We see two major themes for enterprise IT organizations in 2025: 1) they will deploy AI to improve productivity, and 2) they will fund it by optimizing costs elsewhere.

These themes emerge from the seven key priorities for enterprise IT that we identified last week. This week, we look at the implications of these priorities and how they will impact the IT and business services industry.

Implication No. 1: Large Deal Activity Will Continue to Be Strong

With most large enterprises expected to prioritize profits over aggressive growth in 2025, enterprises will be on the hunt for savings in 2025.

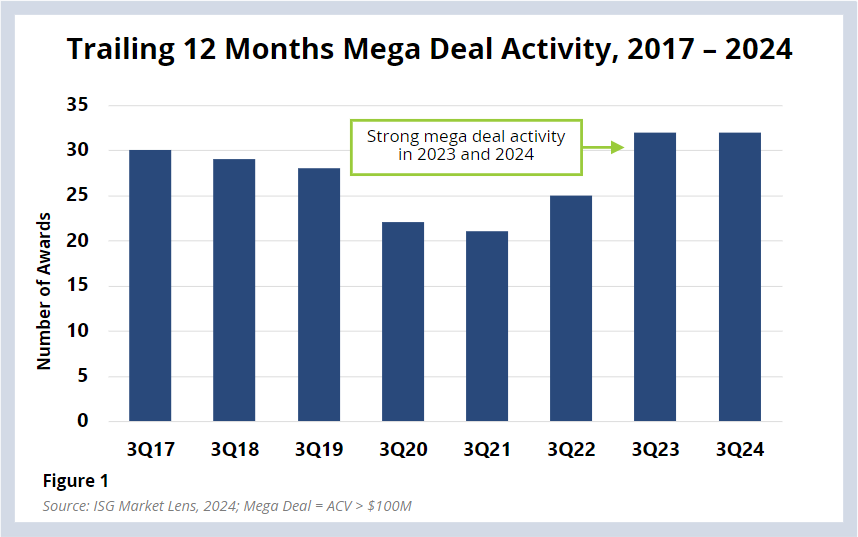

This means the industry will continue to see strong demand for deals that move the needle on cost. In an economic environment where interest rates are still elevated, this favors larger deals, including mega deals with more than $100 million in annual contract value (ACV).

And, as you can see in Figure 1, mega deal activity has been quite strong over the past 18 to 24 months. This will likely continue to be the case in 2025.

Most enterprises don’t take a mega deal to the market. More often than not, these deals are shaped by providers, who will need to continue building and scaling their big deal teams to shape large deals in 2025.

Implication No. 2: Longer Deals Will Continue to Be the Norm – Not the Exception

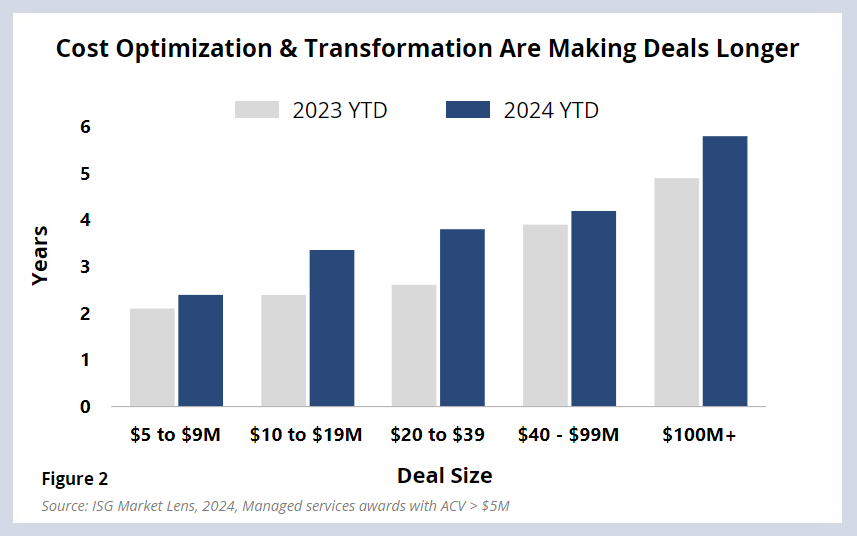

Enterprises that are in their second-, third- or even fourth-generation sourcing agreements have, for the most part, already used all the levers a provider can pull to reduce costs: labor arbitrage, process improvements, workflow, automation, etc.

The way firms will get to net new savings will be through technology modernization, which usually means transforming both technology and operating models – which often includes multiple enterprise towers. This bundling and transformation require time. And this is why deal durations are up across every deal size band (Figure 2).

