If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

BIG THREE THOUGHTS FROM 2Q22

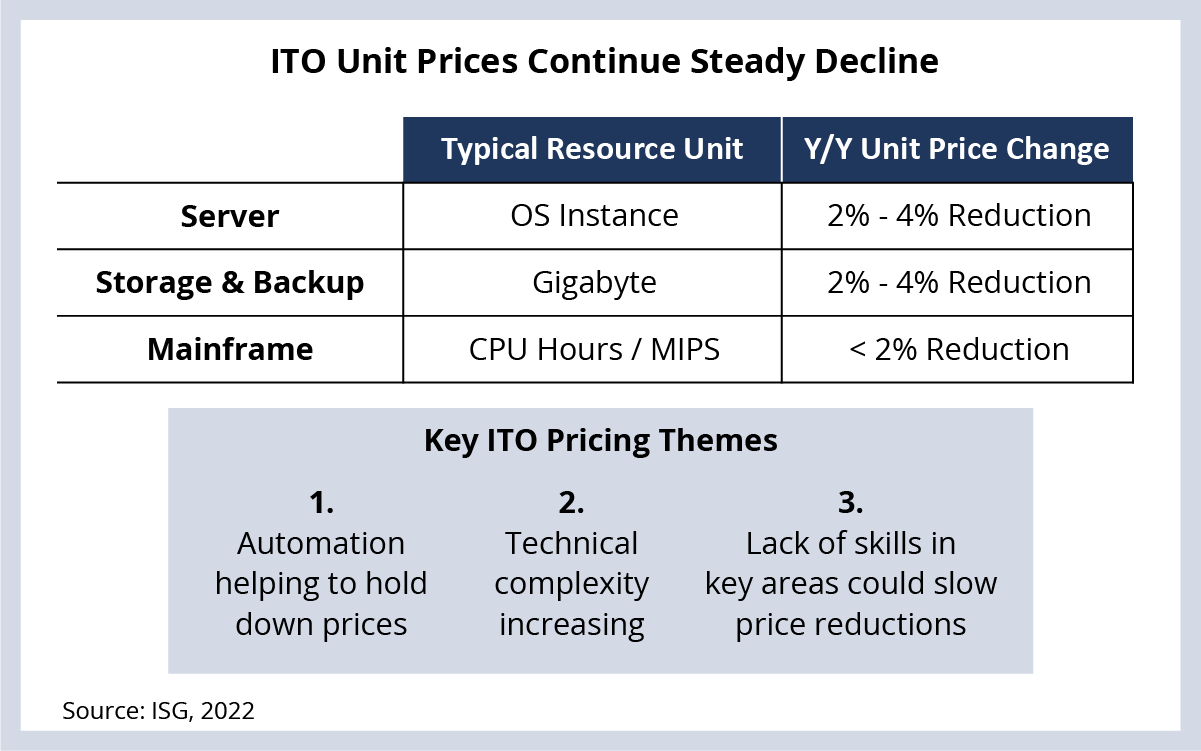

Unit prices for IT managed services continue to hold steady – and in many cases continue to decline – despite recent wage increases. There are lots of reasons for this. Providers continue to aggressively automate everything from patching servers to re-writing legacy code. They are also focused on widening the bottom of their staffing pyramids. As we discussed a couple of weeks ago, 40% of staff have been hired within the last 12 months. For some providers, freshers (or recent university graduates) make up a quarter to a third of those recent hires.

Providers also continue to build out new delivery locations, using remote working models to tap into talent in smaller and lower cost cities across the globe. And, of course, competition for commodity IT services also continues to be intense, driving down prices to win new business.

You can see these changes affecting unit prices of many traditional IT services towers (see Data Watch).

Unit prices for server management are down between 2% and 4%, primarily due to increased levels of automation and standardization.

Storage and backup unit prices continue to decline but more slowly than in the past. Increased use of flash-based storage is increasing complexity, which is slowing unit price reductions.

And price declines for mainframe managed services are down – but only slightly – given the lack of qualified COBOL programmers and the steady rise in mainframe software costs.

My colleague Kathy Rudy will cover IT services pricing in more detail on the 2Q22 Index call on next Wednesday at 9:00 AM ET. Hope you can join us.

DATA WATCH