Unlocking Growth through Strategic Services Procurement

Enterprises around the world are increasingly relying on external service providers to augment their operations and drive strategic growth. From the decades-old technical support domain to management consulting to marketing and finance, the service industry has grown to become an indispensable component of global business. For growing businesses, IT services procurement has become a strategic enterprise function.

Enterprise services encompass a broad spectrum of critical operational and technology-based functions, such as IT infrastructure, cloud platforms, cybersecurity, application support and managed business processes. But procuring these enterprise services can be quite an undertaking that demands a delicate balance between cost optimization, quality assurance and risk mitigation.

7 Procurement Pitfalls Growing Business Can’t Afford

Growing enterprises occupy a unique position in the market. They are beyond the startup stage but have yet to transition to the robust infrastructure and IT environment of a multinational organization. Growing businesses, or mid-tier organizations, are those with revenue between $50 million and $1 billion and roughly 500–5,000 employees. They face unique procurement challenges due to limited scale, resources and buying power compared to large enterprises. Identifying these challenges is the first step toward transforming procurement into a competitive advantage.

- Financial constraints: Procurement relies on capital reserves to make long-term strategic investments and operational expenditure. Because growing companies have financial constraints, they are typically more risk averse and need to focus their funds on immediate operational requirements.

- Talent shortage: Growing businesses need expertise in procurement specialities, including negotiations, industry-specific procurement standards and supplier agreement structures. Unlike established organizations that have deeper pockets to attract and retain specialized procurement talent, growing businesses often struggle to compete in the labor market for professionals with advanced procurement expertise. Insufficient internal skills can result in poor supplier management and unclear procurement procedures.

- Weakened leverage in negotiations: Large purchasing volumes and longer-term agreements can tilt the scale in favor of larger organizations when negotiating with suppliers. Without these, organizations can struggle to secure favorable pricing or service levels and service customizations. As illustrated in Figure 1, factors such as volume bundling, extended contract terms and multi-category deal structuring play a critical role in strengthening negotiation positions. Absent these, organizations may find themselves under increased sourcing pressure with limited room for trade-offs.

Figure 1: Negotiation Levers, Source: ISG - Underutilized digital tools: Investing in automated procurement systems is only effective if the tools are carefully implemented and seamlessly integrated into the organization’s ecosystem. Implementation challenges and integration complexities in growing businesses lead to a lack of transparency in ROI for technological investments. The World Economic Forum reports that approximately 25% of small- and medium-sized businesses say keeping up with the demands of technology and innovation is a top challenge.

- Compliance and risk management neglect: Mid-size players struggle to commit to risk management frameworks and instead take a reactive approach to compliance. This creates potential legal vulnerabilities and missed business opportunities. The lack of comprehensive risk management strategies or structured audit mechanisms can hamper business continuity and growth prospects.

- Scalability bottlenecks: Enterprises often reassess their procurement strategies to find that processes that worked at a smaller scale or during a growth stage have become a bottleneck as the company has grown. Scalable procurement capabilities support continued growth, yet an organization needs to achieve sufficient growth to justify investments in scalable systems. Increasing the supplier base, securing a robust technology infrastructure, expanding geographically and allocating adequate resources are some of the challenges growing enterprises face.

- Integration challenges: Mid-tier businesses that are restricted to a siloed approach often struggle with fragmented systems. A significant disconnect is often between procurement and finance departments, which can impact both operational efficiency and financial visibility. Another gap is often between procurement and IT, which can lead to shadow IT as departments bypass formal procurement channels.

The Procurement Paradox for Small- and Medium-Sized Businesses

Some of the above challenges are also faced by multinational organizations, but they often have the right tools and strategies to overcome them. Growing organizations need targeted strategies that address their unique procurement needs and establish a foundation for future scalability.

Preparing the Foundation: Evaluating Your Current IT Landscape

Before adopting advanced technology, developing organizations must assess their current tech landscape. This helps identify gaps, prioritize investments and align acquisitions with business goals. Start with the following four steps:

- Infrastructure inventory analysis: Identify all hardware, end-user devices, software, networking equipment, storage system and service components along with their current configuration, versions, age, warranty status and lifecycle position. This exercise will not only help you identify unmanaged or shadow IT assets but also standardize the process of assessing actual needs, making right-size acquisitions and maximizing the value of technology investments.

