If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

DEMAND

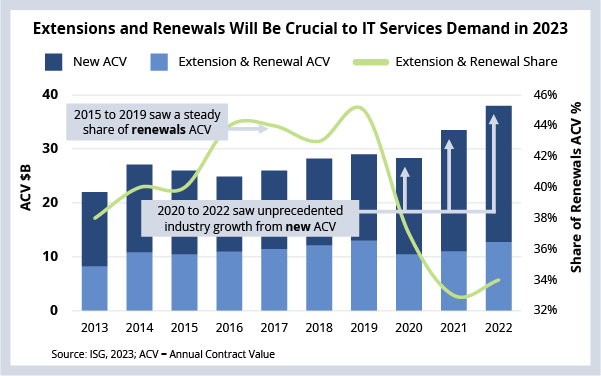

New scope awards – as opposed to extensions and renewals – are what drove the unprecedented growth in the IT and business services industry over the past 24 months. Extensions and renewals, which have stayed relatively steady over the years, now make up a smaller portion of the managed services market than ever before. However, that may be changing. While outsourcing demand remained strong in the first quarter of 2023, much of that strength came from extensions and renewals, while new scope awards cooled off.

DATA WATCH

As you can see in this week’s Data Watch, the market share of extensions and renewals has fallen significantly, driven by record new-scope award activity from 2020 through 2022. This “new” activity represented work that is either new to the market or is existing work that is outsourced to a new provider.

Extensions and renewals are what they sound like – continuing or sometimes expanding work with the same provider. Think of “new scope” as growth and “extensions and renewals” as continuity for a provider – and for the industry as a whole.

The Details

- From 2015 to 2019, the share of extension/renewal scope was consistently greater than 40%.

- In 2021, it dropped to an all-time low of 33%.

- Signaling a potential rebound in extension and renewal activity, 1Q23 returned to 40% plus share with over $4 billion in renewal ACV.

What’s Next

A potential rebound in the share of renewals and extensions has a number of implications for both service providers and enterprises.

Providers are likely to put a strong focus on current clients and on the continuity or extension of ongoing work at a time of market uncertainty. It’s also important to remember that the huge wave of new scope work that was added in 2020-21 will start showing up as extensions and renewals in the second half of this year.

That’s going to make it a critical time for incumbents, at a time when other providers will be looking to grow by taking share from competitors. This is especially important now because incumbents face a significant risk of losing some or all scope when the work is competitively bid in the IT and business services market.

Enterprises will double down on value realization with their existing providers and outsourcing contracts. As we’ve discussed, cost optimization is critical in today’s uncertain macro environment – so look for enterprises to be laser-focused here as a big wave of post-pandemic agreements come up for renewal later this year.