If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

HEADLINES

Morgan Stanley deepens Microsoft relationship. Global investment bank will expand its partnership and focus on application infrastructure modernization and multi-cloud, with the ultimate goal of increasing speed and improving customer experience. This follows a pattern of other large financial services firms announcing partnerships with hyperscalers – usually with one as the “prime” provider. Link

FireEye sells its products business to Symphony Technology Group for $1.2 billion. FireEye becomes Mandiant Solutions, focusing on consulting and threat intelligence. Private equity firm STG adds yet another product to its cybersecurity portfolio, which includes McAfee’s enterprise business ($4 billion) and RSA from Dell ($2 billion). Link

Virtusa gets a new CEO. Santosh Thomas, former head of growth markets at Cognizant, will take over for outgoing Virtusa founder and CEO Kris Canekeratne. Baring Private Equity Asia acquired Virtusa for $2 billion earlier this year. Link

REGIONAL REVIEW: FRANCE

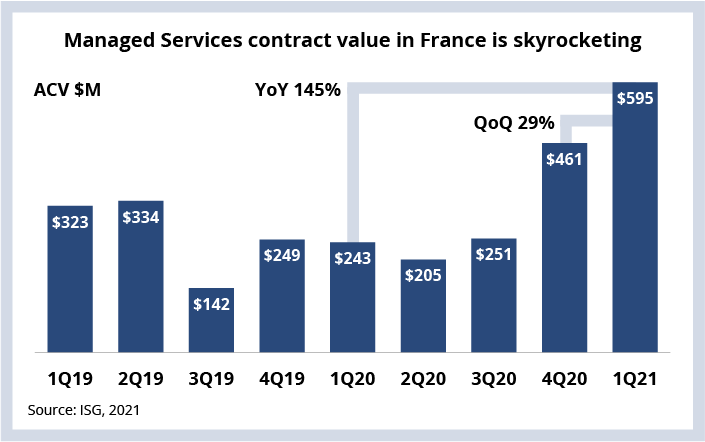

Managed services contract value has skyrocketed in France over the past two quarters. Q1 managed services ACV was up by 145 percent year over year and 29 percent quarter over quarter (see Data Watch). There is a significant amount of pent-up demand for managed services in France. During the peak of the pandemic, IT services negotiations were delayed – but are now picking back up as the economy reopens. Much of this backlog is focused on sole source negotiations and extensions of existing work – as well as breaking existing work into smaller contracts. Case in point: overall contracting volume is also up significantly – 117% Y/Y and 44% Q/Q.

We’re also seeing a significant uptick in transformational work in France – as well as a greater willingness to use third parties to accelerate transformation. Examples include BNP Paribas engaging Orange to deploy the first large SD-WAN in the French retail banking sector, testing and certification firm Bureau Veritas engaging Atos to build a new security operations center and transportation manufacturer Alstom engaging Accenture for a new cloud-based PLM system.

The French government also recognizes the need to modernize. Just a few weeks ago, it presented its national plan for cloud technology focused on three pillars: creating a cloud-first strategy, supporting data-intensive industrial initiatives using AI and creating labels for “trusted” cloud providers. That said, creating a sovereign cloud is not easy. France tried this in 2015 with Cloudwatt and Numergy – which went nowhere fast.

But given the maturity of cloud technology today – and the immense pressure created by the pandemic – this time may be different. Capgemini and Orange just announced a new joint venture dubbed "Bleu," which will be part of the GAIA-X initiative focused on building a federation of trusted providers across Europe. Equinix announced earlier this year it will create the first carrier-neutral data center in the Nouvelle-Aquitaine region, and Accenture recently acquired French cloud services provider Linkbynet.

DATA WATCH

DEAL ACTIVITY

- Whirlpool and Google. Home appliance manufacturer deploys SAP on GCP. Link

- Huma and Atos. European healthcare company shifting drug trials from hospitals to homes. Link

- State of New Hampshire and Conduent. Expansion of existing Medicaid BPO relationship. Link

- Williams Companies and Microsoft. North American energy provider working to reduce its carbon footprint. Link

M&A

- Private equity firms CD&R and KKR buy data platform company Cloudera for $5.3 billion. Link

- Microsoft acquires device security firm ReFirm Labs. Link

- HCM software firm UKG acquires benefits platform company EverythingBenefits. Link

- Bell Canada signs 5G deal with AWS. Link

- Automation software provider Kofax acquires document capture firm PSIGEN. Link

- Wipro sells stake in Denim Group for $22.4 million. Link