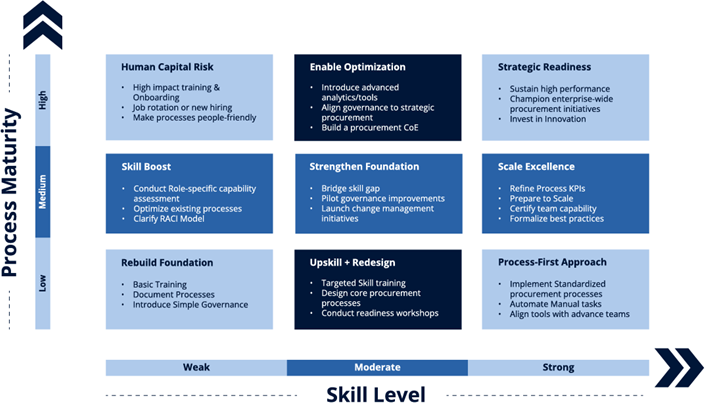

- Organizational health check: Internal structures, stakeholders and capabilities need to be aligned to effectively adopt, integrate and manage new IT services. This requires executive sponsorship and accountability for procurement decisions. Early on in the process, organizations should evaluate the procurement function’s maturity, project and change management skills and technical expertise in areas such as cloud, cybersecurity, data integration and service management. This will provide a realistic view of current capabilities and gaps before engaging in IT services procurement. It lays the foundation for better planning, smoother transitions and maximum value realization. A recent study assessing the readiness of mid-market organizations for Industry 4.0 adoption in the manufacturing sector highlighted significant disparities in preparedness levels. The research evaluated key factors such as digital infrastructure, employee skills, management support and investment capabilities. A procurement readiness assessment evaluates an organization’s preparedness for procurement changes and identifies gaps in people, processes and governance. To guide such assessments, frameworks like the Organizational Readiness Matrix (see Figure 2) help identify where an organization stands in terms of skill level and process maturity, and what targeted interventions are required across people, process and governance dimensions to drive procurement transformation.

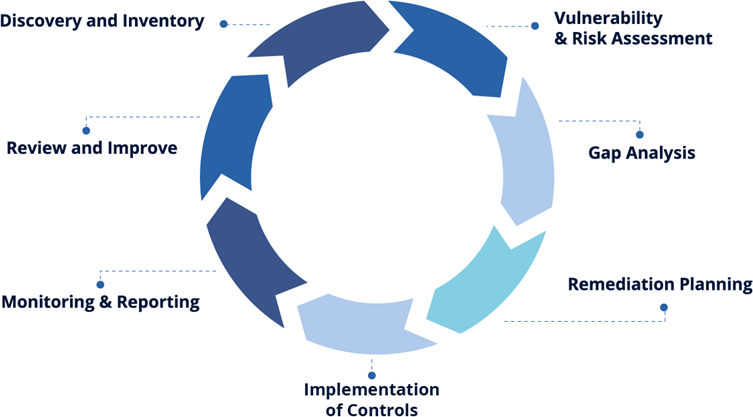

Figure 2: Operational Readiness Matrix framework with targeted interventions, Source: ISG - Evaluating security posture: For any organization, security and compliance considerations must be integral to procurement decisions. As organizations scale, their security risks multiply and their visibility as potential targets increases. In recent years, small businesses have increasingly become targets of cyberattacks, underscoring their vulnerability to data breaches and security threats. A company’s security strategy should align with its digital transformation initiatives to ensure security enables rather than impedes innovation. The lifecycle of a security posture assessment, as illustrated in Figure 3, provides a structured framework for identifying risks, planning remediation and continuously improving controls—critical steps for embedding security into the procurement process.

