If someone forwarded you this briefing, consider subscribing here.

INSURANCE

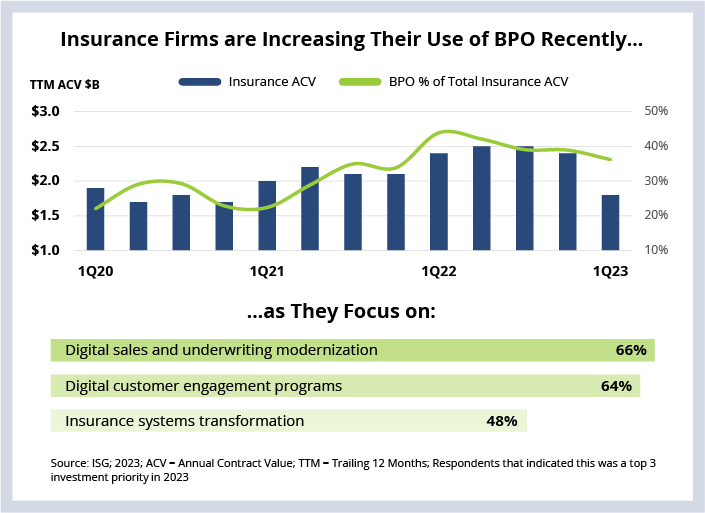

Business process outsourcing is driving most of the ACV growth in the insurance industry, as carriers focus on improving customer experience and modernizing processes.

DATA WATCH

Background

As my colleague Dennis wrote recently, “insurance companies have traditionally been home to a disproportionate number of digital deniers.” This is an industry that has largely been paper-based for decades.

So, it’s no surprise that the outsourcing services insurance carriers bought in the past reflected this way of working. Business process outsourcing in insurance was very transactional and was focused on areas like policyholder services and claims support. And the overriding goal with these contracts was to take cost out by moving the work to lower cost locations.

But this is changing. Starting in 2021, we began to see a major shift with insurance carriers leveraging BPO providers to help transform their operations. And while there is still a cost optimization and offshoring component, these new industry-specific BPO deals are technology-led, with providers bringing solutions to drive end-to-end process modernization across both property and casualty and life and retirement subsectors.

And this is one of the key reasons we’ve seen such strong demand for BPO, and why it drove most of the growth in the insurance industry over the past couple of years. Of course, ACV growth has slowed a bit recently given the macroeconomic situation – but that is happening across other industries as well.

The Details

- The global BPO sector had its best year ever in 2022; ACV was up 36% year-over-year.

- Most of this growth was driven by industry-specific BPO, which was up over 50% Y/Y.

- And within the insurance industry, BPO now makes up 36% of all ACV, compared to just over 20% in 2020.

What's Next

As you can see from this week’s Data Watch chart, our buyer behavior research indicates that insurance carriers are showing strong proclivity towards modernizing customer interfaces, core processes like actuarial, subrogation and underwriting, and the underlying systems and data analytics that support these processes.

This plays well for service providers with insurance specific solutions around these areas that were once off limits for outsourcing. And is why we think we’ll continue to see demand for BPO – both for pure play BPO firms and for bigger firms with BPO capabilities, while ITO likely stays relatively flat. A similar pattern is emerging in the banking sector, which we’re keeping an eye on.

As a reminder, the 2Q23 Index Call is on July 13 at 9:00 AM ET, I hope you can join Steve, Kathy, Namratha and me as we share more data and insights around the health and growth of the IT and business services sector.