating manufacturing, sales and distribution applications to the cloud (link).

- City of San Diego and Zensar. Eighth largest U.S. city signs four-year full ITO deal. (link).