Figure 3: Lifecycle of Security Posture Assessment, Source: NIST SP 800-115 - Reviewing your supplier ecosystem: A comprehensive vendor and contract portfolio review is an essential part of assessing enterprise readiness for procuring new or optimized IT services. As businesses grow, vendor ecosystems can become fragmented, contracts outdated and service overlaps common — all of which can dilute value, increase risk and hinder scalability. A supplier ecosystem review provides visibility into the current sourcing environment and serves as a baseline for a strategic, future-ready procurement approach. Contracted vendors can charge different prices per unit and lead to savings leakage. Tracking IT services providers, evaluating vendors and addressing high-risk contracts help organizations cut inefficiencies, reduce risks and streamline enterprise procurement.

Please fill out this form to continue.

Future-Proofing Procurement: Your Roadmap to Strategic Success

How does a growing business bridge the gap from current capabilities to future goals?

Developing a roadmap is critical to ensuring enterprise services procurement is proactively aligned with long-term business objectives. For a growing business, it is a bridge between current capabilities and the desired end state—articulating a clear path toward scalable, efficient and value-driven IT services. In addition to defining the target operating model, organizations need to prioritize quick wins (e.g., contract renegotiation and process automation) and longer-term transformation goals (e.g., full cloud migration and vendor consolidation). A key aspect of future-state planning includes measuring and continuously improving performance.

A thorough readiness assessment will allow growing businesses to better understand their IT landscape and make informed procurement decisions. This exercise can also identify opportunities to optimize existing assets, possibly reducing the scope and cost of new investments.