Longer deals in 2024 are a clear exception to what the industry has seen in the past, but it will likely be the norm in 2025.

Implication No. 3: Providers Will Be Expected to Improve Productivity

With most large enterprises expected to prioritize profits over aggressive growth in 2025, IT organizations will be laser-focused on getting more from the resources they have today.

Most enterprises feel that they are falling behind on their productivity targets, and they will look to the IT services sector to help them catch up.

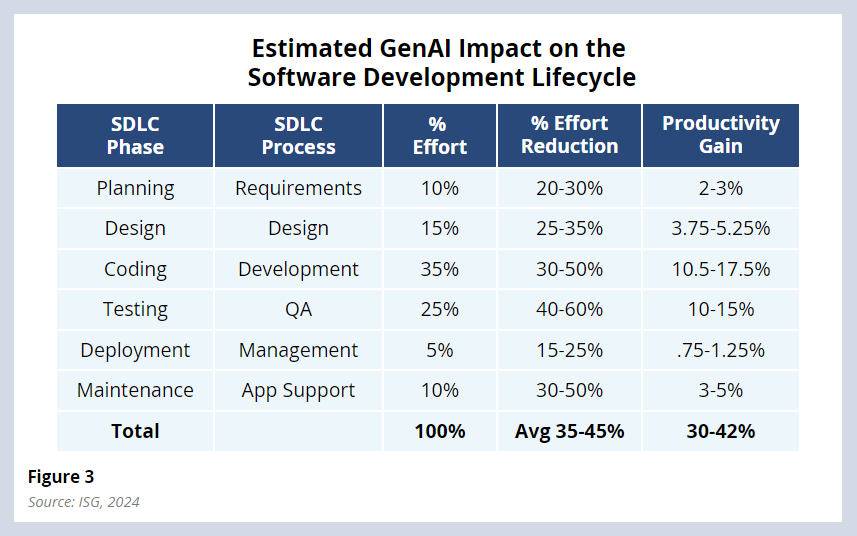

Providers will respond to this need in 2025 by turbocharging the use of generative AI in their delivery. Our estimates are that – in certain areas like software development – generative AI will reduce effort by between 35%-45% (Figure 3). Enterprises will start to use this new-found provider productivity to drive the savings they need in 2025.

Providers who are unable to demonstrably improve productivity will struggle to stay competitive.

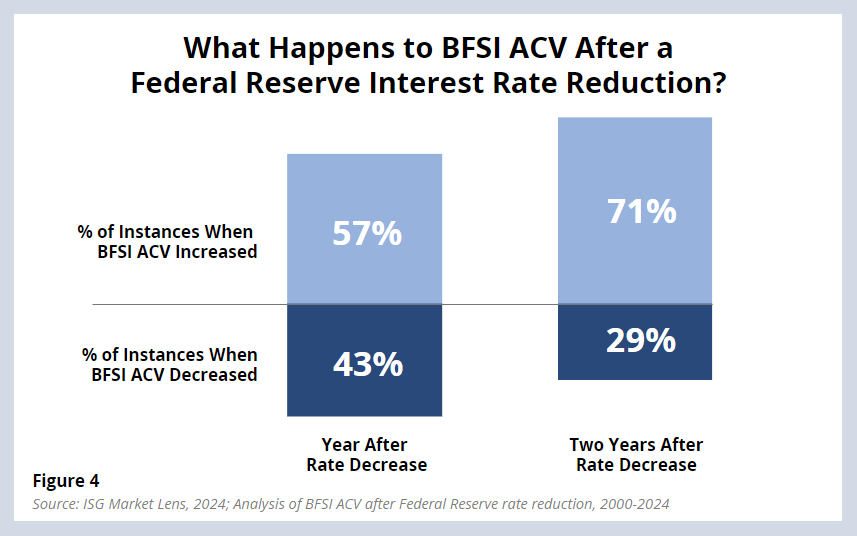

Implication No. 4: BFSI Bookings Will Likely Bounce Back

IT services bookings in the BFSI sector have been under significant pressure. Year to date, ACV in BFSI is down 11%. Banks are focused on realizing value from existing transformation programs, and, as a result, large-deal activity has dropped significantly. For example, on a trailing 12-month basis, ACV for awards over $50 million is lower today than it was in 2021.

Still, there are some positive signs for 2025 and beyond. Short term, several providers report sequential growth in BFSI revenues this quarter. This could be an indication that discretionary spending is starting to open back up for smaller, project-based work.

