If someone forwarded you this briefing, consider subscribing here.

DEMAND

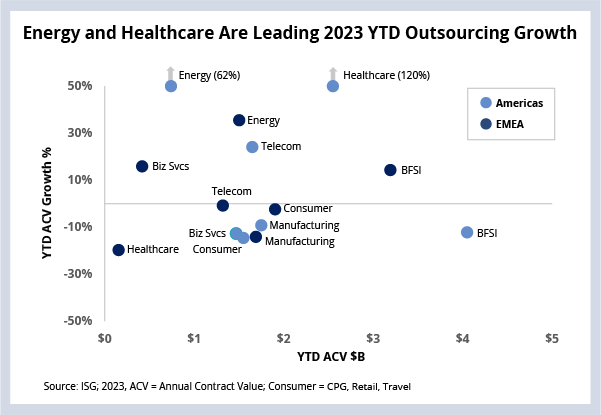

Through the first three quarters of the year, demand for IT and business services has been strongest in the global energy sector, the U.S. healthcare sector and the European banking and financial services sector.

DATA WATCH

Background

As we discussed on the 3Q23 Index call, demand for managed IT and business services remains very strong. Over $30 billion of annual contract value (ACV) was signed in the first three quarters of the year, up 6% year to date.

That record-setting result was unevenly distributed across industries and geographies. “Defensive” sectors, like healthcare and energy, have performed well YTD, given that they traditionally have more immunity to macroeconomic swings.

For BFSI, the story is more nuanced. The financial services sector makes up nearly 30% of outsourcing ACV, so it has a huge impact on the overall industry. Global BFSI ACV is down 3% YTD, primarily due to declining demand in the Americas and Asia-Pacific.

However, the sector has remained strong in EMEA; ACV is up double digits YTD, with most of the growth coming from BPO.

The Details

- In the Americas, healthcare and pharma bookings are up 120%; energy is up over 60% YTD.

- In EMEA, energy bookings are up 36%, while BFSI ACV is up 14% YTD.

- And, while the business services sector in EMEA and the telecom sector in the Americas have seen strong YTD results, much of this growth has been driven by a small number of mega awards.

What’s Next

Over the past several weeks, we’ve seen a modest improvement in the speed of enterprise decision-making, but concerns persist around energy prices, the strong dollar and the expectation of a protracted period of high interest rates.

Still, demand for outsourcing remains strong, primarily driven by the need to optimize costs. And it’s our view that the more defensive industries will remain strong in the fourth quarter. We expect business services and manufacturing to return to low single-digit growth and BFSI in the Americas to see Q/Q growth.

Plus, it’s important to keep in mind that Q4 is typically a strong quarter for deal activity in the IT and business services industry. Over the last ten years, Q4 has generated less contract value than Q3 only once. It’s the combination of these regional, industry and historical factors that is underpinning our 5.4% managed services growth forecast for 2023.