If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

PRICING

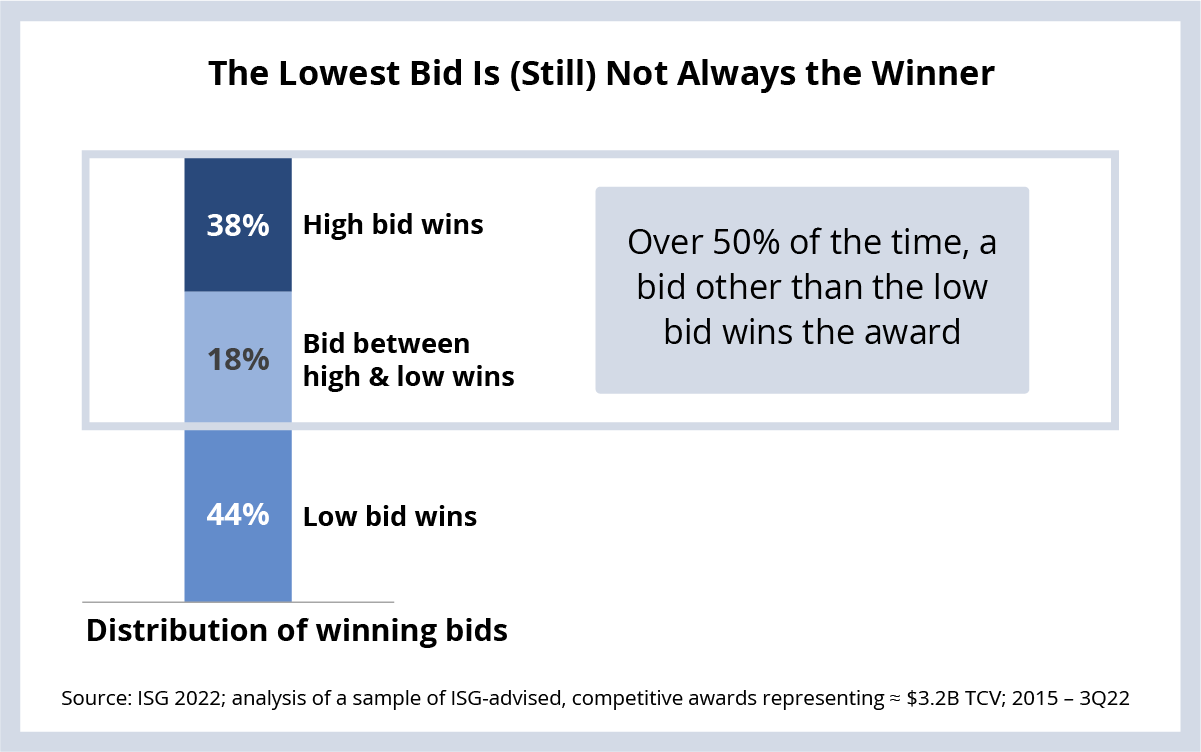

High bids win competitive outsourcing awards nearly 40% of the time, reinforcing the fact that many enterprises continue to value factors like technology modernization, industry expertise and compatibility between the client and provider team as much as (or more than) price.

Background:

We revisited our analysis from 2021, in which we analyzed a basket of ISG-advised managed services awards that involved multiple service provider bids on the same scope. This updated analysis adds in the first three quarters of 2022. For the basket of awards we analyzed, the smallest award was ~$6 million in total contract value (TCV); the largest was ~$540 million in TCV. The total TCV for the analysis was ~$3.2 billion (see Data Watch).

The Details:

- High bids won 38% of the time, while low bids won 44% of the time.

- Bids between the high and low bids won 18% of the time.

What’s Next:

The fundamental value proposition of outsourcing has changed over the past several years. While enterprises still expect savings from outsourcing (and providers continue to deliver them despite wage pressures), the need to modernize technology stacks and the need for tech talent amid an exceptionally tight labor market are becoming just as critical as cost reduction.

Enterprises are also becoming more aware of the risks when providers submit very low bids. They are increasingly asking if the provider is just trying to win the business without consideration for future delivery. Or if the provider really understands the complexity of the services being delivered. These questions are more prevalent than ever given the multi-year declines in infrastructure ACV (and associated margin pressure) for many service providers.

However, this is just part of the equation. As we’ve discussed multiple times, personal connections matter more than ever. Providers that can create these connections with prospects are more likely to move past the first round of evaluations, putting them in a better position to be the winning bidder.

We’ll revisit this analysis again in 2023 to determine what impact the macroeconomic situation of 2H22 has had on winning bids, but we expect the data is unlikely to change significantly given the reasons above.

We’ll have more perspective on IT and business services pricing changes on the 4Q22 Index call in January. Chris and I encourage you to register here.

DATA WATCH