Hello. This is Alex Bakker and Loren Absher with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

AI

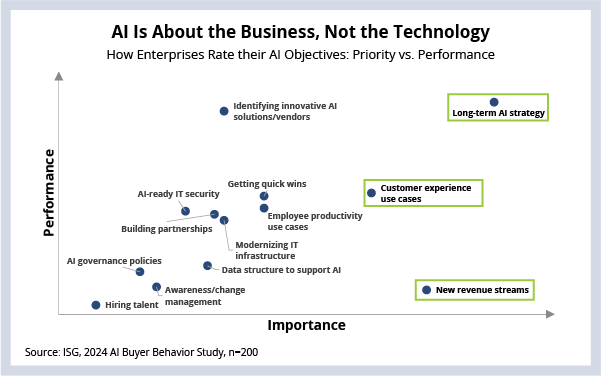

Our recent study on AI adoption, plans and priorities indicates that organizations’ top three priorities for AI include: 1) creating a long-term AI strategy and roadmap, 2) developing AI use cases that build new revenue streams, and 3) developing AI that improves customer experience. To date, performance has been inconsistent across these priorities. (See Data Watch) Enterprises feel they are performing well on developing roadmaps, middling on customer experience and poorly on developing revenue-generating use cases.

Background

As we discussed a few weeks ago, organizations have ambitious plans for the number of AI-enabled applications they plan to deploy in the next 12 months, and they have plans to allocate more budget to AI in service of those goals. Most organizations have been adopting predictive AI for several years in limited scope, but the advent of generative AI models available for commercial use in late 2022 changed the level of interest and the rate of AI adoption at nearly every enterprise.

What’s Happening?

The current round of AI adoption is markedly different than normal technologies because business lines do not view it as a technology to be left to the IT department. The ability for people to interact with AI in a natural way has businesses pushing aggressively for customer-facing, commercial and strategic objectives – as demonstrated by the importance placed on revenue and long-term strategy for AI.

For IT service providers, the rapid adoption is both a blessing and a curse. On the positive side, AI is still a technology that businesses need help enabling and operating, and service providers have the experience to drive technology adoption, transformation and efficient operations. On the negative side for providers is the novelty of the technology and enterprises’ explicit focus on revenue when it comes to AI. This puts IT services providers in the difficult position of having to help their clients not only operate their technology, but also operate their businesses.

Enterprises indicate that the areas where IT service providers are falling short of expectations are: 1) holistic understanding of their clients’ business needs, 2) delivering projects to time, scope and cost, 3) deep industry-specific knowledge about how to apply AI, and 4) creating a provider ecosystem that can help drive business growth.

Enterprises are eager to adopt AI at scale, and service providers are eager to bring AI into their solutioning process, but for most service provider and client relationships, it appears some value is being left on the table. The early use cases being implemented for GenAI have all tended to focus on internal efficiencies. We expect to see a push for more strategic and revenue-focused use cases as the business ramps up pressure.

If service providers can expand their sights from driving IT outcomes to driving business outcomes with AI, they will also be tapping into new budget centers for funding AI investments that help them grow the revenue enterprises want.