Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

Enterprises expect AI to generate significant value once their SAP migrations are complete, with expectations varying by industry. However, one challenge is common across all industries: the value enterprises eventually generate from AI will be heavily influenced by systems and data that exist outside of SAP.

Data Watch

Background

We’ve discussed the anticipated and actual impact of AI on enterprise processes at length over the past year. A common theme we continue to see in the data – and on the ground with clients – is that there are no “fast followers” in AI yet. Most firms are still trying to determine where and how to apply AI and, just as important, how to measure the impact.

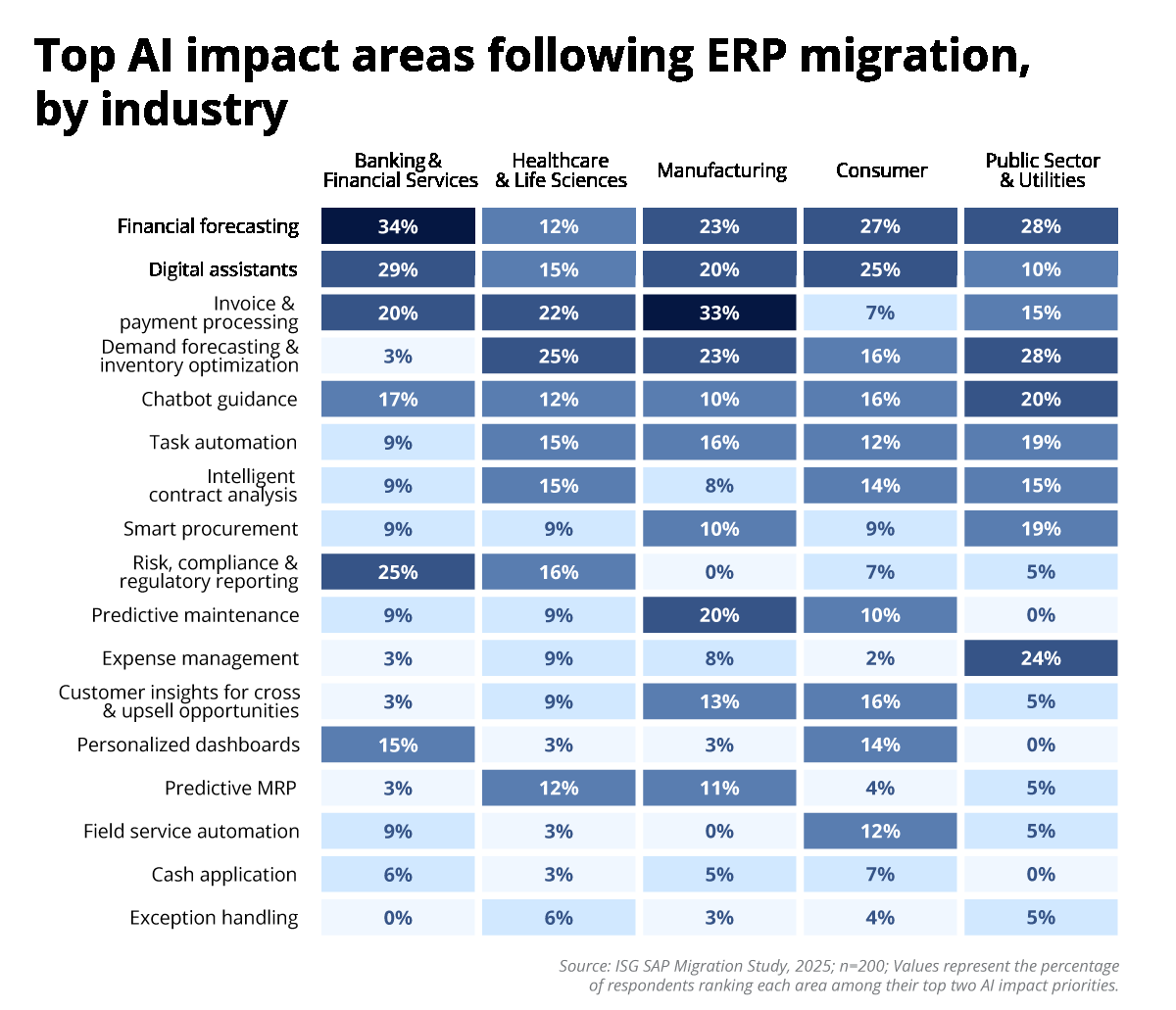

We see that theme come up again in our recent State of SAP Migrations report. We asked enterprise leaders where they thought AI would have the most impact once their SAP migration is complete. And, as you can see in this week's Data Watch, though there is some concentration in the data, very few firms agree on where AI will have the most impact.

While many respondents say financial forecasting is likely to be highly impacted by AI post-SAP migration, other areas vary quite a bit by sector.

The Details

- Manufacturing and healthcare organizations believe AI will generate value in operational and supply chain use cases like invoice processing, demand forecasting and predictive maintenance.

- Banking and financial services firms believe value will be in decision support, digital assistants and regulatory reporting.

- Consumer-facing organizations believe value will come from copilots and customer insights, while public sector and utilities cite expense management and forecasting.

What It Means

While it’s helpful to understand where AI will create value post-migration, and to understand that value varies by industry, it’s also important to understand what role SAP plays in that value creation. As we noted in the report:

SAP’s AI strategy is best understood as an application-level enablement approach rather than a standalone intelligence platform ... In this model, SAP provides orchestration, governance and application context, while AI models are trained and evolved outside the core ERP environment … SAP’s introduction of Business Data Cloud and its partnership with Databricks reflect an acknowledgement that AI value increasingly depends on integrating SAP and non-SAP data. (More on this partnership from my colleague Matt Aslett here).

So, for firms that are migrating their SAP environments and expect to see value from AI in areas like financial forecasting, digital assistants and invoice processing, that value will need to come from both SAP’s embedded Joule capabilities and from data and systems outside SAP. This will put even more pressure on firms that are increasingly recognizing that high-quality, business contextual data is the most important asset in generating value from AI.