Happy Friday!

Welcome to the second edition of the new ISG Index Insider™. Whether you are a service provider, technology vendor, enterprise technology leader, investment professional, or a member of academia or the media, my team and I want to give you the most up-to-date data and analysis on the fast-moving global technology and business services markets – something you can read in five minutes or less.

If you like this content, sign up here. Signing up means you’ll get the Insider in your inbox every week. And feel free to send me a note at [email protected] with your feedback.

Here’s what’s important this week:

- Cloud managed services acquisitions are heating up

- Google is making enterprise headway

- Network virtualization is on the critical digital path

- Cybersecurity warnings issued for cloud infrastructure

- H-1B clarity comes from new U.S. administration

M&A

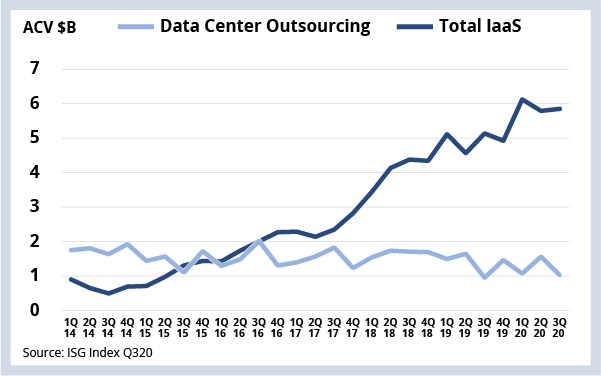

IBM beefs up its cloud managed services to offset revenue declines. IBM announced quarterly results yesterday and, while earnings are up, revenues are down. The market’s rapid shift from data center outsourcing to infrastructure-as-a-service (see chart below) is having an outsized impact on IBM’s GTS business, which was down nearly 8% (adjusted for currency). To stem the tide, IBM has been extra cloud acquisitive over the past 30 days.

First up is Nordcloud, a European pure-play cloud implementation and managed services firm. The Nordcloud acquisition is interesting because it focuses on what we’ve been talking about for some time – the movement of workloads to hyperscale providers, which requires both a technology change and an organizational change for enterprises.

In terms of technology, an entirely new world is emerging around containerized applications. Next-generation cloud managed services for areas like managed Kubernetes, managed service mesh, managed cloud native security and cloud observability services are all picking up steam. These technologies require new skills – and often these skills reside at smaller firms.

In terms of organization, the traditional focus on managing demand based on a limited supply of computing power is going by the wayside. With hyperscale providers, supply is essentially unlimited (at a cost). Re-thinking how the company embraces this mindset is going to be increasingly important. Nordcloud may help IBM address both of these critical needs.

The Taos acquisition appears to be more enterprise digital transformation oriented. Taos has solutions across digital strategy, workplace, cloud and cloud expense management. When IBM acquired Gravitant several years ago, it got a platform that focuses on normalizing cloud prices and defining a target architecture. The Taos acquisition will help IBM with the demand side – spend optimization and chargeback. Competitors have already acquired or built this kind of capability, so we’ll track this closely to see how these two acquisitions impact future results and fit into the IBM / NewCo strategy, which we recently wrote about here.

DATA

Quarterly ACV for Data Center Outsourcing and IaaS

CLOUD

Google continues to expand outside the U.S. – and into the enterprise. Last week Karan Bajwa, who currently leads Google Cloud in India, was tapped to lead Google Cloud in Asia Pacific. As we discussed on the most recent ISG Index call, as-a-service growth is exceptionally strong in Asia Pacific. As-a-Service annual contract value (ACV) grew almost 16% year-over-year and is now 77% of the total Asia-Pacific market. Google also announced it is launching a new cloud region in Saudi Arabia via a new company it will form there.

Google recently announced two important enterprise wins: Tapestry, the parent company of Coach, will migrate its SAP S/4 HANA installation to the Google Cloud Platform (GCP). Nokia announced in Q4 a five-year agreement to migrate its on-premises infrastructure to GCP.

Former Oracle executive and current Google Cloud CEO Thomas Kurian’s industry-specific strategy appears to be paying dividends. We’re watching this closely to see how enterprise leaders respond to running mission-critical enterprise workloads on Google’s cloud.

NETWORK

The network is the factory floor of digital transformation. My colleague Margot Wall said this a few years back, and it continues to hold true today. The network is finally getting the attention it deserves as enterprises work to retool their factory floor to 1) take advantage of hyperscale cloud services outside their perimeter and 2) move to a zero-trust security model.

We’re going to see more software-defined network transformation along the lines of what Orange Business Services (OBS) is doing with BNP Paribas. In what is being positioned as the “first large-scale SD-WAN project in the French retail banking sector,” OBS will virtualize and secure the perimeter of 1,800 bank branches across France.

This also represents a big change for traditional telecom providers. After the unsuccessful attempt to move into managed hosting via M&A a few years ago, we’re seeing a few of these providers successfully transition into – and deliver – higher-value managed services around service integration and management (SIAM) and managed security services.

CYBERSECURITY

This week the U.S. Cybersecurity and Infrastructure Agency issued an alert about several recent attacks on cloud infrastructure stemming from poor configuration hygiene. Human error is now as common as social media as causes for breaches – and misconfiguration errors are increasing. Complexity, spawned by an explosion of internet-facing devices and services, is what’s driving this. It’s also why we’re seeing such strong demand for managed cloud security services.

POLICY

As we discussed last week, the outgoing U.S. administration announced changes to the prevailing wage rates for worker visas, including the H-1B. This week, the new administration asked agencies to postpone rules for 60 days that have been published but not taken effect, and to withdraw rules that have not yet published.

What this means: Proposed changes to the employer-employee relationship are likely to be withdrawn, and changes to wage rates and the H-1B lottery are likely to be litigated.

The bigger picture: Indian-heritage firms have been preparing for these types of policy changes for some time by increasing local hiring, tapping into subcontractors and automating more. We don’t foresee a change in this strategy, even with the new administration. That said, we do see a number of providers taking a more proactive stance at solving the underlying challenge – a lack of STEM education and training – through programs like UST’s Step it Up America and Infosys’ Reskill and Restart Program.

INDEX RECAP

In case you missed the 73rd ISG Index call last week, here’s a recap of the headlines from Steve Hall and me.