If someone forwarded you this briefing, consider subscribing here.

And don’t forget to register for the Q4 Index Call on January 18. You can reserve your spot here.

Demand

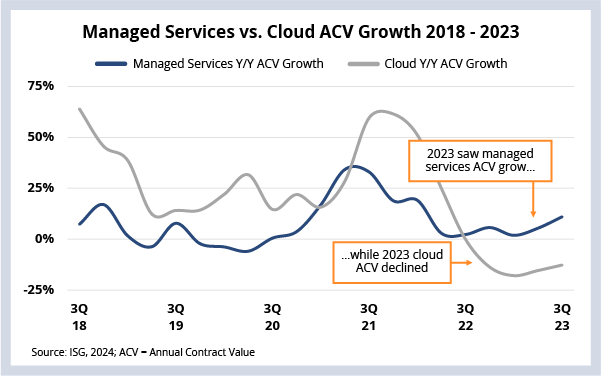

Demand for IT and business services was choppy in 2023. Outsourcing ACV grew, but cloud ACV fell. What will happen in 2024? As companies look to further optimize costs in the first half of the year, demand for outsourcing will remain strong. And as discretionary spending pressure starts to ease in the second half, demand for cloud services will start to recover.Data Watch

Background

Sometimes it’s important to take a longer view to understand what’s happening in an industry. So, while we’ll report out on the fourth quarter on the Index call on Jan. 18, we thought it would be a good idea to start the year off with some perspective on what has happened with demand over the past few years and how that may impact 2024.

As you can see in this week’s Data Watch, managed services ACV grew by over 6% through the third quarter of 2023 – almost double its historic growth rate. Over the same time, cloud ACV declined by 16%. This happened because companies are using outsourcing to optimize costs, while they buckle down on discretionary spending, which has had an outsized impact on cloud bookings.

But if you look over a longer term, you can see that the two markets tend to move in sync. And that’s because enterprises buy and use services from both sectors. And each sector is dependent on the other for growth.

So what does all this mean for 2024? Four out of the ten predictions we published before the holidays were related to demand, so here’s a recap:

2024 Demand Predictions

- Managed services bookings will remain strong: We’re projecting the need for cost optimization to continue to be strong this year, which will fuel outsourcing ACV.

- Large and megadeal activity will continue to be robust: A record amount of megadeal ACV was signed in 2023; demand for cost optimization and risk reduction will create opportunities for large deals.

- ADM will be the primary driver of managed services growth: ADM now makes up over 60% of IT outsourcing ACV as enterprises optimize and modernize their application portfolios; this will continue in 2024.

- Cloud bookings will start to recover: In 2H23 IaaS ACV started to stabilize, and SaaS ACV saw Y/Y gains; new AI features will drive incremental new demand.

For managed services, we’ll measure the intensity of enterprise demand by analyzing managed services bookings of dozens of ITO, BPO and engineering service providers throughout the year. We’ll also have our ear to the ground on enterprise sentiment through ISG industry and regional leaders. And we’ll be tracking and reporting on BPO buyer behavior in Contact Center and Finance and Accounting studies and conducting industry-specific studies in Manufacturing,Utilities and Healthcare.

In terms of the cloud market, we’ll be focusing on the top 10 SaaS providers, as well as the big three U.S. hyperscalers, given this is where the majority of enterprise cloud spending goes. We’ll also be conducting a new cloud adoption and migration study as well as an IT finance and FinOps study, which will help us compare how cloud adoption and perceived value are changing over time. And of course, we’ll be leveraging our new world-class software research capabilities from recently acquired Ventana Research.

We’ll be discussing these trends on the Q4 and full-year Index call on January 18, so make sure to reserve your spot.