Today India is reporting more than 330,000 new COVID-19 cases, a global record. Hospitals in major cities are critically short of beds and oxygen. We’re watching this situation closely and thinking of family, friends and co-workers across the subcontinent.

Was this email forwarded to you? Sign up here to get the Index Insider every Friday.

INDIA

India is experiencing a massive second COVID-19 wave. It is now second in the world in COVID-19 cases behind the United States. Delhi is the nexus of the spike, with over 25,000 new cases reported yesterday. Bangalore and Pune both added over 10,000 cases. Despite adding nearly 8,000 cases yesterday, numbers in Mumbai are declining, unlike in other major Indian cities.

Vaccinations are ramping up quickly. It took India just 95 days to vaccinate more than 130 million people, a rate faster than China or the United States. It was announced this week that India’s first home-grown vaccine COVAXIN has an efficacy rate of 78 percent against severe COVID-19 infections. Bharat Biotech is ramping up the production of the Phase 3 drug to 700 million doses.

As district and state-level occupancy restrictions were lifted earlier this year, IT service providers began to move some staff back on site. These workers have largely been reverted to 100 percent work-from-home as of this week. As of yesterday, we’re only seeing sporadic impact on sales, transition and delivery. We are aware of at least one project with a jeopardized go-live due to a localized spike in cases, but we believe this is an outlier for now.

PRACTITIONER POV

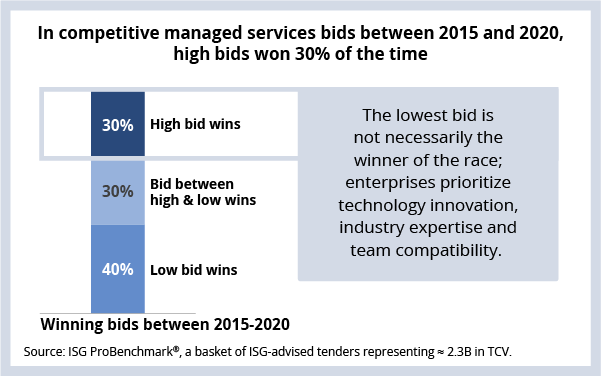

The lowest deal bid is not necessarily the winner of the race. Case in point: we analyzed 20 ISG-advised managed services deals over the past five years in which multiple providers bid on the same scope. The smallest deal was $16 million in total contract value (TCV) and the largest deal was $540 million in TCV. The total TCV for the deals we looked at was $2.3 billion.

Among these deals, the highest bid won 30 percent of the time; the lowest bid won 40 percent of the time (see Data Watch). Bid size notwithstanding, our experience tells us that enterprises select providers that can demonstrate 1) industry expertise, 2) compelling technology solutions and 3) compatibility amongst the client-provider team. Of course, how these criteria rank in importance depends on who’s doing the evaluating – the deal team or the sponsoring executive. When buyers know that acceptable pricing terms can be reached during the negotiation process, the compatibility factor becomes even more important as they picture themselves working with the potential provider.

When a provider submits very low pricing, the buyer often wonders if it is just trying to win the business without consideration for future delivery. Will the low bid price create margin pressure that, over time, degrades service quality? Low bids can create another question in the buyer’s mind: does the provider really understand the complexity of our situation? Low bids that contain constraints that would make it difficult for a buyer to operate during transition also can create doubt in a buyer’s mind.

Net: Enterprises buy innovative solutions and services that provide value at the right price point.

DATA WATCH

DEAL ACTIVITY

- UD Trucks and HCL. New cloud, ADM and workplace deal for Japanese truck company. Link

- RS Components and Orange Business Services. British electronic components distributor moving to SD-WAN and cloud contact center. Link

- Insurity and LTI. Insurance technology company building Snowflake-based data warehouse. Link

- Bureau Veritas and Atos. French health, safety and sustainability firm building new security operations center. Link

- Broadcom and Google Cloud. Semiconductor firm migrating its software to GCP. Link

M&A

- Atos acquires Processia, cryptovision and Ipsotek. Product lifecycle management, cryptography and computer vision firms, respectively. Link

- Accenture acquires Root Inc. Fourth organizational/cultural change acquisition this year. Link

- Tech Mahindra acquires DigitalOnUS. HashiCorp specialist snapped up for $120 million. Link

- Infinite Computer Solutions acquires IBM Talent Suite. Includes Lead Manager, BrassRing and OnBoard SaaS products. Link

- SAP spinning off financial services portfolio. Creating new standalone financial services unit with investor DEDIQ GmbH. Link