If someone forwarded you this briefing, consider subscribing here.

BANKING

Amidst a backdrop of macroeconomic uncertainty, banks are laser-focused on costs. This has led to one of the tightest spending environments in recent memory. However, banks realize that tech modernization and transformation are key to growth – and to defending against non-traditional competitors. Looking to 2024 and beyond, we believe much of this modernization and transformation will happen in customer experience and AI.

DATA WATCH

Background

Discretionary spending has been under significant pressure in 2023. This is especially the case in the banking sector. Throughout 2023, we’ve seen significantly greater scrutiny on ROI at banks, with the number of approvals needed for a project increasing and the dollar value threshold of these approvals decreasing. It’s one of the tightest approval environments in the last two decades.

However, as we wrote a few months ago, banks are unlikely to defer tech spending despite industry stress. We believe this continues to hold true, especially for large banks. A quick glance at recent earnings from banks reinforces this: a strong focus on cost but with continued tech spending in areas that have a clear ROI.

So, heading into 2024, the question becomes: where will this tech spending go?

2024 Tech Spending Priorities

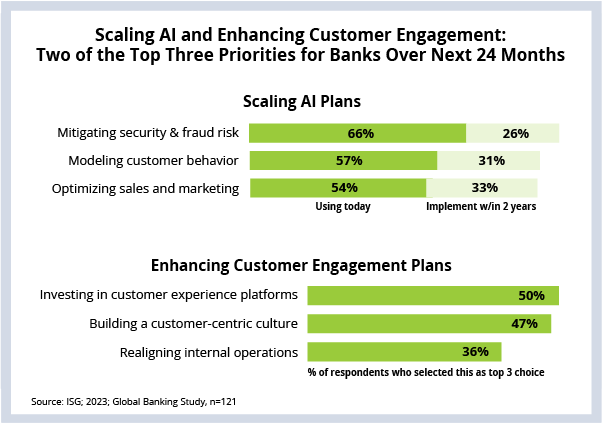

Based on a study we just wrapped up of 121 global banking leaders, we believe two of the top three areas will be artificial intelligence and customer experience.

As you can see in this week’s Data Watch, banking leaders indicate they have already deployed AI across a number of areas, including security and fraud, predictive analytics and sales and marketing. But remember, with the advent of generative AI, we’re moving from technology that can learn and repeat to technology than can create and re-create. And nowhere is this happening faster than in the banking sector, according to our recently released State of Applied Generative AI Market report.

This will open a new set of opportunities to extend these existing AI investments and create new ones that will be deployed over the next 24 months. Case in point: Over two-thirds of survey respondents indicated they are researching or deploying a generative AI use case today.

While scaling AI is the overwhelming response to our “hot topics” question, banking leaders are also clearly prioritizing customer engagement in 2024, with over 50% of respondents indicating they plan on investing in customer data and/or experience platforms.

What’s also interesting is the degree to which much of this activity over the next 24 months will be internal, focused on operating model changes to support better customer engagement. This is a pattern we’ve consistently seen since the pandemic.

What’s Next

Within the banking sector, new technology adoption and transformation is often funded using discretionary spending and project-based work. As we’ve discussed, discretionary spending remains under pressure, so we expect banks to rely on cost optimization in their managed services agreements to fund these 2024 transformation and modernization programs.

We’ll be discussing these and more red-hot topics at our annual TechXchange: BFSI event on December 5 in New York. We hope to see you there.