COVID-19 continues to surge in India, where officials are now reporting more than 300,000 new coronavirus cases for the eighth consecutive day. Our primary focus is on the health and safety of friends, family and colleagues across the subcontinent. We are monitoring the situation closely, and as of today, have not identified any significant disruptions to enterprise or provider operations due to the surge.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

INDIA

This week we polled 25 ISG project leaders who are advising large enterprises with outsourced delivery in India to get a pulse on how the pandemic is currently impacting IT services. Since the beginning of the surge in early April, we have identified only two instances in which a provider missed a key milestone, five instances in which a provider fell behind on project work, and seven instances in which enterprises activated their business continuity plans.

The cases in which providers missed key milestones and fell behind on project work were primarily with clients in the midst of negotiation and transition of services. These teams tend to be smaller and more specialized, so there is less redundancy than with ongoing operations. More importantly, we’re seeing robust communication between providers and their enterprise clients – with both sides focusing on ensuring the physical and mental wellbeing of India-based staff and their families.

As we have discussed extensively over the past several months, the Indian IT services sector has proven remarkably resilient in the face of COVID-19. We believe this will continue to be the case.

HEALTHCARE

The pandemic has spurred enormous growth in the adoption of virtual care systems. Here are my colleagues Ron Exler and Bob Krohn with more:

Healthcare providers are deploying connected healthcare monitoring devices at an explosive rate as doctors overcome lockdowns and work to reduce risk for themselves and their patients. According to the Consumer Technology Association, total revenue from U.S. shipments of healthcare monitoring devices increased by 73 percent in 2020 and is forecasted to reach $1.2 billion by 2024. A recent report from nonprofit FAIR Health found that telehealth claims for private insurers rose nearly 3,000 percent in 2020.

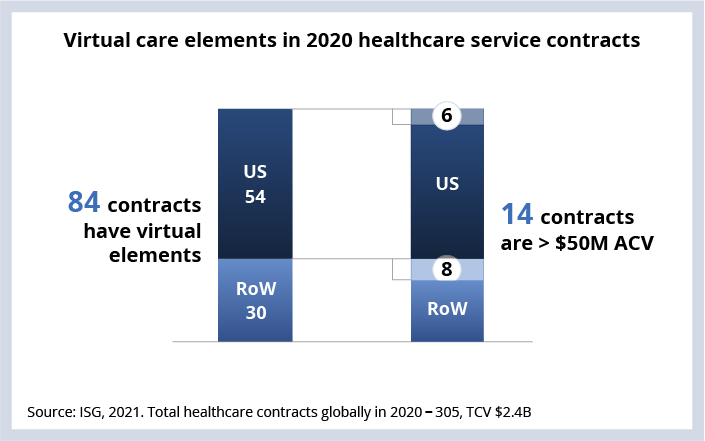

While the pandemic may have accelerated the move to remote and virtual care, it will not end when the pandemic wanes. People have grown used to virtual care, and many will prefer it despite the option of in-person care. Analysis of ISG deal data illustrates the global growth of virtual healthcare (see Data Watch). Virtual care is not a temporary measure but a long-term practice beneficial to members and patients. This shift requires rethinking the traditional assumptions and embracing value-based care. This means healthcare payers and providers will need to make a permanent shift in their business models.

Continue reading Ron and Bob’s POV here.

DATA WATCH

DEAL ACTIVITY

- Parle Products and IBM. World's largest biscuit brand adopting hybrid cloud. Link

- ERIKS and AT&T. Industrial services provider deploys WAN across 17 countries. Link

- ERES and Capgemini. Women’s swimwear brand building Salesforce-based online store. Link

- Eutelsat and Atos. European satellite operator building payload monitoring solution. Link

- First Horizon Bank and DXC. U.S. regional bank modernizing card processing services. Link

- Wavin and TCS. Dutch pipe manufacturer deploys cloud ERP. Link

- People’s United Bank and Virtusa. New England-based bank deploying Pega-based customer information hub. Link

- Apria Healthcare and Rackspace. Home medical equipment company modernizing its infrastructure. Link

- Papa John's and Google. U.S. pizza chain enhancing e-commerce, mobile and order tracking capabilities. Link

- Schlumberger and Google. Oilfield services company migrating SAP to GCP. Link