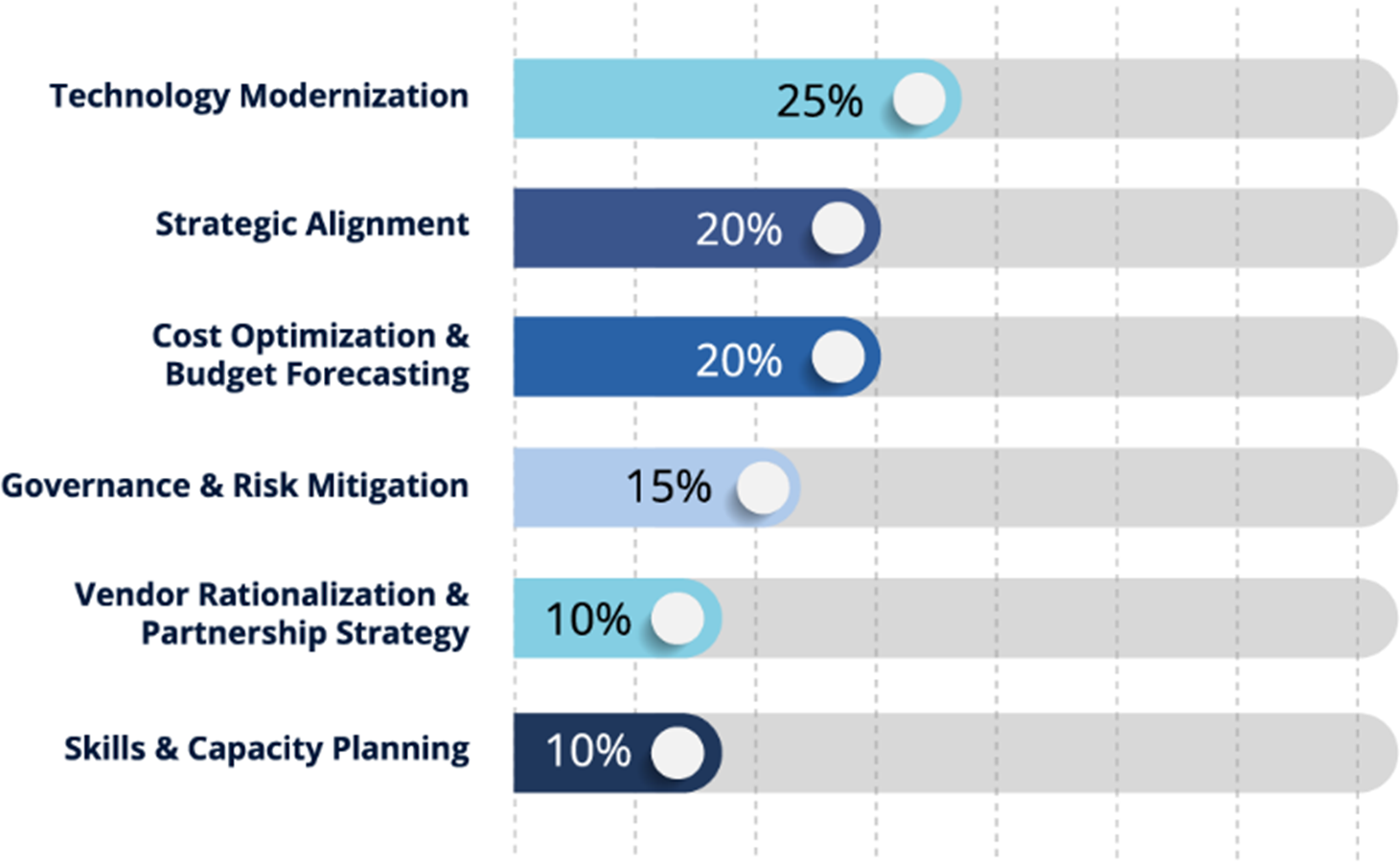

A key aspect of future-state planning includes measuring progress and continuously improving performance across multiple dimensions such as technology, governance, cost and capability. As shown in Figure 4, areas like technology modernization, strategic alignment and budget forecasting are top priorities for organizations shaping their future-state IT procurement strategy.

Figure 4: Future-State Planning Focus Areas, Source: ISG

How to Optimize Technology in Procurement

Mid-market organizations can drive meaningful procurement outcomes by prioritizing the right technologies and ensuring rapid, measurable returns. Here are key strategies to consider:

Prioritize your tech investments: In today's technology-rich environment, growing enterprises face a crucial challenge: distinguishing between essential technologies that drive core business functions and nice-to-have solutions that, while appealing, may not justify their investment. Organizations need a clear classification for technologies: a) mission critical, b) business-enhancing, and c) supplementary technologies. Growing businesses need to focus on how quickly investments will generate return, as they have lower tolerance for extended payback periods than larger enterprises. Technologies that deliver measurable financial benefits within 12-18 months generally deserve higher priority than those with longer-term or less certain returns.

Embrace automation and AI: Modern procurement has undergone a digital transformation that helps organizations achieve unprecedented levels of efficiency, visibility and strategic value. For mid-market enterprises, leveraging technology effectively can level the playing field with larger competitors and provide the operational excellence needed to support continued growth.

Some of the well-known technologies for procurement include:

- Digital procurement platform: Digital procurement platforms provide a unified interface for managing all procurement activities, from requisition to payment. These platforms also ensure approval hierarchies that adapt to organizational structure, spending thresholds and procurement categories and, in turn, reduce cycle times and ensure appropriate oversight of procurement decisions. By providing real-time spend analytics capabilities that can be used to analyze spending patterns by supplier, category, department and time, the procurement organization can identify opportunities for consolidation, contract renegotiation and process improvement. Despite facing challenges, such as limited IT infrastructure and resistance to change, small and medium-sized companies can recognize the benefits of e-procurement in enhancing transparency, reducing costs and improving procurement performance.

- Automation: Automated procurement systems can generate purchase orders from approved requisitions, match invoices to orders and receipts and process payments without human intervention for routine transactions. Other automation capabilities include optical character recognition (OCR) and machine learning to extract data from invoices automatically, match them to purchase orders and identify discrepancies that require manual review.

Bridging the Procurement Gap: Tech and Collaboration as Equalizers

To thrive in a procurement landscape dominated by scale, growing businesses must adopt new strategies that amplify their influence — from consortium participation to building deeper supplier partnerships.

The power of purchasing consortiums: For mid-market companies with limited procurement resources, competing against enterprise giants is a challenge. Purchasing consortiums offer a powerful solution that enable mid-sized organizations to aggregate their collective buying power and achieve enterprise-level negotiations and terms previously accessible only to Fortune 500 companies. This collaborative approach transforms procurement from a resource-constrained function into a strategic advantage that levels the competitive playing field. Joining a group purchasing organization (GPO) can reduce procurement costs by 10–20% across commodity and SaaS services.

