Hello. This is Michael Dornan stepping in for Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

IT Spending Patterns Are Changing

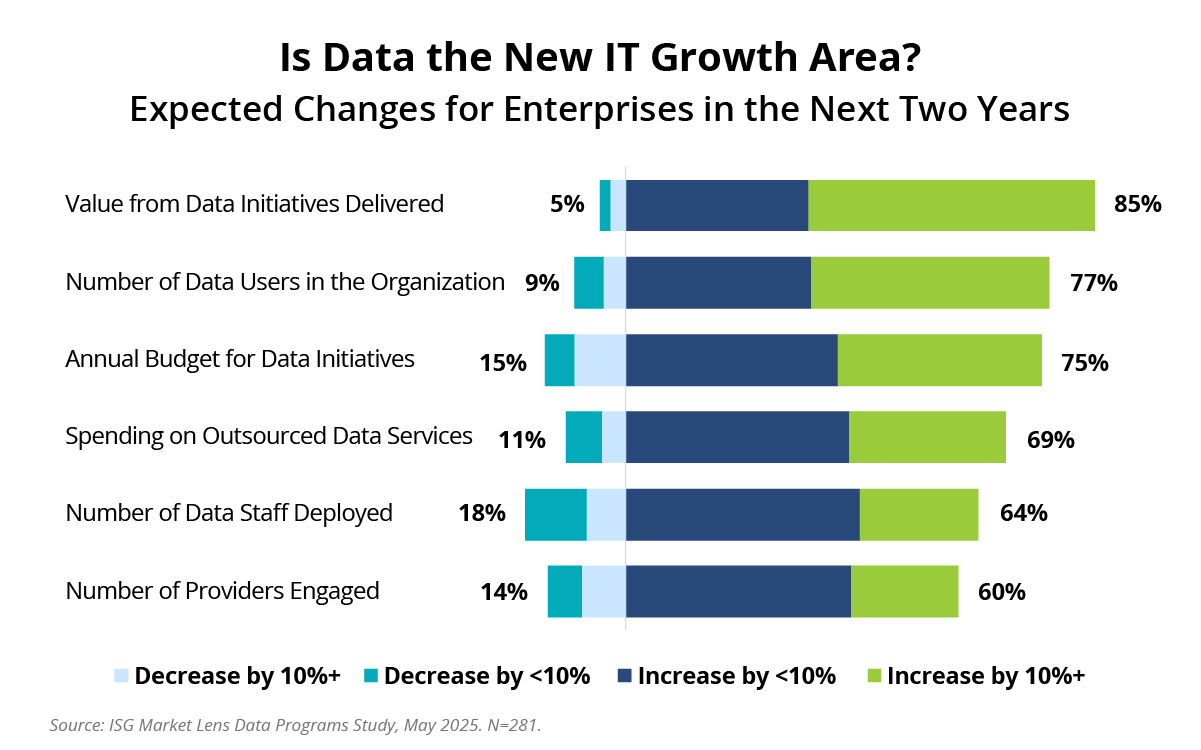

As we entered 2025, we discussed how IT budgets were likely to change in the coming year. We also looked at the drivers behind those changes. Since then, AI and applications remain two of the growth areas for IT spending. The question now is: is it the applications that drive decision-making or is it the data that run the applications that drive decision making? In our latest ISG Market Lens™ study on data programs, we went looking for an answer.

Data Watch

Background

The Details

- Enterprises report an average budget increase of 7.5% over two years for data initiatives.

- The volume of data that enterprises will need is expected to increase by nearly 5% to support the number of data users, which is growing at twice this pace.

- Enterprises say they are spending the most on business value from insights. They expect the business value from these investments to increase by almost 15% over two years.

- Despite growing business involvement in data initiatives, the CIO is most commonly the decision-maker for all aspects of the data portfolio, from strategy and governance to outsourcing decisions.

What It Means for IT Services

While data presents a massive opportunity to improve business performance, most agree that the complexity of managing data is the main barrier to success. As a result, enterprises are planning to increase their spending on outsourced data services by an average of 7% over the next two years, with 60% of enterprises engaging new providers as part of these data programs.

Organizations are seeking help in the following areas:

- Data organization: Most respondents agree that centralized data governance allowed for greater efficiency in delivering business insights, but less than a half feel they have achieved this in their organization.

- Data design: Application data structure is the leading inhibitor to enterprise data usage. Inflexible design and ineffective tools to expose or share data are holding enterprises back.

- Drive for productivity: 45% of respondents say that AI and data productivity investments are falling below business expectations despite being among their top four investment priorities.

- Access to talent: Talent is identified as the biggest hurdle to data and AI initiatives reaching production status. Enterprises struggle to recruit multidisciplinary talent that combines technical expertise with business understanding.