If someone forwarded you this briefing, consider subscribing here.

And don’t forget to register for the Q4 Index Call on January 18. You can reserve your spot here.

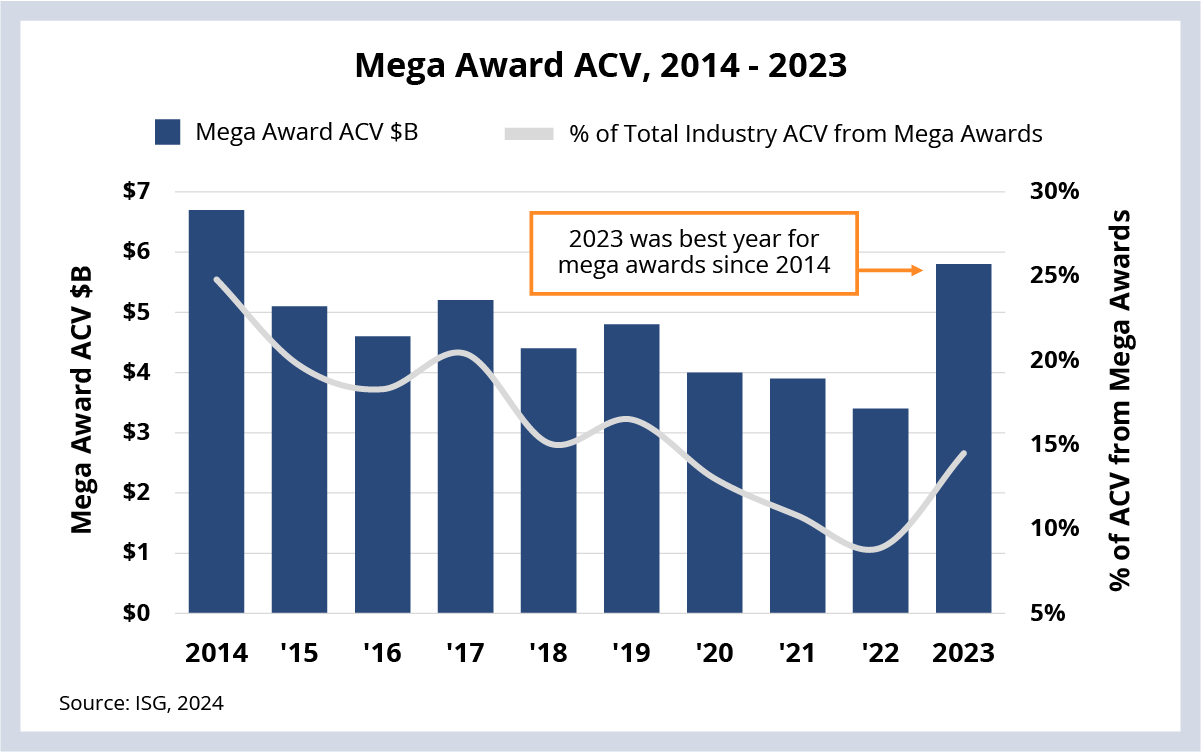

Mega Deals

There were more awards with $100 million of annual contract value (ACV) in 2023 than there have been since 2014. Mega awards made up almost 15% of the total ACV in the industry last year and were one of the key reasons for the strong ACV growth. The reasons for this mega-deal growth – enterprises needing to optimize costs and providers getting better at shaping large deals – remain in place in 2024.Data Watch

Background

The IT and business services industry reversed a nearly 10-year trend of declining mega-deal activity. By both ACV and award counts, 2023 was the best year for big deals in a very long time.

Why?

There are a couple of reasons. First, enterprises continue to be laser-focused on cost optimization. This is not small cuts here and there. Many firms are looking for fundamental change in their cost structure – and outsourcing is a lever they are pulling to make that happen.

It’s important to note here that, for the most part, we’re no longer talking about a “your mess for less” type of transaction. A lot of technology and process modernization is required to get the savings companies need. So, mega deals today include a lot of transformation.

The Details

- There were 34 mega deals in 2023 with a combined ACV of nearly $6 billion.

- That represents 15% of the total ACV in the industry, up from 9% in 2022.

- 18 of the deals were in the Americas, 12 in EMEA and four in Asia Pacific.

What's Next

There’s another big change over the past 10 years.

A decade ago, mega deals were infrastructure-heavy. Lots of IT assets got moved to a provider, and the provider managed it for less. With the advent of cloud, infrastructure outsourcing ACV started to decline, which means there were fewer assets to transfer – and this led to a decrease in mega-deal activity.

As providers recognized that these large, infrastructure-heavy deals were on the decline, they started to focus on shaping deals that combined different areas of scope, modernization, re-badging the people who supported these areas and financial engineering to create near-term value for clients.

This is not always done with an RFP. Often it’s done proactively through incumbency and relationship building. This is what we mean by deal shaping.

Given the continued need to optimize costs in 2024 – and the fact that more providers are growing their big deal teams – we expect the environment will be conducive to more large deals in 2024.

We’ll be discussing these trends on the Q4 and full-year Index call on January 18, so make sure to reserve your spot.