Mid-tier manufacturing organizations are constantly struggling with the pace of technology change. When these organizations look for a solution, they do not always consider outsourcing. The thinking is often: “we’re too small for that.” Leaders spend so much time executing day-to-day operational activities that they lack the capacity to analyze performance in a way that might lead to transformational initiatives. Some mid-tier manufacturers believe outsourcing is too big for their budget or that they won’t qualify for sufficient customer service from providers.

But the outsourcing market is evolving, and mid-tier manufacturers are thinking in new ways.

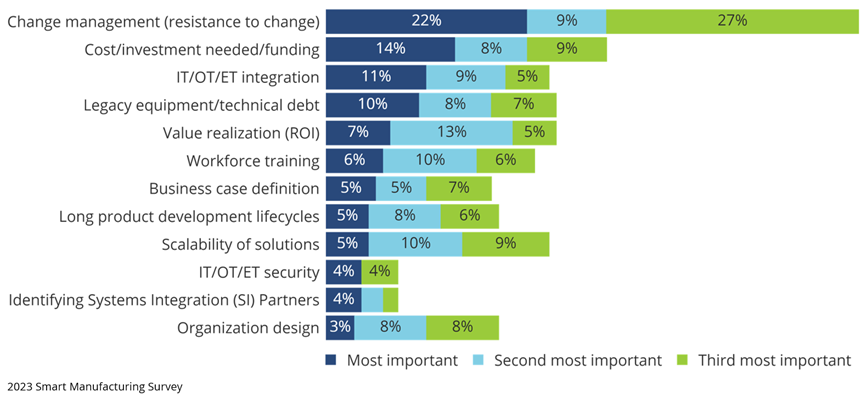

Top 3 Challenges to Adopting or Progressing Smart Manufacturing Initiatives

Source: ISG Market Lens™

5 Common Challenges to Outsourcing

Mid-tier manufacturers that take on outsourcing initiatives often face similar challenges to larger manufacturers:

- Resistance to change: The 2023 ISG Smart Manufacturing survey indicated 22% of organizations believe resistance to change (change management) is the most challenging aspect of their transformation objectives. This might be active or passive resistance. The programs often create uncertainty for existing employees, who may decide to look elsewhere for employment. Many organizations struggle with internal communication. Effective communication is the linchpin of successful transformation. Communication barriers lead to misunderstandings, delayed project timelines and subpar results.

- Poor cost estimate: Enterprises often look to outsourcing partners to optimize their budgets, which may not deliver the desired outcomes if insufficiently planned. Mid-tier organizations commonly struggle to estimate precise costs, requirements, timelines and resources, which means they struggle to properly estimate their ROI from such programs.

- Lack of strategic roadmap/vision: Mid-tier organizations that are just getting started with outsourcing may find the entire process daunting. It pays off to know industry standards, average prices and best practices before jumping in.

- Insufficient selection process: Trustworthiness is a crucial element for any business for a strategic partner to help it achieve its desired outcomes. But organizations often fall short on conducting thorough due diligence of potential service providers. Selecting an appropriate provider does not only involve the scope of work, price and quality, it also depends on factors like geographic location, innovation strategies, ease of transport and managerial skills. Manufacturers should ensure that the provider understands their products and implementation processes.

- Technical debt: Technical debt has created a significant roadblock for manufacturers deploying emerging technologies. The increased burden is not unusual, as global enterprises have implemented many disparate solutions across multiple organizational functions and locations to meet their needs. Managing and reducing technical debt clears way for organizations to become agile in their development processes, increasing their ability to adapt to evolving consumer experience and implement market-leading solutions to drive cost, quality and efficiency.

