If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

HIRING

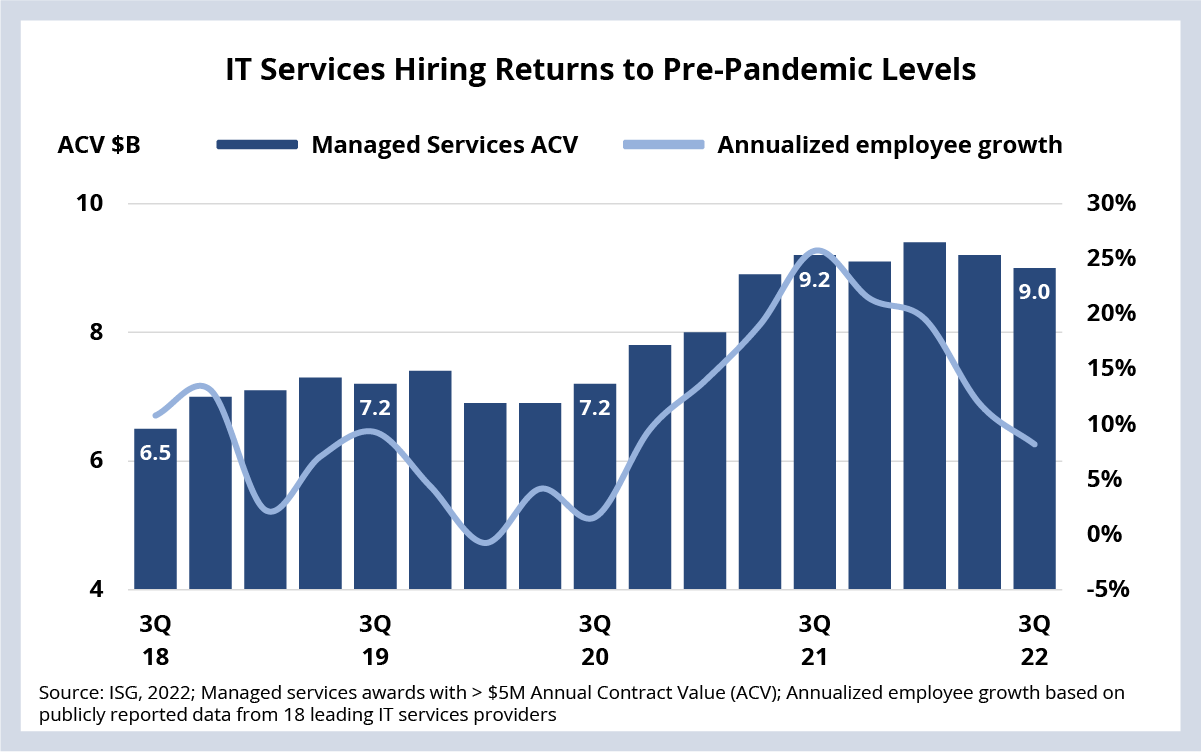

Hiring in the IT services sector has slowed to pre-pandemic levels. Employee counts soared immediately after the pandemic to support unprecedented demand. However, employee growth has been slowing of late and, in the third quarter of 2022, returned to pre-pandemic levels (see Data Watch).

Background:

As we discussed in our 3Q22 recap, the IT and business services sector has generated more than $9 billion of ACV for five consecutive quarters. To support this surge in demand, providers ramped up their hiring engines in a big way – for both entry level and lateral hires.

This explosion in hiring has led to one of the biggest additions of new talent in history, so much so that – as of 3Q22 – over 35% of employees in the sector have been with their firms for less than a year.

The Details:

- Prior to 2020, annualized employee population growth averaged around 8%.

- Then, growth surged post-pandemic, peaking at over 26% in 3Q21.

- Over the past two quarters, annualized employee growth slowed to 10%.

What’s Next:

The detail on Q3 shows that around 40% of the firms saw annualized employee growth of 6% or less. Given the tight linkage between employee growth and revenue growth in the sector, that number suggests that these firms are likely 1) forecasting for low single-digit growth or are 2) struggling to hire fast enough to backfill for attrition in an exceptionally tight labor market or are 3) feeling more comfortable about their ability to hire just in time, which has been a big challenge over the past two years.

That said, the tight labor market continues to be a net positive for the IT services sector. Enterprises need tech talent now and are increasingly tapping into IT services to find it. This, in turn, is leading to significant interest from enterprises in providers that are best managing and growing their talent pipeline.

So, providers that can hire (and retain) talent – especially in areas like apps, industry-specific business process work and product engineering – will be well positioned to capture a share of the solid demand we’re projecting over the next several quarters.

DATA WATCH

M&A

- Exadel acquires Polish software engineering firm Codete (link).

- Globant acquires Adobe and Salesforce e-commerce specialist eWave (link).

- Sopra Steria acquiring Belgian IT services firm Tobania (link).

- Orange acquires Swiss cybersecurity providers SCRT and Telsys (link).

- Atos sells part of its Italian operations to IT service provider Lutech (link).