Longer term, lower interest rates typically stimulate economic activity, leading to increased technology investments and larger transformation budgets in the BFSI sector. In fact, nearly 60% of the time, one year following a rate reduction, BFSI bookings are positive (Figure 4).

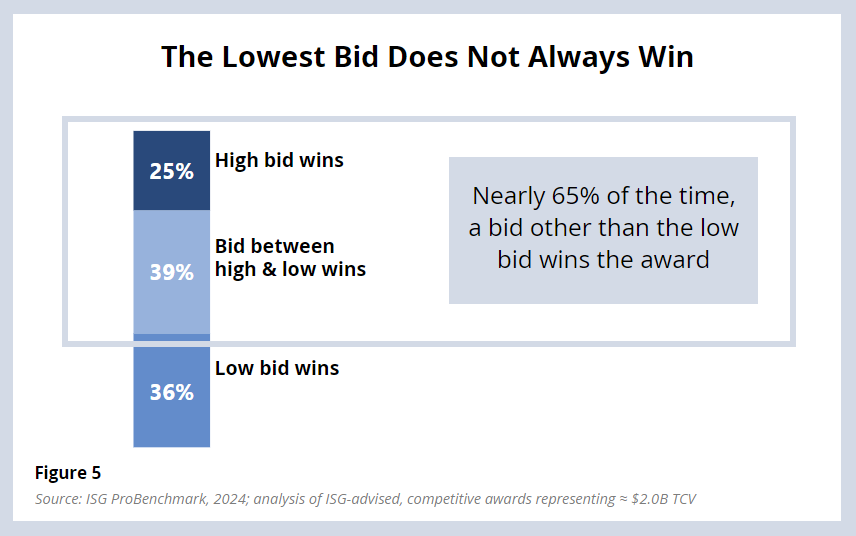

Implication No. 5: Pricing Will Be Critical to Success (but Won’t Significantly Change)

Market-aligned pricing has always been critical, but in 2025 it will be even more so. Enterprises will continue to aggressively benchmark prices and rate cards in 2025 to find savings.

Market-based pricing also will be critical in making sure providers do not leave money on the table when they do win.

Inflation continues to impact all areas of the market, which means providers are seeing increased labor and software costs. This is reflected in slightly higher labor rates for some roles and a flattening of unit prices, especially in infrastructure.

However, the IT and business services industry is exceptionally competitive, and providers will continue to price aggressively, as you can see in Figure 5, in anticipation of future benefits from both generative and predictive AI.

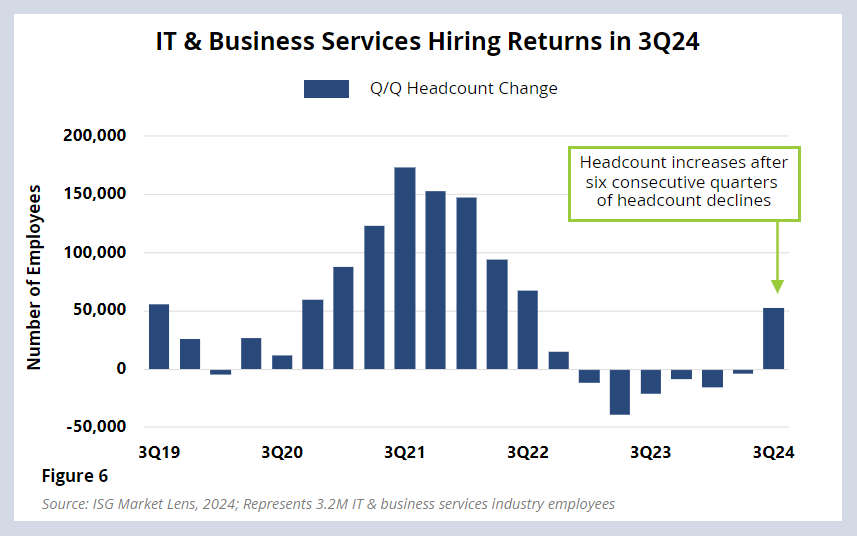

Implication No. 6: Industry Headcount Set for Return to Growth

Employee headcount growth in the IT and business services industry was down for six consecutive quarters as enterprises pulled back on discretionary spending (Figure 6). That changed in the third quarter when the industry saw headcount growth increase by over 50,000.

That said, most of that growth was concentrated with a few providers, and some of the increase came from M&A activity.

Industry headcount will return to positive in 2025, with providers hiring to address a likely increase in attrition and to meet the demand for AI-related services and the expected ramp-up of large deals.

Providers that fail to plan for and hire in anticipation of demand will likely face challenges related to attrition, service delivery and competitiveness for new work.

