Voice of the Investor

Get reliable, detailed data about what your investors are thinking and feeling to guide decision-making, assess the impact of changes and make course corrections early.

About the Program

For 13 years, ISG has been helping fund managers understand what matters most to their institutional investors. Using a proven combination of qualitative and quantitative methods, the Voice of the Investor program:

- Provides comprehensive, detailed data instead of relying on anecdotal reports or standalone satisfaction scores

- Establishes a baseline against which to assess the impact of changes

- Precisely identifies the opportunities for elevating the investor experience

- Shows your investors you truly care about them and their needs

- Uncovers different needs and priorities among investor groups or regions

- Determines what matters most to investors; it may not be what you think

Addressing industry challenges:

With comprehensive, detailed data that:

Cuts right to the heart of what matters.

- No wasting time with irrelevant questions

- Efficiency and predictive value of the question set has been proven

Multi-dimensional.

- Up to 10 standard modules with the option to customize or add others

- Up to 60 individual metrics

- Data segmented by asset class and region

Frank and unfiltered.

- Analysis and insights delivered by an independent third party, free from bias and vested interest

- Participants provide frank and perceptive observations, unhindered by the social or employment concerns that may constrain inhouse research

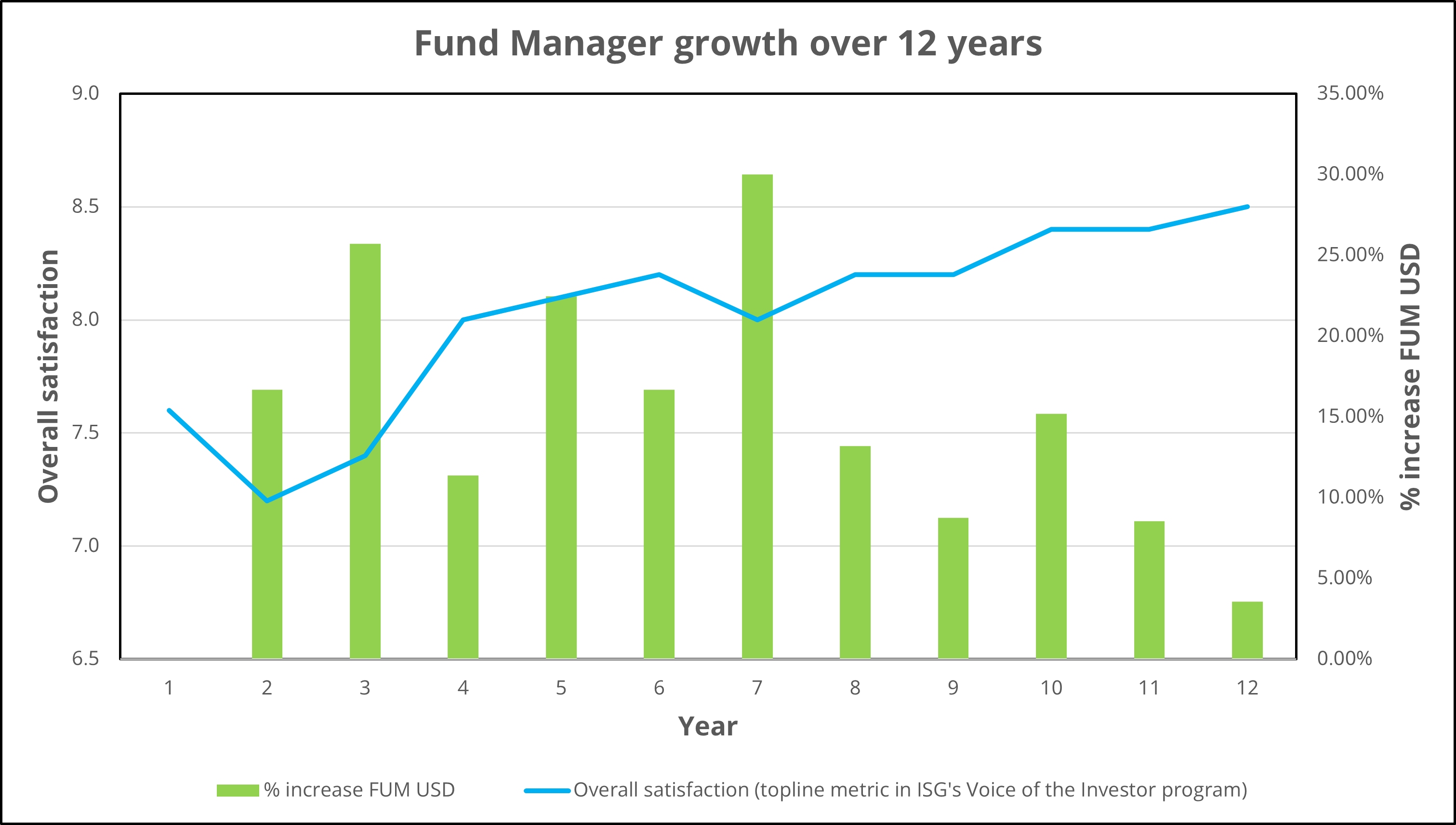

Case Study: A global fund manager has run the Voice of the Investor program for over 12 years to measure and understand investor sentiment. Actioning the output of the assessments has enabled them to grow overall satisfaction year on year, and the byproduct is managing more and more investment dollars.

More than a report...

EXECUTIVE PRESENTATION:

Summary of the insights and key findings for your senior team

MAIN REPORT:

Key recommendations plus detailed analysis of sentiment and quantitative data for each module

INTERACTIVE DASHBOARDS:

Drill down on the data for further detail using interactive dashboards

VERBATIM COMMENTS:

Hear what your investors actually said, word for word