In this edition: The resiliency of the global IT services market; how to pay for cloud managed services; Swedish transportation authority signs multi-year AMS agreement; surge in product engineering M&A continues.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

MARKET

The IT services market has shown incredible resilience throughout the pandemic. It’s important to remember what happened 15 months ago. Hundreds of thousands of service provider resources had to pivot to a virtual delivery model almost overnight. And it was not just delivery that had to make this pivot – sales and transition did as well. And, on the whole, it worked.

That’s not to say it was easy. Recall that in the early days of the pandemic, productivity fell by 20 percent. We saw some enterprises in the hardest hit industries request discounts, extend payment terms and delay negotiations, which had a huge impact on service providers - and their quarterly bookings. Fast forward to 1Q21, and it was clear that the recovery was in full swing: global ACV for managed services and as-a-service markets exceeded $17 billion for the first time ever.

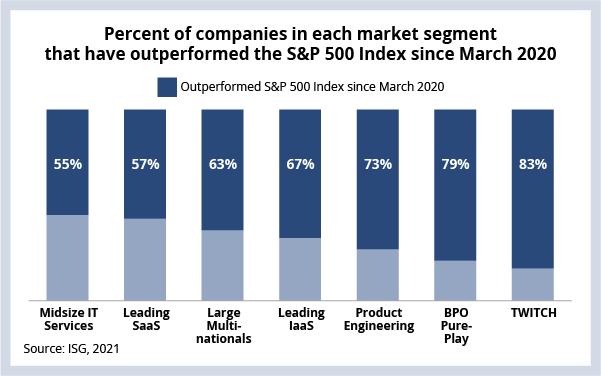

Some market segments have recovered faster – and more fully – than others (see Data Watch). Product engineering firms are benefiting from the fact that industrial equipment and consumer durable goods manufacturers are digitizing their products. India heritage (TWITCH) firms used their massive HR engines to make the pandemic pivot faster than their peers. And while BPO firms were hit hard during the pandemic, industry-specific BPO is seeing strong traction. IaaS and SaaS both showed solid growth throughout the pandemic – but that growth has decelerated a bit. Many of the midsize IT services firms were more susceptible to regional impacts of the pandemic, especially in Europe and Asia.

The 2Q21 ISG Index call is July 7 – I encourage you to take a minute to register here.

DATA WATCH

PRACTITIONER POV

How should enterprises pay for cloud managed services? We’re seeing more and more bids based cloud managed services pricing on how much an enterprise spends with a hyperscale cloud provider.

While this percent-of-spend model is certainly easier and faster than a more traditional pricing structure, it’s not the right model for all enterprises and all workloads. There are two big reasons for this. First, if an enterprise does not have a strong consumption management and governance function, cloud spending can spiral out of control. It’s important to remember that cloud pricing, unlike pricing for the on-premises data center, is based heavily on utilization. This requires being able to measure how much time a VM is used, how much network traffic is generated, etc.

Second, it’s important to remember that the commercial relationships between MSPs and hyperscalers incent both parties to drive more workloads to the cloud platform. This means enterprises need to understand the business model the MSP has chosen and align payment structures to the underlying services that drive cost. This is also why it’s important to consider separating the systems integrator that transforms workloads from the MSP that manages them.

DEAL ACTIVITY

- Swedish Transport Administration and Sogeti Sweden. Transportation authority signs €220 million AMS framework agreement with Capgemini company. Link

- Harmont & Blaine and IBM. Italian clothing brand modernizing infrastructure; migrating SAP. Link

- Suntory Beverage & Food and Hitachi. Japanese food company uses Lumada to build food tracing IoT platform. Link

- DNB and TietoEVRY. Nordics bank signs three-year extension for core banking and payments services. Link

- Archrock and Infosys. Natural gas compression provider deploys new field services solution. Link

- Virgin Atlantic and TCS. Expansion of 17-year relationship; 70 employees transfer to TCS. Link

- Hy-Vee and Google. U.S. supermarket chain signs multi-year agreement for GCP. Link

- BMO Financial Group and AWS. Eighth-largest bank in North America picks its preferred cloud provider. Link

M&A

- The surge in product engineering-related M&A continues with Accenture’s acquisition of German firm umlaut Link and product lifecycle management consulting assets from DI Square Link. LTI also acquired Indian product engineering firm Cuelogic Link.

- Australian telecommunications giant Telstra acquires MediaCloud, expanding into media management and content orchestration. Link