Yes, we’ve heard it. European utilities are leading U.S. utilities in transforming the customer experience. Australian utilities lead U.S. utilities in the adoption of smart meters and advanced distribution management systems. U.S. utility leaders have largely been able to ignore such headlines. Is it because they don’t care? Certainly not.

The utility regulatory ecosystem in the U.S. is very different than in other countries. Within the U.S., local regulatory bodies – more than federalized policies – drive actions since that is where rate cases and rate recovery issues are resolved. A certain number of the U.S. public utility commission seats are filled as a result of elections, as in California and Michigan. Others, such as New York and Texas, are filled via political appointment. When these positions are filled via an electoral process, regulatory preferences are often driven by the mood of the electorate more than they are by practical engineering constraints.

What’s different now? Is there a reason utility leaders, including CIOs, should begin to look and think globally?

The answer is yes, and the driving force is decarbonization.

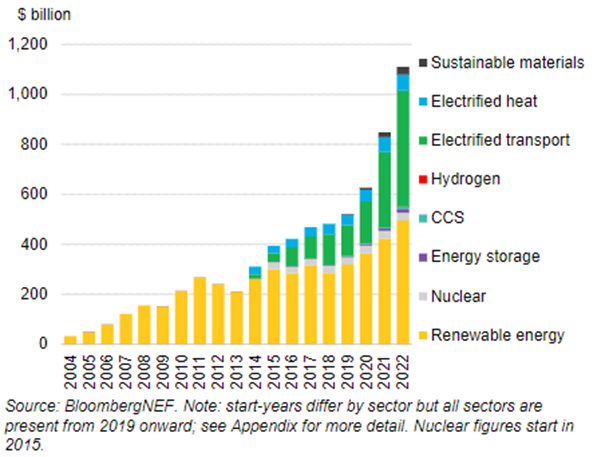

Many readers may have seen or are familiar with energy transition investment trends as published by BloombergNEF. In 2022, we saw a significant push created by a global investment of more than $1 trillion in energy transition initiatives.

In addition, BloombergNEF, Accenture and others have worked with the United Nations to support the achievement of the UN’s Sustainable Development Goals (SDGs) to promote sustainable development around the world.

Given this level of investment and societal momentum, U.S. utilities have little choice other than to look up and look around.

Shifting Attitudes About Carbon Reduction

Trends that gain momentum of their own most frequently gain that momentum after a “tipping point” event. For the decarbonization shift, that point was the 2015 Paris Climate Accords. It signaled a shift in global attitudes that continued into the current decade. Many countries, including the U.S., measure themselves against the carbon reduction goals triggered by the accords.

In addition to the actions coming out of the Paris Agreement, the movement benefitted when Greta Thunberg entered the discussion in 2018. Thunberg was a 15-year-old who skipped school to protest in front of the Swedish parliament. These protests caught the attention of media and politicians, and suddenly an exploding youth movement was born. Thunberg’s 2019 address to the United Nations Climate Summit in New York cemented the attention of Gen Z. Gen Z represents fully 20% of the U.S. population.

Are there metrics to prove that a commitment to decarbonization is real?

According to recent trend studies published by EY, 55% of Gen Z respondents say they are very or extremely interested in environmental issues. For this generation, climate has become a moral obligation on which they are acting. As reported in the same EY study, 71% of Gen Z respondents reported buying or having someone buy for them at least one used or pre-owned clothing item since March 2020.

The Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) are more recent commitments that build on the Paris Agreement and the work that has been underway for 7-8 years.

