If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

EUROPE

European demand for outsourcing remains strong despite macro headwinds. The slowdown in decision-making and delays with deals in the region that we noted in September and October are now moderating. Deal flow is increasing, and decision-making is speeding up.

Background:

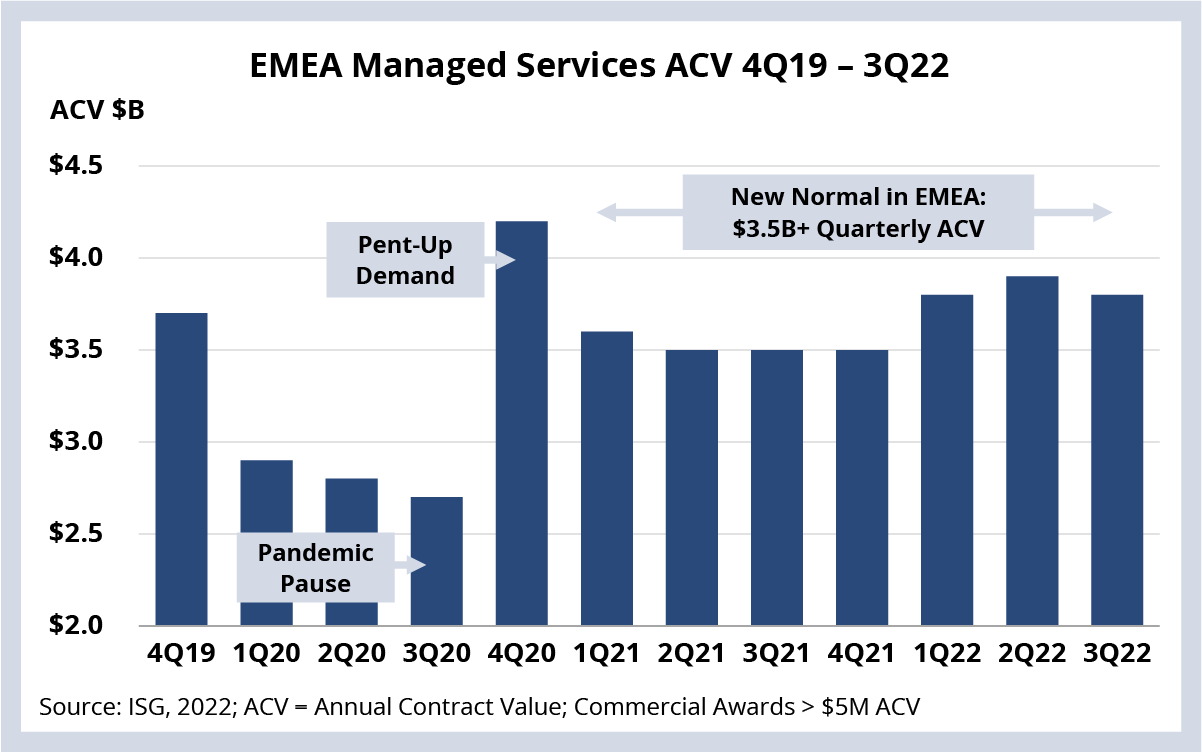

As we noted in the 3Q22 Index call in October, EMEA managed services results have been exceptionally strong of late. The region has seen a record eight consecutive quarters of ACV above $3.5 billion. And if you were to look at recent results on a constant currency basis, 3Q22 would be even stronger at $4.1 billion.

This mirrors what’s happening globally – a surge in post-pandemic demand for IT services, especially in areas like ADM, engineering and industry-specific BPO.

The Details:

- DACH (≈25% of EMEA ACV) was the big growth driver in 3Q22, with over $1 billion in ACV for the first time in almost two years.

- UK and Ireland (≈25% EMEA ACV) were up over 60% Y/Y; however, this was against a soft 3Q21.

- France and S. Europe (≈25% of EMEA ACV) also saw double-digit gains. The region is up almost 24% YTD, with France up over 75% against its five-year average.

- The Nordics (≈10% of EMEA ACV) was up 5% Y/Y. However, 3Q22 was a very strong quarter, with ACV up almost 40% on its five-year average.

What’s Next:

There has been increasing concern that the murky macro picture would slow demand for IT services in Europe. And, while we did see some temporary slowing of decision-making early in the third quarter, that has largely abated through November.

That said, we can’t overlook the potential impact of an energy crisis on Europe – and the downstream impact on IT services demand. Europe has lost its primary source of natural gas due to the war in Ukraine, which is driving up energy costs across the continent.

This shortage will likely have an outsized impact on highly industrialized countries like Germany, which makes up for more than a quarter of all IT services demand in Europe.

We’ll have more perspective on changes in European demand – as well as key changes in pricing and delivery operations – on the 4Q22 Index call in January. Steve and I encourage you to register here.

DATA WATCH