If someone forwarded you this briefing, consider subscribing here.

GLOBAL CAPABILITY CENTERS

Client questions and conversations around global capability centers are at an all-time high as enterprises work to balance an exceptionally tight labor market with intense pressure to optimize costs.

Different Directions, Same Reasons

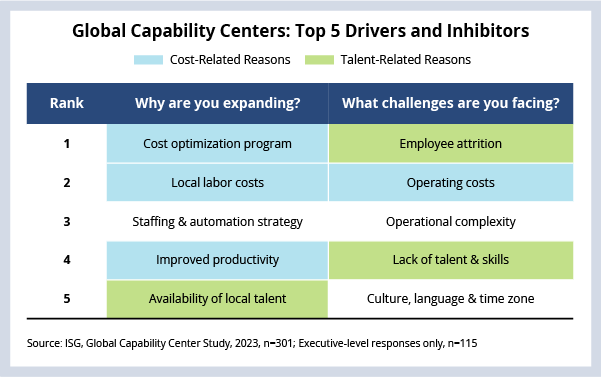

On the second quarter Index call, we talked about the exceptionally strong market activity around global capability centers. And, as we discussed, most of this activity is driven by two factors: optimizing costs and accessing talent.

The interesting twist here – and one that may be unique in the history of the sector – is that this unprecedented activity includes not only enterprises that want to build or expand GCCs, but also ones that want to exit or monetize them as well.

The top reasons we see enterprises setting up or expanding GCCs – accessing talent and reducing costs – are essentially the same reasons we see enterprises wanting to reduce staffing or altogether exit – the talent they need is not available locally, and they’re not reducing their costs.

DATA WATCH

We recently wrapped up a buyer behavior study of more than 300 executives with responsibility for current GCC operations.

And, based on this data, we’re starting to see three archetypes emerge that may help explain some of this “dumbbell” type activity to either grow – or exit – a GCC.

- Archetype One: Achieved cost savings at the expense of quality.

This group of enterprises realized objectives around cost reduction, but quality suffered. Customer satisfaction, quality and employee experience scores are all down. - Archetype Two: Realized moderate results, now consolidating.

This group started their GCC using a build-operate-transfer (BOT) model and realized good results across cost and customer experience scores. For the next 24 months, they are primarily focused on optimization and consolidation via automation. - Archetype Three: Started with outsourcing, now expanding.

This group outsourced first, then moved to a GCC-like model. Think of this as a “managed captive” option. They are seeing scores up across every category and are planning on expanding staff over the next 24 months.

It’s our view that Archetype One is likely driving much of the activity focused on exiting or monetizing a GCC. Archetypes Two and Three are driving much of the BOT activity in the market.

What’s Next

It’s important to keep in mind that a GCC is just another delivery model. In-house, staff augmentation and managed services are delivery models, too, and most large enterprises use a mix of all of them.

Right now, there is a lot of focus on the GCC delivery model given how central tech is becoming for nearly every enterprise. It makes sense that companies want to retain these skills. But as you can see in the data, the supply side of the GCC equation can be really challenging. And this is just one component.

We’ll be covering these GCC-related opportunities and challenges in more detail on the 3Q23 Index call on October 12, so we hope you can join us. And, as always, if you’re interested in more detail on this red hot topic, feel free to reach out to Alex or me anytime.