If someone forwarded you this briefing, consider subscribing here.

MEGA DEALS

Incumbency appears to have a strong influence on mega deal wins. Often, these deals happen because the incumbent shapes the deal with their client over time. However, this approach also introduces risk, as a different provider can seize the opportunity to win the expanded scope.

DATA WATCH

Background

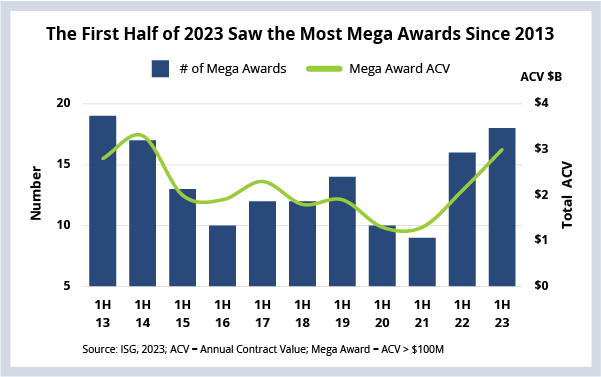

We held our 17th annual Sourcing Industry Conference in Dallas this week, and one of the key topics of discussion was mega deals (awards with ACV greater than $100 million). There has been intense interest in mega deals over the past six to 12 months, in part due to the fact that there have been more mega deals in the first half of 2023 than there have been in any half year in the past decade.

The Details

- The first half of 2023 saw 18 mega awards; that compares to 16 in 1H22 and nine in 1H21.

- There was over $3 billion of mega award ACV in the first half of 2023, which totaled 15% of all the ACV in the market.

The Value of Incumbency

How are providers winning mega awards in this ultra-competitive environment? It appears that incumbency is the key ingredient. We analyzed a basket of mega awards going back to 2019 and identified a small group of “controlling” providers involved at the enterprise that awarded a mega deal.

And here’s what we found: when these providers own at least 50% of the TCV previously awarded at the enterprise, they win the mega award about 75% of the time. So, the question then becomes: how does the award come to market? Does the client have the idea or did one of the controlling providers shape the deal?

The answer is both.

In some cases, we identified situations in which the client has a vision to significantly reduce costs and needs help (enabled by transformation) to get there. In other cases, providers are clearly shaping these deals given their existing relationships, by showing their clients the art of the possible if, for example, they combine several pieces of work or monetize their assets.

It’s also important to note that the controlling provider(s) don’t always win. This means that – in some cases – it’s risky for a provider to shape a mega deal with its client. Because 25% of the time, someone not in the controlling group wins the mega award. We’re not saying this situation happens every time – but it does happen. In fact, some non-incumbent providers have been more effective in going after and winning mega awards.

Will 2023 set the all-time record for number of mega awards? That’s still to be determined. It’s important to remember that mega awards tend to be “lumpy,” which means they are hard to forecast. Our research shows these giant deals are taking between one to two years to get to signature, so we’ll have to wait and see.

If you’re interested in more details on this mega deal research, let Sunder or me know. And, finally, it’s hard to believe, but the 3Q23 ISG Index Call is only four weeks away. We hope you can join us there where we’ll spend more time – and answer your questions live – on these important mega deal trends.