Hello. This is Stanton Jones and Jamie Burke with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Healthcare

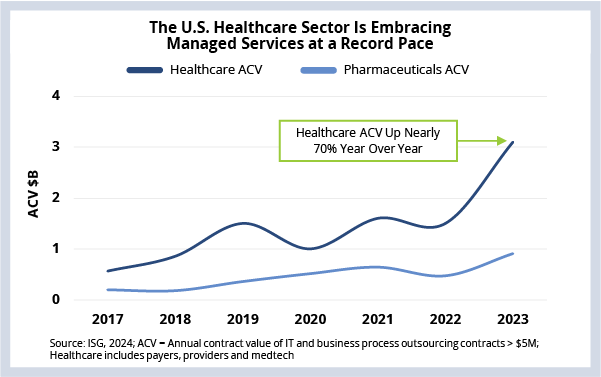

The U.S. healthcare sector has significantly increased its use of managed services in the face of dramatically increased cost, regulatory and cybersecurity pressures.

Data Watch

Background

The U.S. healthcare sector is vast. It accounts for 17% of U.S. GDP today and is projected to reach 20% by 2032. Given the size of this sector – over $4 trillion in consumer spending – it generates an enormous amount of technology-related spending as well from healthcare payers, providers, and pharmaceutical and medical technology firms.

A significant portion of that tech spending is on outsourcing. Historically, pharmaceutical firms have tended to spend a greater percentage of their total IT spend on outsourcing than healthcare systems have. Pharma firms spend an average of 28% on outsourcing; healthcare systems spend an average of 24%. However, as you can see in this week’s Data Watch, outsourcing is growing faster in healthcare compared to pharmaceuticals due to several converging factors that are impacting both payers and providers.

The Details

- Healthcare accounts for 18% of the Americas market ACV.

- While ACV in the Americas grew 7% in 2023, healthcare grew by nearly 70%.

- The momentum continues in 2024, with first quarter healthcare ACV up 17%.

What’s Next

The U.S. healthcare sector is unique in that it’s comprised of healthcare payers and providers. They each face different pressures, which is driving different levels of adoption of outsourcing.

Payers are facing intense cost pressure as Medicare reimbursement amounts have been slashed, driving many of them to look for savings. At the same time, payers tend to be earlier adopters of outsourcing than providers, so they are often in their second- or third-generation outsourcing agreements. This is driving them to look for consolidation opportunities – and of course – ways AI can increase productivity and decrease costs.

Healthcare providers are also facing significant cost pressure and struggling with technical debt at the same time, especially in areas like revenue cycle management and electronic health records. In addition, providers are struggling to attract and retain technology talent, which is in turn leading to a greater risk of cybersecurity breaches. This risk is driving both regional and large healthcare providers to look at the IT and business services sector as a source of strategic funding in exchange for a multi-year commitment.

These converging forces – cost pressure, lack of skills, increased regulation, AI-based innovation – are only going to accelerate over the coming years. As will the need for healthcare in the U.S. as the population ages and lifespans increase. This means that, over the long run, demand for IT and business services in the healthcare sector will remain strong.