Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Engineering

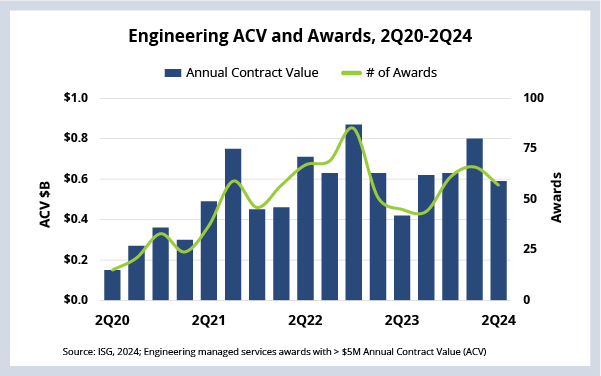

Growth in engineering services has slowed of late after a sharp surge in 2021-22.

Data Watch

Background

Companies in sectors like manufacturing, aerospace, automotive, healthcare and energy continue to be laser-focused on building data-driven information flows into design, manufacturing, distribution and aftermarket support processes. This is known as the digital thread.

But building this thread is hard. Really hard. That’s because firms that are good at building things now need to be good at stitching together things that were once siloed, like systems, processes and data. And they need to do it at scale – and at a price point that makes sense.

It’s this need that drove the strong demand for engineering (or ER&D) services after the pandemic. However, when discretionary spending started coming under pressure in early 2023, new contract awards in engineering services slowed (see Data Watch).

The great news for the industry is that engineering activity has stabilized and could be poised for further growth when macro conditions improve.

The Details

- YTD, engineering annual contract value is up 33%.

- There were 28% more engineering awards in 1H24 than in 1H23.

- On a regional basis, the majority of 1H24 ACV growth came from the Americas and APAC.

- In terms of industry, most of the growth was in the energy and healthcare sectors.

What’s Next

Spending in the engineering market today continues to be largely in-house as opposed to outsourcing. And a lot of this internal spending is done through global capability centers (GCCs). As we’ve discussed, some GCCs are thriving while others are struggling to find the talent at the scale and cost they need.

And, when companies do go external for engineering services, they tend to do so with project-based or staffing engagements. Outsourcing awards in this space – like ADM – are very susceptible to downturns in discretionary spending. This is one of the reasons for the slowdown in 2023.

The combination of two factors – 1) continued scarcity of engineering talent at the scale and price that enterprises need and 2) a potential easing of discretionary spending pressure – could be signaling that engineering services is poised for future growth.