Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

SMART MANUFACTURING

Smart Manufacturing – leveraging technology and data to coordinate product development and design, manufacturing, supply chain, and end-user feedback into a closed loop to improve outcomes in the manufacturing business – is on lots of enterprise agendas. In the lead up to ISG’s Smart Manufacturing event, ISG has conducted a survey of leading global manufacturers. We wanted to gauge their objectives and progress on their Smart Manufacturing journey.

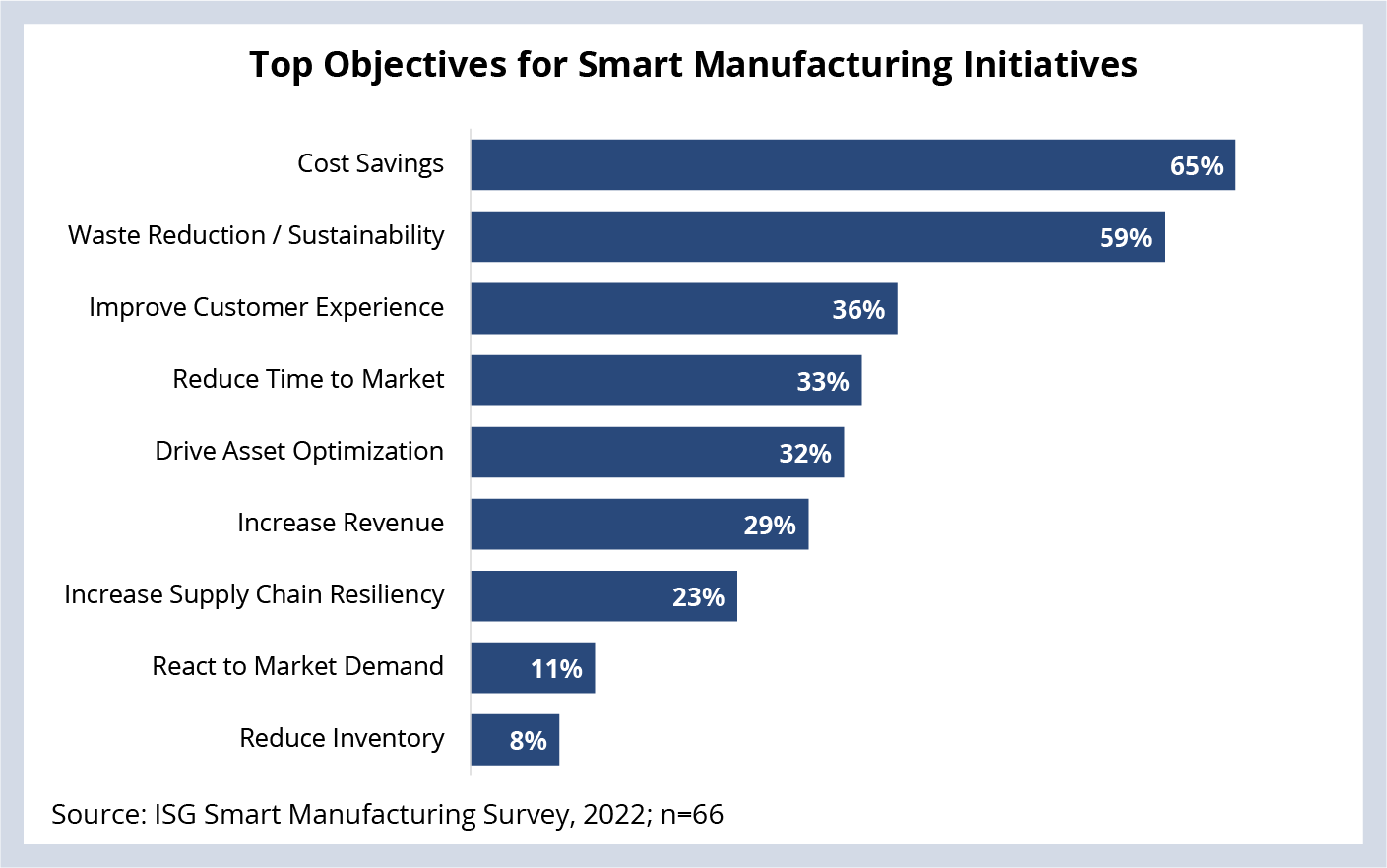

It is clear from the data that Smart Manufacturing initiatives are currently targeting profitability over growth. More than half of the enterprises we surveyed state that either direct cost savings or indirect cost savings through waste reduction and sustainability are the top objectives for their Smart Manufacturing initiatives. Growth objectives like reduced time to market and increased revenue were lower down the list.

This prioritization of cost savings and waste reduction likely reflects that operational data is available and can be immediately put to use to achieve them. We have seen a similar tendency in the early adoption of IoT, big data and automation systems, where businesses initially focused on using the data coming from those systems to validate their approach and strategy in using them. The survey findings also show many large organizations are early in their Smart Manufacturing journeys and have set relatively near-term goals to first build out business cases and gain organization and technical maturity before expecting the initiatives to spur business growth.

ISG believes that business growth will absolutely be an outcome of the adoption of Smart Manufacturing in the long run. Growth objectives are not less important to enterprises; they are just farther away. To learn more, please join ISG at our Smart Manufacturing event in April to hear Partner David Lewis discuss the full study results.

DATA WATCH

NETWORK SERVICE CHANGES IN RUSSIA AND GLOBAL IMPACTS

As we continue to cover the fallout in the IT industry from the war in Ukraine, one area of client interest has specifically been the impact on telecommunications in Russia. While this may be an incomplete list, we would like to highlight the actions of a few telecom providers and network equipment manufacturers. It is important to understand that these actions are expected to generate additional consequences outside of Russia, causing unexpected service impairments. Certain types of customers may be more sensitive to these interruptions, and planning is advised.

TELECOMMUNICATIONS

- COGENT (a GTT company) – the world’s largest internet traffic bearer, supporting an estimated 25% of global internet traffic, cut off Russia from its network on March 3 (link) and (link).

- Lumen – the multinational technology company disconnected its physical network from Russia at the hardware level (link).

- Vodafone – on March 3, the telecommunications multinational ended a 14-year, recently renewed partnership with Russian operator MTS. Vodafone was the next choice for MTS peering and transit, which will increase the challenges for carriers remaining in the region (link).

- OneWeb – the communications company building broadband satellite internet services announced on March 3 it is cancelling all scheduled low earth orbit (LEO) launches from Kazakhstan. Notably, the British government owns a 42% stake in the company. Bharti Enterprises @ 42% and Softbank @ 16% are the other stakeholders (link) and (link).

- ViaSat – the high-speed satellite broadband services and secure networking systems provider fell victim to a cyberattack on the morning of the Russian Federation’s “special operation.” The attack disabled modems across Europe, including in Ukraine, Slovakia, Czech Republic and Germany, impacting tens of thousands of customers. The United States NSA and France's ANSSI governmental cybersecurity agencies are investigating (link).

NETWORK PROVIDERS

- Fortinet – the cybersecurity service provider has ceased operations in Russia, including sales, support and professional services (link).

- Juniper Networks – the network service provider is suspending sales, product deliveries and support services to customers in Russia and Belarus until further notice (link).

- Ericsson and Nokia – the networking and telecom giants ceased product deliveries to Russian operators while they assess the impact of Western government sanctions on both 5G rollout and maintenance of existing infrastructure across all four major mobile network operators: Beeline, MTS, MegaFon and Tele2 (link and link).