Emerging Lessons Learned from Decarbonization

The last four years of hyper-focus on energy transition around the world marks the beginning stages. Grid investments will be a constant over the coming years. The following are among the lessons learned so far:

Nuclear power must be part of the energy generation mix. Germany over-reacted to the Fukushima disaster in Japan and ordered a shutdown of nuclear power by 2022. The Ukraine war jarred policy makers to revisit that decision and it has now been overturned. This reversal, combined with an overdue reality-check in California leading to reversing the shut-down of Diablo Canyon highlights how nuclear is being recognized as a critical part of the solution. The U.S. Senate Committee on Energy and Natural Resources has wisely reconsidered the value of its largest and most stable source of carbon-free electricity – nuclear power. The math simply does not support mass replacement of highly dense “always on” sources of energy with low density and hard to predict renewables sources. When measured by its capacity factor, U.S. nuclear plants achieve 92%, regardless of location. Even in sun-rich Texas, the capacity factor of Texas solar farms was just 24% in 2020, according to the U.S. Energy Information Administration. The capacity factor drops to 20% if the same solar array is positioned in sunny Florida. Particularly in Florida, there has been limited discussion about the impact to fragile ecosystems in deploying large-scale solar. It is fair to expect such discussions to become more common.

Storage solutions must catch up. Given the intermittent performance of electricity generation by renewables, the need for advanced utility-scale storage solutions has become clear. When electricity grids are subjected to wide swings driven by changing weather conditions such as wind and sunlight, instability is the result. Utility-scale storage can provide a critical piece of the puzzle through its ability to store excess energy during times of high production and release it back when demand exceeds supply. Utility-scale storage is not, however, without challenges. It depends on complex and high-risk supply chains that feature lithium, cobalt and magnesium. The U.S. does not produce material amounts of cobalt, which creates a dependency on supply chains that include the Democratic Republic of the Congo, Australia, Russia and Cuba. Adding to this complexity, the control equipment includes inverters and transformers, which means the solutions are more than simple drop-ins.

Affordability is a real concern. There are risks for middle-income and lower-income energy affordability during the transition to decarbonization. There are now two different studies that quantify necessary global grid investments to support renewables at $275 trillion USD. To put that investment in perspective, the total GDP of the U.S. in 2022 was $23.6 trillion. The energy transition is not free. Incremental grid investments will be a recurring annual burden for the foreseeable future. For example, electric vehicles (EVs) create a distribution load that roughly equates to one residential home (roughly 29kWh per day). This means that the electricity infrastructure required to support the average neighborhood will need to double in capacity at the point when every home relies on EVs. As we know, citizens (utility customers) are the ultimate source of funding. Cost control will be an on-going concern for the coming decades.

Transmission capabilities are a constraint. High-voltage direct current (HVDC) is increasingly being looked at as an option to transmit power over long distances (from solar-rich locations to solar-poor locations) with reduced energy loss. Energy lost during transport over long lines is referred to as line loss. The U.S. standard alternating current (AC) transmission experiences a 5% - 7% loss. DC cables enable transmission of very high voltages over long distances without incurring the limitations created by the charging and re-charging necessitated by AC based transmission. Is this an easy fix? Not really. One of the issues is scale. A material conversion of the U.S. transmission system to HVDC would be an expensive undertaking that requires years to accomplish, overcoming not-in-my-back-yard permitting barriers and massive investment.

Recommendations for Utilities CIOs

Decarbonization is more than a local, regional or national issue. It spans global boundaries. It is persistent and will remain a top issue for the foreseeable future. Utilities can benefit by sharing and collaborating. This is an “all hands” type of issue that requires big solutions.

The following are utility CIO recommendations:

- Keep up with decarbonization trends, successes and failures. Decarbonization is driven by global factors that will remain persistent. There is no silver bullet. In 2023, there are a number of initiatives that are showing promise, such as industrial clusters. A mix of solutions that will work for your specific utility’s geography is likely different than for a utility 1,000 miles away.

- Be part of the conversation to show where and how technology plays a role. Digitization is at the heart of nearly every serious solution. Higher-complexity solutions necessitate higher levels of monitoring, tracking and control than previously required. Ensure your teams become equally fluent in IT and OT and establish centers of excellence to address needed competencies.

- Extend your network. Attend events where you have the chance to meet utility leaders from other countries. You will be amazed! We face many common challenges and wrestle with the same technologies. Personal experience has shown that you are likely to make several valuable points of contact and learn from the experiences of others.

ISG helps utilities navigate the changing technology market as part of their decarbonization plans. Contact us to find out how we can help.