If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CONTRACTING INTELLIGENCE

As we discussed on the 2Q22 Index call last week, the managed services sector generated $8.8 billion of annual contract value (ACV) in the second quarter – that’s the fifth straight quarter of ACV exceeding $8 billion. A terrific result. However, the sector only grew 2% Y/Y. As we talked about on the call, we’re in one of the strongest sustained demand periods in the history of the sector. So why is growth slowing from previous double-digit-growth quarters?

There are two primary reasons: First, year-over-year comparisons. The quarters up through 1Q22 were being compared with COVID-19 impacted quarters. Now, we're starting to compare with quarters where ACV results were strong. That’s the “technical” reason for growth slowing.

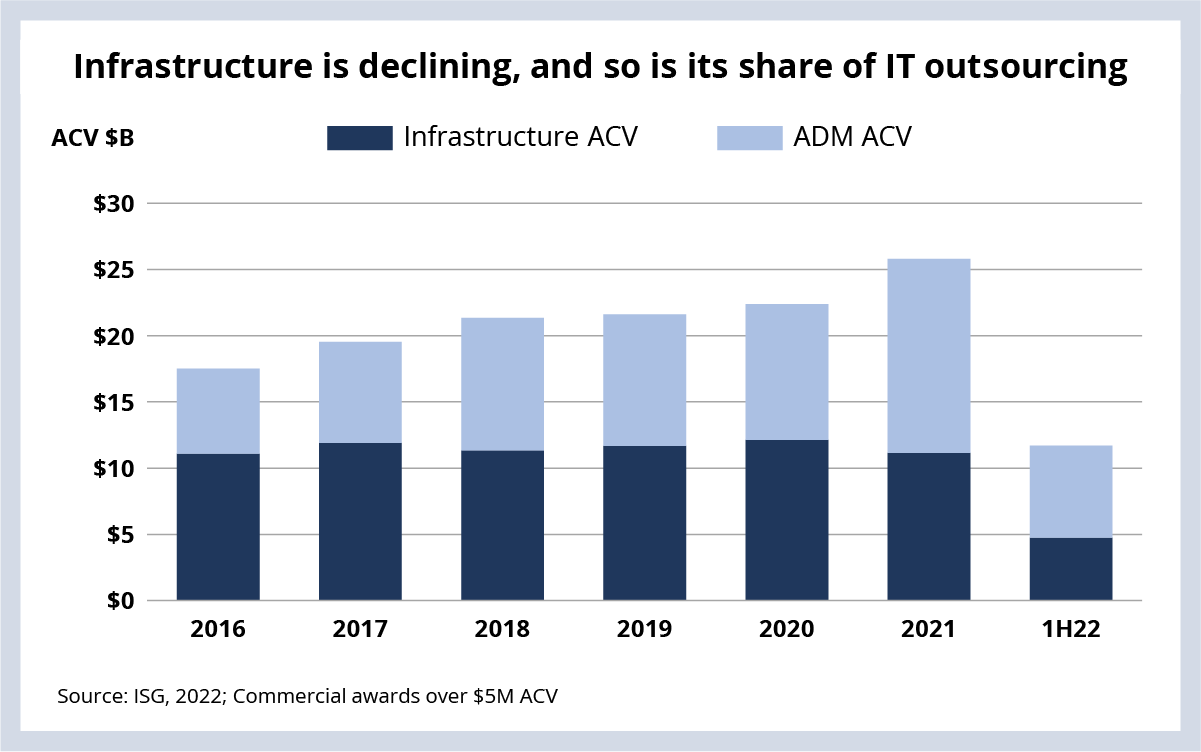

But there’s also another reason: demand is shifting. Infrastructure outsourcing used to be the backbone of the IT outsourcing market. In 2016, it made up more than 60% of ITO ACV. Today it’s just over 40%. But that 40% is continuing to shrink as companies shift from infrastructure outsourcing to moving workloads to the cloud (see Data Watch).

Case in point: In 2021, infrastructure ACV was down 10%. And through the first half of this year, it’s down 15%. This is one of the key reasons we are seeing spinoff activity with providers that have a big infrastructure footprint. Some providers will be working through shrinking – and oftentimes unprofitable – infrastructure outsourcing relationships for years to come.

So, what’s growing in infrastructure’s place that is enabling the market to generate five consecutive quarters of record ACV? It’s applications, engineering and industry-specific BPO. All these areas were up at least 25% on their five-year averages. And it’s these areas we expect will power ACV growth over the next several years.

As a reminder, you can access the full 2Q22 Index replay here and the slides here.

DATA WATCH