Why Mid-tier Manufacturers Are Outsourcing Now

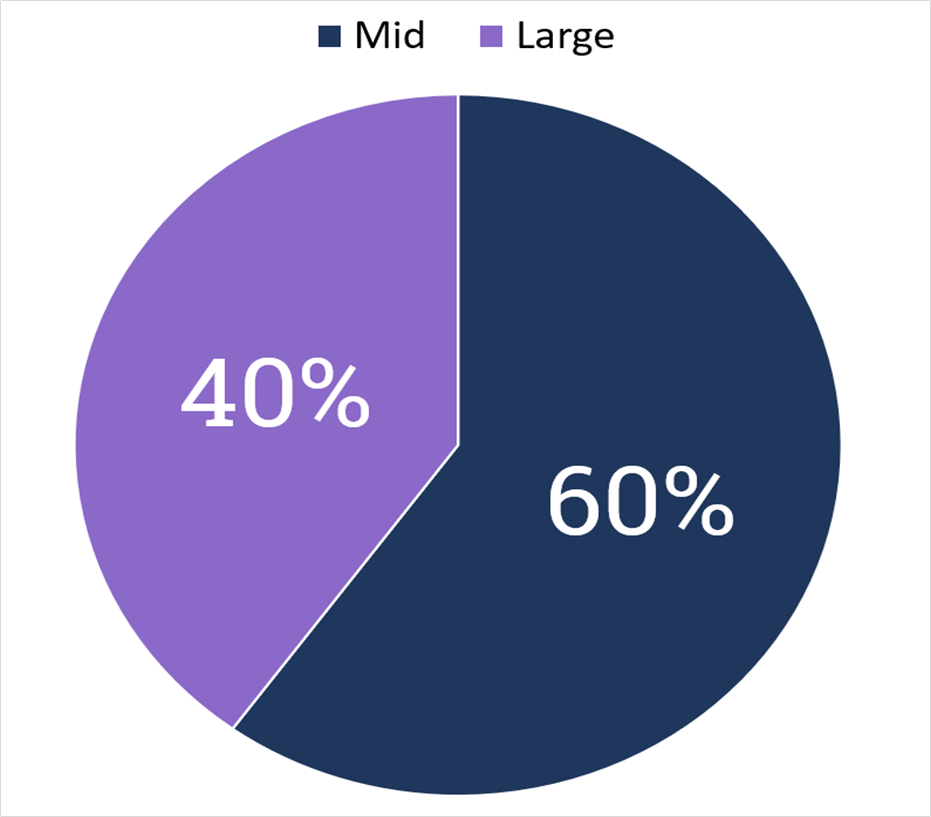

The outsourcing market today is dynamic. Fueled by globalization and technological advancements, IT and business services providers can bring enterprises cost-efficiency and specialized expertise. In the past, many small and mid-tier organizations were priced out of the market or didn’t have the tech backbone necessary to properly integrate outsourced contributions. Though traditionally unable to fully leverage the benefits of outsourcing, mid-tier organizations in recent years have been increasingly able to take advantage of this powerful strategy to help them focus on initiatives that drive shareholder value. ISG observes that 60% of mid-tier organizations prefer to outsource one or more business function.

Figure 2: Percentage of organizations outsourcing globally in the Manufacturing industry (2017-2022), Source: ISG Contracts KnowledgeBase

ISG believes that mid-tier organizations are increasingly turning to outsourcing IT systems and business processes to reduce cost, increase organizational agility and focus more on core competencies. In other words, they outsource for the same reasons their larger, global counterparts do. Mid-market organizations are increasingly outsourcing critical business functions - ranging from Finance, HR, Payroll and IT to Engineering.

Here are six reasons mid-tier manufacturers are outsourcing now:

- Cost optimization. Transforming internal operations comes with significant expense. Launching a new product or improving a peripheral function involves adding staff, purchasing new equipment or acquiring new physical space. These investments can be economical if done at scale. However, mid-tier organizations rarely benefit from this advantage. As a result, outsourcing often offers the lowest-cost option to accelerate these programs. For example: SEG Automotive emerged from the BOSCH Starter Motors and Generators division in January 2018, and signed a five-year sourcing contract with DXC Technology. This contract helped SEG Automotive benefit from cost optimization and risk reduction, as well as critical security, cloud and applications capabilities across its entire technology stack.

- Focus on core competencies: Mid-tier organizations benefit from outsourcing by getting rid of an array of routine and repetitive tasks, thus giving more time to manage their major business initiatives that require greater organizational focus.

- Scaling staff: The cost and time of hiring new employees is a major challenge. Outsourcing allows provider resources to be integrated into projects and critical tasks instantly. The number of resources can be scaled up or down, depending on the requirement. This gives enterprises unprecedented control of project management, without having to dedicate time and resources to hiring and training new employees.

- Access to improved technology: Many large enterprises can afford their own warehouse management and transportation management systems, while mid-tier organizations struggle to do so. Working with an external service provider, mid-tier organizations gain access to state-of-the-art tools without capital investment in those systems.

- Improved security: Outsourcing allows organizations to gain access to additional security services, such as data protection, monitoring and backup. Service providers can flag and monitor unusual network activity, update essential software, such as anti-virus, and ensure good cybersecurity practices. This is advantageous for organizations that cannot afford to invest in cybersecurity infrastructure or that have dangerous gaps in coverage. These gaps can impact business functions beyond IT.

