Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Global Capability Centers

Global business uncertainty is at a multi-decade high due to recent trade policy changes; nearly half of U.S. CEOs expect revenues will decline this year as a result. This could lead to significant challenges for GCCs that are not well aligned or integrated with the business.

Data Watch

Background

As we discussed last week, discretionary spending is under pressure again as business uncertainty grows across industries. This uncertainty is likely to have a ripple effect outside of the IT and business services industry and into the global capability center (GCCs) sector.

If this happens, it will hit especially hard for GCCs that are not well aligned with the business. For example, a center established to focus on a major transformation may have to change its hiring plans in line with the overall business and, as such, the transformation may see a shift in timing or funding.

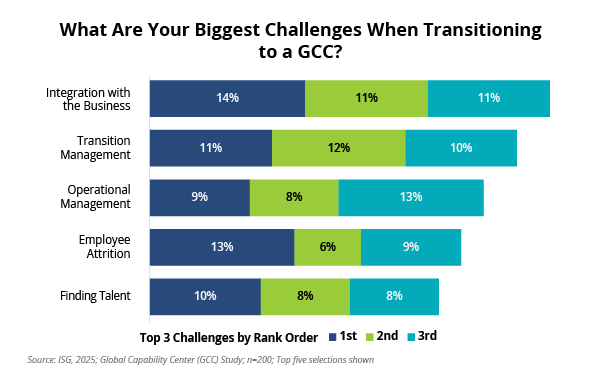

And it’s this challenge – lack of integration with the business – that enterprises indicate is the most prevalent as they transition to a GCC model (see Data Watch).

The Details

- In a recent ISG study of enterprises with a new or recently transformed GCC, “integration with the business” was the highest ranked challenge, followed by employee attrition and transition management.

- The largest firms by revenue in the study indicated attrition was the most important challenge, while the smallest firms indicated cultural fit as the biggest challenge.

- For firms with new GCCs, the cost of transition was the most common challenge.

What’s Next

As we covered at the NASSCOM GCC Summit earlier this week, top line pressure is mounting, causing cost pressure to increase as well. This will mean that enterprises will be looking for areas to further optimize costs.

A GCC that is not well aligned – be it strategically, operationally or from a cost perspective – will likely face significant competition as IT service providers are actively looking for opportunities to shape large and lengthy awards by taking over underperforming GCCs. This is one of the key reasons mega deal activity has been so strong of late as well.

The challenge is that, to reduce costs and drive more productivity, GCCs will need AI. However, only 39% of GCCs plan on adding AI and ML skills over the next two years. Those GCCs that don’t add AI talent – either by hiring or tapping into the IT services sector – risk falling further behind their peers, and further misalignment with the business.