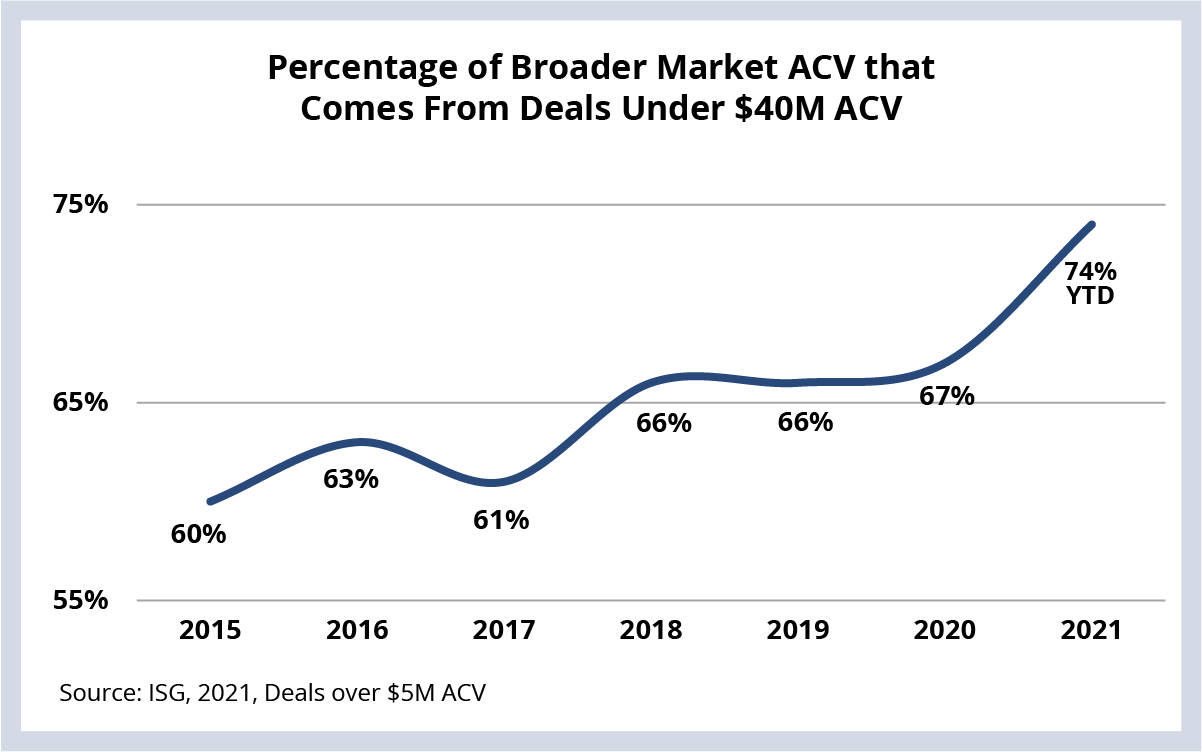

In this edition: Nearly 75% of the contract value in the market comes from deals under $40 million. AWS outage reinforces importance of architecting for failure. Latin American airline is modernizing its passenger system with DXC. Largest cooperative bank in Germany partners with HCL on IT services acquisition.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

DEAL METRICS

Through the first three quarters of the year, nearly 75% of the annual contract value (ACV) in the market comes from deals under $40 million. That’s the highest percentage in the history of the ISG Index (see Data Watch). And recall a few weeks ago we talked about the fact that, year to date, 11% of the ACV in the market comes from mega deals (deals with ACV > $100 million). That’s down from 20% just five years ago.

And it’s highly likely this trend is going to continue. Peruse any number of firms’ earnings transcripts and you’ll see lots of bullish commentary about how strong pipelines are for deals in the $10 – $40 million ACV range. There are a number of factors converging that are causing deals to get smaller and shorter.

For one, fewer assets are changing hands. Companies have gotten more sophisticated in their use of sourcing. And high growth areas like applications and engineering are focused more on the opportunities created through near-term modernization than they are on the original value proposition of outsourcing – long-term cost reduction via labor arbitrage, standardization and increased scale.

DATA WATCH

CLOUD

AWS had a significant outage on Tuesday. While the official post-mortem is yet to come, AWS has said the downtime was an “impairment of several network devices.” The outage impacted core services delivered from the U.S. East region, as well as the millions of customers and connected devices that use those services. This, of course, includes Amazon’s vast retail operations as well.

Our POV: We’re still in the early innings of cloud, and this latest outage won’t slow public cloud growth. As we discussed on the 3Q21 Index call, IaaS ACV grew 36% YTD – its fastest growth rate since 2018. What the outage will do is help companies recognize the need to learn and quickly adapt from these failures.

This means architecting applications for failure, using multiple and or hybrid clouds, having an integrated network strategy, and deploying strong cloud governance to ensure the health of the cloud estate. Adapting to this new cloud-centric operating model is going to be critical for enterprises to remain competitive over the next decade.

DEAL ACTIVITY

- Copa Airlines and DXC. Latin American carrier modernizing passenger system (link).

- AkzoNobel and Atos. Dutch multinational extending existing infrastructure agreement to public cloud (link).

- Rivian and AWS. Electric vehicle maker selects its preferred cloud provider (link).

M&A ACTIVITY

- apoBank and HCL. Largest cooperative bank in Germany partnering with HCL to acquire IT consulting firm Gesellschaft für Banksysteme GmbH (link).

- Cognizant acquiring U.S. product engineering firm Devbridge (link).

- Atos acquiring London-based cloud services firm Cloudreach (link).

- CGI acquiring Australian systems integrator Unico (link).

- Ceridian acquired LATAM payroll and HCM provider ADAM HCM (link).

- Tech Mahindra acquires customer experience firm Activus Connect (link).