While daily cases continue to decline in major cities in India, the global COVID crisis is far from over. Service providers continue to manage the recent surge with limited disruption – as they did during the first wave of the pandemic.

Also in this edition: mainframe prices have stopped declining, Capgemini wins at Airbus, and Zensar acquires digital engineering firm M3bi.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

MAINFRAME

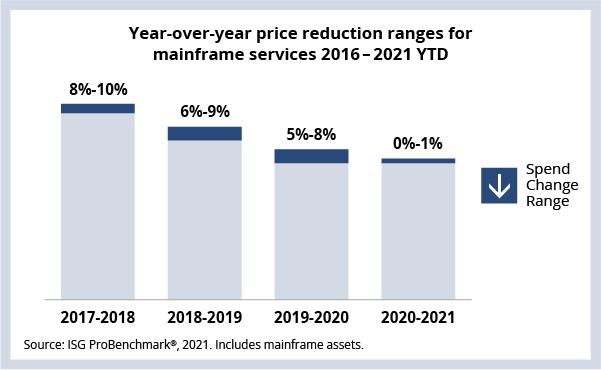

Prices for mainframe managed services have been declining for years – but in 2020 they leveled off (see Data Watch). A number of factors are driving this. Chief among them is that mainframes are still critical for hundreds of banks, insurance firms, retailers and public sector entities across the globe. Demand for this technology is not going away any time soon.

However, traditional mainframe outsourcing is changing. Many leading service providers no longer sell new mainframe managed services deals, although most will renew existing agreements. In its place, we’re seeing an increase in demand for Mainframe-as-a-Service, for which the buyer pays an all-in price – often per MIPS. But to reap the potential commercial benefits of this model, buyers need to improve their demand management capabilities.

The lack of onshore mainframe talent continues to be a major concern for CIOs (note: several India heritage firms are investing in training a new generation in mainframe technologies). Another forcing function is mainframe software. Costs are soaring, and licensing terms are becoming increasingly restrictive. This is leading enterprises to evaluate other options – like transformation.

Eventually, most enterprises will move these mainframe-based applications to the cloud – and some will do it via an application transformation agreement. For example, a number of providers are offering conversions from COBOL to Java over a multi-year AMS relationship. The hyperscale cloud providers also want these workloads, and they are providing conversion tools that systems integrators can use to speed the conversion to the cloud. But this transformation won’t be easy. Transforming just one application can take weeks or months, and the entire environment can take years.

Returning to the question: why have mainframe managed services prices leveled off? It’s a combination of factors, but two of the biggest are rising software costs combined with increased offshore labor rates. But the good news is that, for now, we see a strong pool of providers for buyers that simply want to keep their mainframes running as efficiently as possible – and for those that want to transform them.

DATA WATCH

DEAL ACTIVITY

- Airbus and Capgemini. European aerospace firm signs five-year digital workplace transformation. Link

- Hawaii Department of Human Services and Conduent. Four-year extension of Medicaid claims processing relationship. Link

- Ooredoo Oman and Tech Mahindra. Omani telecommunications provider signs multi-year ITO deal. Link

- Guam Waterworks Authority and DXC. Australian water corporation finishes JD Edwards implementation. Link

- PayPal and Google. Existing infrastructure relationship deepens into analytics; Google adds PayPal as payment option for Ads and Workspace. Link

- Hoist Finance and LTI. European financial services company signs Temenos-based banking-as-a-service agreement. Link

- Carlsberg and Wipro. Danish brewer implements trade promotions solution in the U.K. Link

M&A

- Zensar acquires digital engineering firm M3bi. Link

- IBM acquires European Salesforce consulting firm Waeg. Link

- Persistent acquires cloud experts and IP from Sureline Systems. Link

- NTT Data acquires full-stack product development firm Nexient. Link

- L&T moves its digital transformation business to Mindtree. Link.

- Accenture to acquire French cloud services provider Linkbynet. Link

- EPAM acquires Netherlands-based analytics firm Just-BI. Link

- Globant buys European digital marketing firm Habitant. Link

- Cisco to acquire vulnerability management firm Kenna Security. Link