- Accelerated innovation: Mid-tier manufacturers need innovation to remain agile and competitive in the face of rapidly changing markets and customer needs. For example, generative AI (GenAI) can enhance customer engagement and satisfaction through personalization, real-time insights, predictive analytics, continuous improvement and optimized customer journeys. With the help of a provider, mid-tier manufacturers can leverage GenAI for pricing optimization, demand forecasting, enhanced sales support and data-driven decision-making. Moreover, organizations are savings costs and improving overall financial performance by implementing GenAI to automate processes, optimize resources, implement predictive maintenance, streamline the supply chain and mitigate risks.

Turning the Business around with an Outsourcing Partner

Peloton bikes became hugely popular during the height of COVID-19 as people exercised at home. The spike in popularity prompted the company to expand production capacity, announcing plans for its first U.S.-based factory in Wood County, Ohio, in 2021. However, soon after the pandemic, it witnessed a significant reduction in sales and share prices. Due to a massive dip in demand, Peloton had to halt the production of its equipment. Its share prices tanked by more than 70%, CEO John Foley resigned and the company laid off more than 2,800 employees.

In a bid to turn the money-losing business around, the organization decided to exit all its in-house manufacturing and concentrate on expanding its current relationship with Taiwanese manufacturer Rexon Industrial. It chose Rexon Industrial to manufacture its bikes and treadmills as part of its strategy to simplify the business and reduce costs. The company also took steps to simplify its supply chain strategy to reduce the cash burden on the business and increase its flexibility. Beyond expanding its partnership with Rexon, Peloton started working with additional third-party manufacturing partners, Pegatron Corp, to build a new product, the Peloton Rower.

Peloton expects that outsourcing will reduce its production expenses annually by approximately $45 million. The organization’s goal is to cut per-product final mile delivery costs by half. It also plans to rationalize its cost structure to bring overall spending in line with the revenue run rate of the business.

How to Construct and Execute an Outsourcing Strategy

Regardless of an organization’s specific situation, the starting point is to focus on a basic strategy. First ask what needs to be accomplished, whether that be cutting costs, acquiring capabilities, adding capacity or accelerating innovation. While this sounds obvious, many initiatives fail at this early stage. To facilitate program success, key stakeholders must be involved so the strategy is articulated, understood and communicated across both the organization and potential partners.

Mid-tier manufacturers should keep these considerations in mind when they embark on an outsourcing strategy:

- Understand the existing environment. Get a clear understanding of current baseline costs and service quality in the context of competitive market trends.

- Big is not necessarily better. Mid-tier organizations may not be best served by the largest, most well-known service providers. Detailed and reliable market intelligence regarding the capabilities of tier two and niche service providers will help companies assess their business requirements against options to identify the appropriate candidates and ensure an effective match.

- Do not underestimate internal management requirements. Sourcing does not mean abdication of management responsibility. Despite years of experience with outsourcing, many businesses continue to underestimate the retained resources required to manage a service provider. Starting with transition, the organization must dedicate sufficient resources to effectively manage its side of the relationship.

- Put the right team in place with the right tools. The internal team tasked with managing an IT or business services provider may lack the necessary skills. Individuals thrust into a new role often revert to their comfort zones of “doing” rather than “supervising;” duplicating effort and inefficiency. To avoid this potential for value leakage, organizations need to evaluate skills and requirements and invest in training and proven governance tools and frameworks.

- Focus on continuous improvement. Effective partnerships are never a one-and-done proposition. They require ongoing attention and governance. While the sourcing arrangements of mid-tier organizations may be less complex than their global counterparts, the stakes for business success are every bit as high.

- Facilitate innovation and transformation. Increasingly, mid-tier manufacturers seek to use outsourcing to transform their operational environments and fundamentally change their way of doing things. To succeed in this approach, service providers need to bring innovation to the table. To foster innovation, organizations must allow their service providers the flexibility and leeway to leverage expertise in the name of meaningful outcomes. In terms of structuring the agreement, this means a greater focus on the “what” of the desired outcome and a less prescriptive approach to defining the “how” of service delivery.

ISG helps manufacturing enterprises of all sizes navigate a rapidly changing outsourcing market, define a custom strategy for their business needs and find a best-fit service provider. We also help clients create contracts and deals that serve their long-term success. Contact us to find out how we can get started.

Acknowledgement

This paper benefited from the contribution of Shashikala M, Lead Research Specialist and Soumyadeep Pal, Analyst.