It’s a hat trick. Our third Index Insider is in the books. As always, our goal is to provide you with a five-minute overview of what’s important in IT and business services this week.

Tuesday the 26th was Republic Day in India. It is a national holiday honoring the day India became a republic. Congratulations to all our colleagues and friends from India!

Here’s what’s important this week:

Banks go all in with as-a-service

Autonomous driving partnerships ramp up

Enterprise service management market consolidates

BANKING

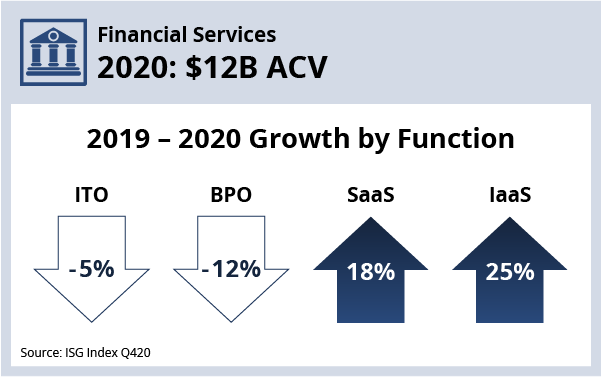

As we discussed on the last ISG Index call, interest rates of almost zero combined with reduced consumer spending had a serious negative impact on banks in 2020. The rapid increase in customer engagement via digital channels also put huge strain on traditional banks – and it’s why we’re seeing a significant uptick in as-a-service bookings in the financial services sector (see Data section below):

Luminor Bank signed a five-year cloud agreement with IBM. The third largest bank in the Baltics will transfer its IT infrastructure to IBM's financial cloud. Around 200 Luminor staff will move to IBM. IBM will also run a major core banking transformation project as part of the deal.

Commerzbank is expanding its Azure footprint. Germany’s number two lender indicated this week that it signed a five-year deal with Microsoft to move applications to Azure. As is the case with most enterprises, Commerzbank is using multiple hyperscale clouds – but it appears Microsoft will run a significant number of its workloads.

This is on top of the significant uptick we’re seeing in Google’s cloud-related activity in the banking sector. We’re tracking 17 Google banking cloud deals. As we discussed last week, CEO Thomas Kurian’s industry-targeting strategy appears to be paying off.

DATA

BFSI generated nearly $12 billion in annual contract value (ACV) awards, an all-time high. SaaS and IaaS were up double digits in all geographies with IaaS up 25% globally. The as-a-service market now accounts for 42% of combined market ACV in BFSI.

AUTOMOTIVE

Supply chain disruption from the pandemic and a shortage of semiconductors made 2020 a tough year for the automotive industry. However, the market is still in hyper-growth mode thanks to Big Tech and venture capital, so we’re going to continue to see a bevy of new partnerships, services and solutions.

Last week, General Motors driverless car startup Cruise announced it will use Microsoft Azure. Under terms of the deal, Cruise will leverage Microsoft’s cloud as its autonomous driving technology platform, and General Motors will use Azure as its “preferred” hyperscale cloud. Microsoft will join other investors in a new equity investment in Cruise of more than $2 billion.

This comes on the heels of the BMW and Amazon announcement in December, when the two companies announced a “strategic collaboration” focused on using AWS to help BMW make better decisions with its data. BMW also plans on training around 5,000 software engineers in AWS technologies.

Managed services providers also are jumping into autonomous driving. This week TCS announced the launch of its Autoscape solution focused on “petabyte-scale driving data collection and analysis, development, validation and deployment of algorithms...”

ENTERPRISE SERVICE MANAGEMENT

Consolidation is afoot in the often-overlooked enterprise service management (ESM) space. On Wednesday, Ivanti, a security, asset and endpoint management software company announced it is acquiring Cherwell, an ITSM software company. It’s our view that the combination will work – and work well – assuming the two companies can combine features quickly. They have highly complementary products: Cherwell’s technology is impressive, but it lacks a strong customer experience layer, while Ivanti has a solid user experience but lacks end-to-end functionality.

This will create some serious competitive pressure to ITSM leaders ServiceNow, BMC and Microfocus, especially in the mid-market, where many companies are realizing they use only about 20 percent of the features of the big ITSM vendors.

Consolidation is happening on the services side as well. Last year, several ServiceNow boutique firms were gobbled up by the big IT service providers: Infosys acquired GuideVision, Cognizant bought Linium and Capgemini acquired RXP Services. Expect this consolidation wave to continue as ITSM continues its march beyond IT and into the business.

DEAL ACTIVITY

- Fiat and Wipro will create a digital hub in Hyderabad. The goal is to beef up Fiat’s digital engineering capabilities. Link

- Verizon Business will deliver network-as-a-service to insurance brokerage HUB International. Telecom vendors continue to move into managed services. Link

- South Australian government engages Atos. Its focus is on two biggies we discussed on the Index call: cloud migration and security. Link

- Optus signs three-year Google cloud contact center deal. This is the first telco in Asia Pacific to use Google’s new cloud contact center solution.

MERGERS, ACQUISITIONS AND ALLIANCES

- Ivanti and Cherwell. Creates a competitor to big three ITSM vendors. Link

- ServiceNow and Element AI. Struggling Canadian firm acquired for $230 million. Link

- Accenture and Wolox. Another cloud acquisition, this time of Argentinian cloud-native firm. Link

- Cognizant and Magenic. Cognizant doubling down on agile and DevOps. Link