Mid-market companies typically face a procurement paradox: they need sophisticated procurement capabilities to remain competitive yet lack the volume and resources to command supplier attention or achieve optimal pricing. Individual mid-market buyers often find themselves treated as secondary priorities by major suppliers that focus their best resources and pricing on large enterprise accounts.

Purchasing consortiums directly address this challenge by creating artificial scale that rivals enterprise buying power. When a consortium of 50 mid-market companies collectively represents $100 million in annual spending, suppliers suddenly view this aggregated demand with the same seriousness they reserve for their largest individual customers. This shift in supplier perception opens doors to pricing tiers, service levels and strategic partnerships that would otherwise remain inaccessible.

Pilot program approaches allow mid-market companies to test consortium participation with limited risk and resource commitment. Starting with a single spending category or supplier relationship provides valuable learning opportunities while demonstrating value to internal stakeholders. Successful pilots create momentum and justify expanded consortium participation.

Technology as your secret weapon: Successful procurement negotiations for anyone but the largest enterprises begin long before the negotiation table. An organization needs essential market intelligence, supplier analysis and internal stakeholder alignment. Technology can be the key to gaining insights into supplier capabilities, market conditions and internal requirements. E-sourcing platforms provide real-time visibility into competitive dynamics, while AI-powered analytics can identify optimal negotiation strategies based on historical data and market patterns. These platforms can analyze vast amounts of historical negotiation data to identify patterns and suggest optimal approaches for specific supplier relationships and commodity categories.

Building strategic supplier relationships: The most successful mid-market procurement negotiations focus on building long-term strategic relationships rather than maximizing short-term gains. This involves transparent communication, fair dealing and consistent follow-through on commitments. Procurement teams that invest in relationship building often find that suppliers are more willing to share innovative ideas, provide preferential pricing and offer additional value-added services.

Your Winning Team: Building or Borrowing Procurement Expertise

Finding the Right Mix of Expertise: For growing organizations, IT procurement represents both a critical business function and a significant resource challenge. Expanding companies must balance broad tech needs with limited budgets and staff. The key is strengthening internal capabilities while leveraging external expertise to enhance procurement efficiency.

For many growing businesses, external expertise provides access to specialized IT procurement capabilities that would be prohibitively expensive to maintain in-house. The key lies in strategically leveraging external resources to complement internal capabilities rather than replace core procurement functions. Companies that use external procurement services with advanced analytical capabilities can increase their procurement efficiency and reduce their procurement costs.

Specialized IT procurement consulting firms offer deep expertise across specific technology categories, vendor relationships and market dynamics. These consultants can provide category-specific guidance for major purchases, conduct market analysis for strategic technology decisions and support complex negotiations with enterprise software vendors. We expect to see an increasing reliance on external procurement services, particularly for small- and medium-sized businesses looking to streamline operations and reduce costs.

Growing enterprises often engage external consultants or agencies for major technology initiatives — not only to access specialized expertise but also to accelerate outcomes and reduce risk. While internal teams manage routine purchases effectively, external partners bring structured procurement practices, deep vendor insights and negotiation leverage that may be otherwise unavailable. Organizations that strategically leverage external resources are often better positioned to drive innovation, ensure compliance and capture long-term cost efficiencies — while allowing internal teams to focus on governance and institutional knowledge-building.

How ISG Turns Your Procurement Challenges into Strategic Victories

For growing businesses, strategic procurement is key to sustainable growth. Treating it as an enabler—not just a back-office function—helps organizations adapt, innovate and stay competitive. Success comes from pragmatic planning, digital tools and expert guidance.

ISG brings deep expertise and proven methodologies to support growing businesses in transforming their enterprise procurement strategies – readiness and maturity assessment, cost optimization and benchmarking, strategic sourcing advisory, technology enablement and automation. ISG helps growing businesses elevate procurement from a reactive necessity to a proactive strategic advantage—unlocking efficiency, enhancing vendor relationships and accelerating growth.

We help mid-market and growing businesses unlock enterprise-grade buying power through data-driven sourcing strategies, deep market intelligence, and supplier relationship expertise. By leveraging ISG’s strategic sourcing frameworks and cost optimization techniques, small and medium-sized organizations gain access to competitive pricing, scalable contract structures and benchmarked deal terms typically reserved for larger enterprises.