Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

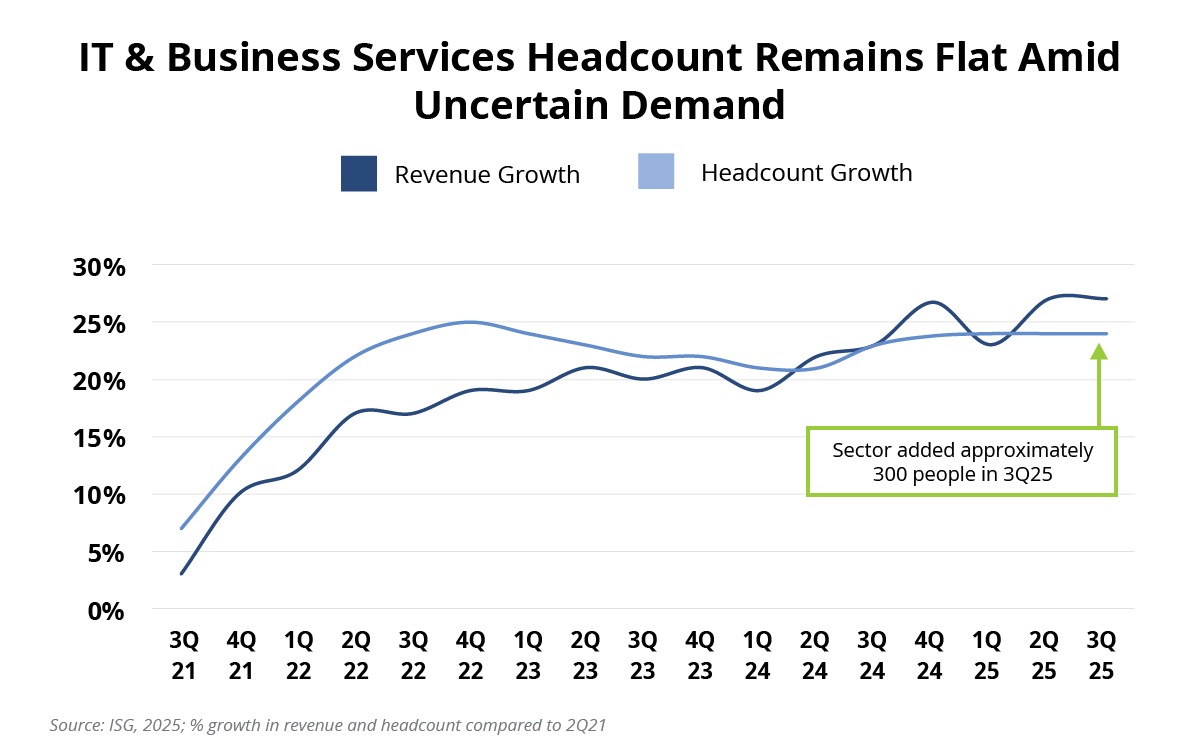

Headcount in the business and IT services industry has been nearly flat for almost two years as providers continue to adapt and evolve their delivery models to an uncertain business environment and the rapid emergence of AI.

Data Watch

Background

As we’ve discussed over the past few quarters, headcount growth in the IT and business services industry has stalled for more than two years. Providers remain in "wait and see" mode, focusing primarily on backfilling for attrition rather than hiring ahead of what has been very choppy demand.

The Details

As you can see in this week’s Data Watch, industry headcount was basically flat again compared to last quarter, with providers adding around 300 people. As a reference point, from 3Q21 to 4Q22 (a six-quarter period), the industry added an average of 107,000 people per quarter. From 1Q23 to 2Q24 (another six-quarter period) industry headcount declined by an average of 17,000 per quarter.

Accenture and TCS are the two largest providers by headcount and, combined, they saw a decline of approximately 30,000 people in the quarter. Other large providers like Capgemini, Cognizant, Infosys, HCL, LTIMindtree and Tech Mahindra all saw Q/Q headcount additions. Most mid-size providers saw headcount growth as well. The combination of these factors led to the net addition of 300 people in the quarter.

What It Means

It’s easy to focus on the stalled headcount over the last few quarters, but if you take a step back and look at a longer time frame, you can see that the industry has grown headcount by 24% since 2Q21.

And, on the revenue side, except for the dip in the first quarter of 2025 due to the massive business uncertainty around Liberation Day in the United States, the pace of revenue growth has stayed relatively steady over the last four quarters driven by healthy growth in the Americas and continued softness in EMEA.

In our view, the flat headcount in the industry is more likely a reflection of the low-single-digit growth environment than it is of AI-driven productivity improvements. Providers are choosing not to hire ahead due to an uncertain demand environment and, instead, are focusing on optimizing existing resources.

That optimization will continue to be a combination of more offshoring, higher utilization, just-in-time hiring and – in some cases – reducing headcount to match the changing needs of their clients.

So, returning to the question: has the sector reached peak headcount levels? It’s not clear yet. But what is clear is that most providers are nearing their peak headcount levels, which – for most of them – was in 2021 and 2022. Even with our forecasted low single-digit growth, we expect them to be operating near or at all-time high levels in 2026