If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

EUROPE

Demand for IT services in Europe remains resilient. Enterprises are prioritizing cost optimization in the face of sustained high inflation and interest rates.Background

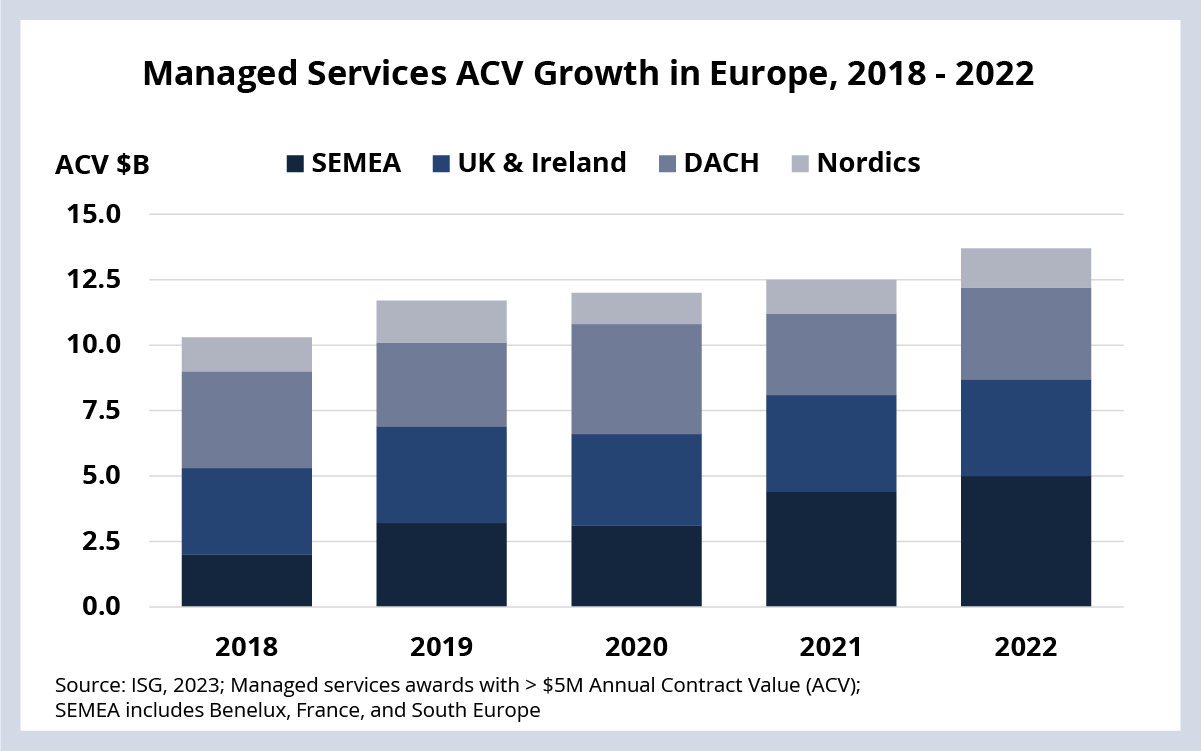

As we discussed the 4Q22 Index call, managed services in EMEA had a very strong year. Annual contract value (ACV) of nearly $15 billion was up 6% for the full year, and more than 1,000 managed services contracts over $5 million ACV were awarded. That’s the highest growth rate since 2011 and the highest number of awards ever for the region. However, within Europe specifically, this record-setting growth was not evenly distributed.

The Details

- ACV in DACH, the Nordics and Southern Europe was up over 10% in 2022; these combined regions generated over $10 billion of ACV last year.

- ACV in the UK and Ireland was flat in 2022; however, this was coming off a strong result in 2021 with nearly $3.7 billion of ACV.

What’s Coming

We have not seen any decrease in demand in Europe through the first six weeks of 2023. However, given the continued pressure of high (albeit declining) inflation and high interest rates, we continue to see clients prioritizing cost optimization in their outsourcing decisions.

Case in point: preliminary results from a cost optimization study we’re currently conducting are indicating that cost reduction is among the top three strategic priorities for over 70% of enterprises. Only around 10% of these same companies feel they are doing much better than their peers to reduce costs.

One of the more significant changes we’re seeing is how enterprises are working to realize these cost savings within the context of their IT services relationships. On the ground, we’re seeing an increased push for provider consolidation in Europe. Companies are hoping to gain more scale and efficiency with fewer relationships.

Our research also shows this trend. As my colleague Alex Bakker wrote about a few weeks ago, we’re seeing signals of provider consolidation as enterprises increasingly expand work to incumbents that are performing well.

Looking a little further out, we’re projecting solid demand for IT services in the region, in particular in Southern Europe and in the banking and public sector industries.

And while our full-year forecast of 4.4% growth for EMEA is a tick below our global forecast of 5%, we believe that demand will remain strong in Europe as enterprises look to reset their long-term cost structures in the face of sustained inflation and high interest rates.

DATA WATCH