If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CONTRACTING INTELLIGENCE

No topic in our industry stirs more discussion – and debate – than mega deals. Awards over $100 million in ACV typically take a long time to get over the line, but once they do, they can provide a significant multi-year revenue stream for the provider and be a catalyst for major technology transformation and standardization for the client.

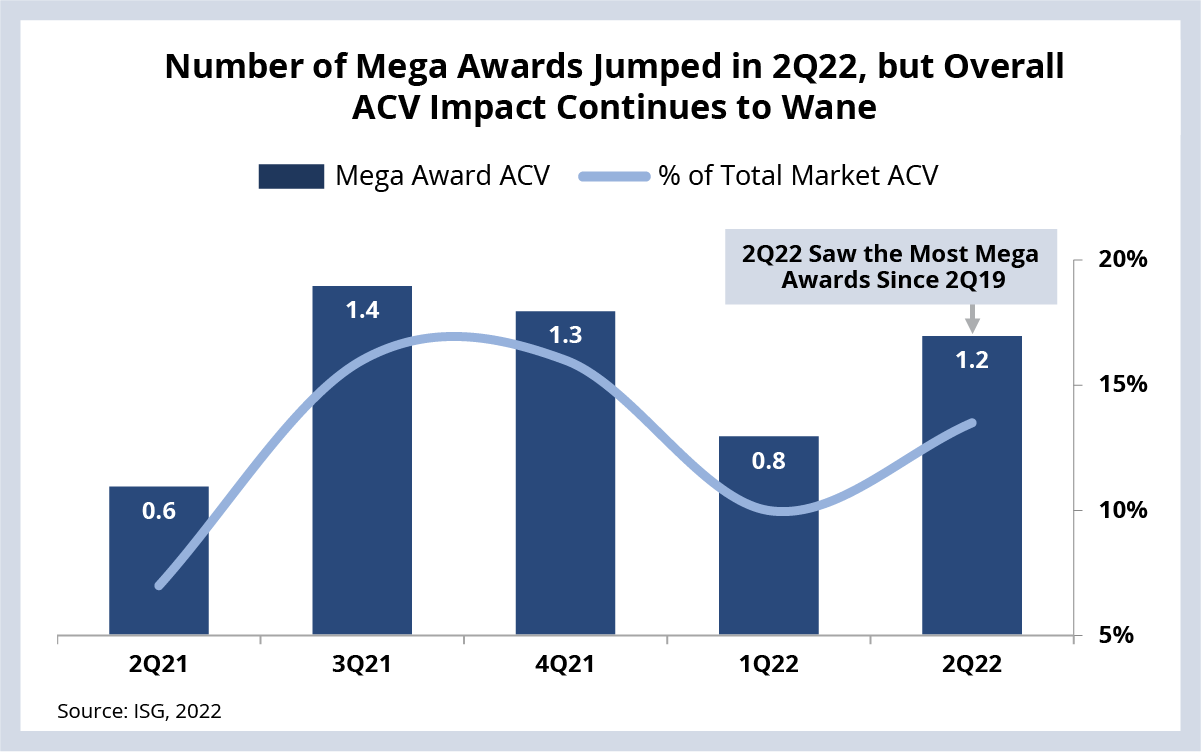

So let’s recap the mega award results from the second quarter: There were nine awards – that’s the most since the second quarter of 2019. The total ACV of these awards was over $1 billion – the third time in four quarters that has happened (see Data Watch).

Also of note was the fact that seven of the nine awards were new scope. That makes 2Q22 the biggest quarter for new scope mega awards in over a decade.

So do these recent results indicate a sea change in the market for mega awards? We don’t think so. Ten years ago, mega awards made up over 20% of the ACV in the market. As you can see from the Data Watch chart, it’s now hovering around 15%. So not only is the total ACV generated by mega awards coming down, their overall impact is waning as well.

On the other side of the coin, recall that over 85% of the ACV in the market is under $20 million in ACV. That’s a sustained trend we have seen for many quarters now as enterprises continue to favor smaller, shorter awards.

DATA WATCH

M&A

- Sopra Steria plans to acquire majority stake in cybersecurity and defense systems integrator CS GROUP (link).

- Accenture acquires Canadian ServiceNow, Microsoft and SAP specialist Solvera Solutions (link).

- Exadel acquires European remote work platform Motion Software (link).

- TietoEVRY evaluating a spinoff of its banking business (link).