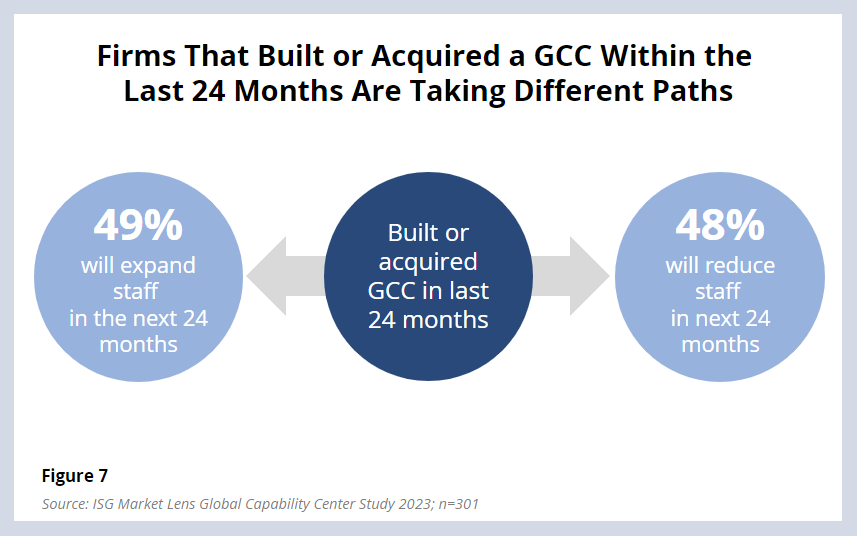

Implication No. 7: Providers Will Embrace the GCC Wave

Global capability center (GCC) activity continues to be very strong. That interest is likely to increase in 2025 as enterprises ramp up their AI spending, which is set to increase by 6% next year. AI is driving this because – on the whole – enterprises want to build AI capability themselves. They are using the GCC model to find the AI talent they need at a scale and cost that works for them – and that often means India.

But GCC activity will be just as strong in the other direction: cost pressure will squeeze GCCs that are not well aligned with their parent organizations, which will be looking to reduce – or even exit – their GCC position (Figure 7).

These two dual mandates from enterprises – to scale or to reduce GCC footprints – means providers will need to embrace the GCC wave with three primary motions: work with, sell to and take over GCCs, depending on the needs or the situation of an enterprise.

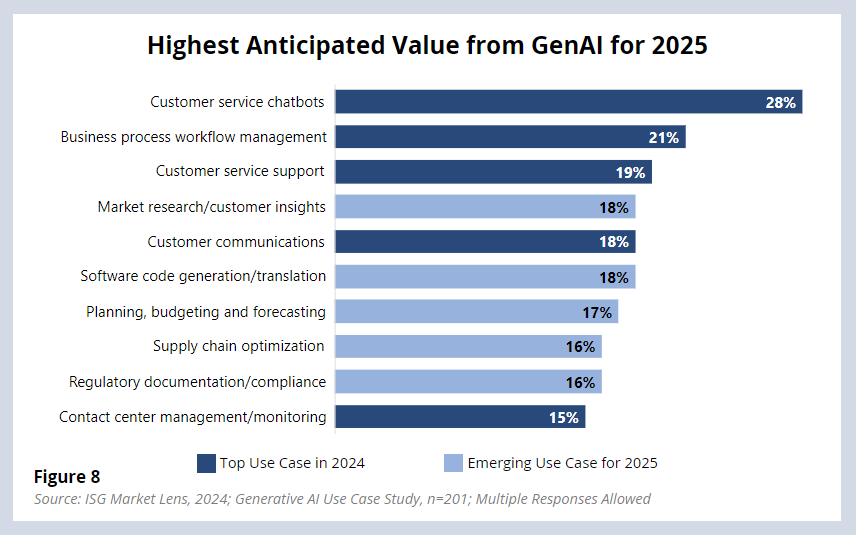

Implication No. 8: AI Will Have a Meaningful Impact on Provider Growth

As we reported on the Q3 ISG Index Call, more than $15 billion of AI revenue has been generated in the IT and business services industry on a trailing 12-month basis. That represents approximately 5% of revenue for service providers (Figure 8).

If you take out AI-related revenue growth, provider revenues would have been down 1%, so AI is already starting to have a meaningful impact on growth, even in these early stages. We believe this will continue in 2025 as many of the pilots started in 2024 will start to move into production, and newer “Wave 2” use cases start to come online.

There’s also a much bigger prize to be had here: as enterprises continue to decouple data management from technology management, it will create a new “data tower” that enterprises will source – just like they do ADM and infrastructure today.