Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Banking and Financial Services

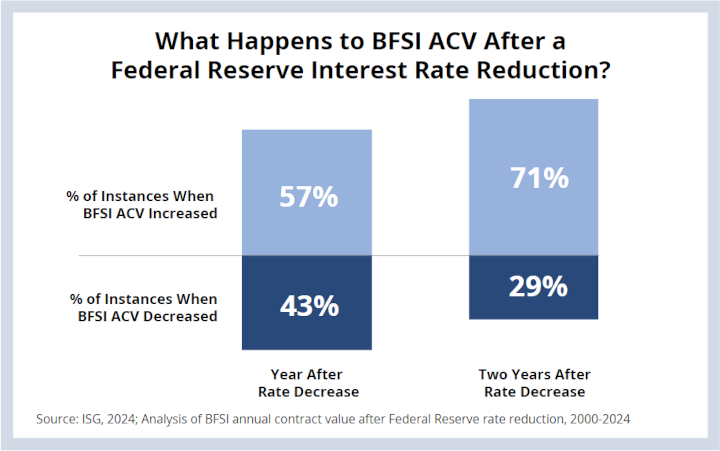

Managed services annual contract value (ACV) in the financial services sector is down double digits this year. But more often than not, when the U.S. Federal Reserve lowers interest rates (as it did last month), ACV increases the following year.

Data Watch

BFSI Tech Spending Pressure

As we discussed on the 3Q24 ISG Index call, IT services bookings in the BFSI sector have been under significant pressure. Year to date, ACV is down 11%.

Banks are focused on realizing value from existing transformation programs, and, as a result, large-deal activity has dropped significantly. For example, on a trailing 12-month basis, ACV for awards over $50 million is less today than it was in 2021.

We talked a few weeks ago about where BFSI tech spending will go once it comes back ( hint: it’s AI). The question we’re talking about today is, when will BFSI bookings growth return?

The Impact of Fed Rate Reductions

Much of that answer depends on what the U.S. Federal Reserve does with interest rates.

The effects of central bank rate hikes are not immediate, often taking 12-18 months to impact the economy. Lower interest rates typically stimulate economic activity, leading to increased technology investments and larger transformation budgets in the BFSI sector. Conversely, rising rates tighten the environment, tend to negatively affect CapEx spending and squeeze contract awards in BFSI.

So what does the Fed’s recent 50 basis points rate cut mean for managed services bookings in BFSI?

As we mentioned in a LinkedIn post earlier this week, several providers reported sequential growth in their BFSI units over the past few days. This could be green shoots for providers that focus on the BFSI sector, and an indication that discretionary spending is starting to open back up for smaller, project-based work.

Longer term, as you can see from this week’s Data Watch, the data says there is a good chance that BFSI ACV will increase in 2025. And an even better chance in 2026.