This week we held our 76th consecutive ISG Index call. Thanks to all of you who attended the livestream. If you were not able to attend, here is a short video recap, the presentation slides and the full replay. We had a huge number of questions and were not able to get to all of them, so like we did last quarter, here’s a summary of some of the questions and answers (you’ll need to register to download).

And – in keeping with the spirit of making sure you can read the Insider in five minutes or less – I cut the deal and M&A activity sections this week, but they will return next week.

MARKET TRENDS

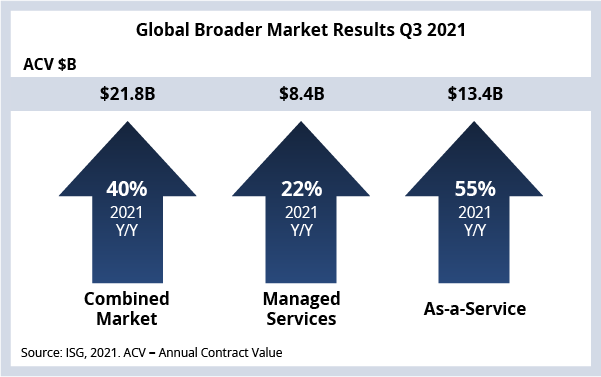

Global demand for technology services is showing a strong recovery from pandemic lows as global combined market ACV was up 40% Y/Y (see Data Watch). This is the highest growth rate we’ve seen since we started tracking the combined market in 2014. Much of the pent-up demand from the pandemic has been released, and we’re seeing strong net-new demand for cloud, applications, engineering and industry-specific BPO.

Managed services set several all-time records as ACV was up 22% Y/Y to $8.4 billion. Just this quarter, 564 managed services awards were signed, and mega-deal activity remains robust with six mega deals (five in the U.S., one in EMEA) signed in 2Q21, which was the most since 3Q19.

Cloud ACV continues to surge as companies accelerate their movement to the cloud. On a year-to-date basis, infrastructure-as-a-service was up 36%, it’s best growth rate since 2018. And software-as-a-service made a comeback after companies paused many of their big transformational implementations in 2020 – SaaS ACV was up 26% YTD.

Applications are overtaking infrastructure as more workloads move to the hyperscalers. Year to date, applications ACV is up 29% over 2020 – this is due in large part to the exceptionally strong growth in IaaS. As we’re moving into a more mature phase in cloud adoption, companies are realizing they need to get serious about application refactoring, rather than simply lifting and shifting. ADM is now over 50% of the ITO market.

Engineering services is surging – and the market is consolidating. Engineering ACV is up over 40% sequentially and up almost 300% Y/Y. Transaction counts are also up significantly – we’re tracking 52 engineering deals, each with an ACV over $5 million, compared to just 19 in 3Q20. And, as we discussed a couple of weeks ago, we see significant consolidation happening in this space as six of the top 26 engineering firms have been acquired since 2019.

While demand is strong, talent shortages are creating some serious challenges for both enterprises providers. Attrition rates are continuing to rise as we get more visibility into earnings. Providers are reporting attrition rates of more than 20% in some cases – and in India we’re seeing rates as high as 50% for young digital talent. Providers are using many levers to address the challenge – more campus hiring, increased lateral hiring and more use of subcontractors. Over the last 12 months, the industry has added $4.5 billion ACV in engineering and applications alone, which we estimate will require more than 100,000 software engineers. This is not something that will get solved in the near term – we believe this is a multi-quarter challenge for our industry.

Even with the talent headwind, we’re still projecting strong growth for both managed services and as-a-service for the full year. We’ve increased our managed services growth forecast by 100 basis points to 10.1% and increased our as-a-service growth forecast by 300 basis points to 25% for the full year.

DATA WATCH