If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

MACROECONOMIC IMPACT

ISG clients in the U.S. are reprioritizing technology budgets to focus on investments that produce results in the short term. With the dollar at a 20-year high, inflation at a 40-year high and the potential for a recession in 2023, there is significant pressure on many U.S. enterprises to reduce costs.

While the bottom-line business impacts of macroeconomic pressures may vary from business to business, almost all organizations are recognizing the significance of technology modernization on their strategies. Regardless of industry, firms are “strategically reprioritizing” technology budgets in response to macroeconomic pressures.

Background: We recently conducted interviews with a group of ISG client executives in the U.S. to find out how the macroeconomic climate is impacting their technology services spending plans. The clients represented multiple industries, including Insurance, Retail, Manufacturing and Energy.

The Details:

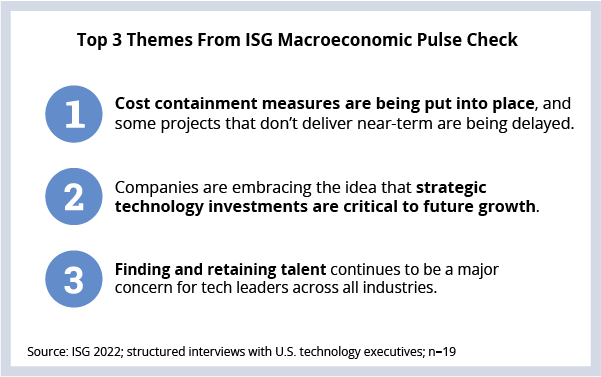

- Over half of the clients we spoke with have already put cost containment measures into place; a similar number indicated projects are being delayed.

- Nearly all respondents communicated a renewed awareness that strategic technology investments are critical to their future growth and profitability.

- More than three-quarters of interviewees indicated that acquisition and retention of tech talent continue to be significant concerns.

What’s Next:

As we discussed on the 3Q22 Index call, demand for IT services remains strong; 3Q22 was the fifth consecutive quarter of $9 billion of managed services ACV. However, we do see growth slowing – and some decisions are being delayed in response to the murky macro environment.

Industry plays a big role in how firms are responding. BFSI ACV continues to show strong growth (up 23% YTD), and firms will continue to invest in financial services modernization using a combination of managed services, cloud and internal reengineering. In manufacturing (ACV up 14% YTD), we believe firms will put significantly more focus on cost optimization in the coming quarters in preparation for a potential downturn.

The big wildcard in all this is talent. Finding and retaining tech talent was a significant concern for most leaders we interviewed. The labor market in the U.S. continues to be very strong across just about every factor (job openings, unemployment rate, wage gains, etc.). This tightness will continue to drive demand for IT services and put pressure on firms to find the talent they need to move initiatives forward over the next several quarters.

If you’re interested in learning more about our recent executive pulse check, contact Rajib and me here.

DATA WATCH