Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

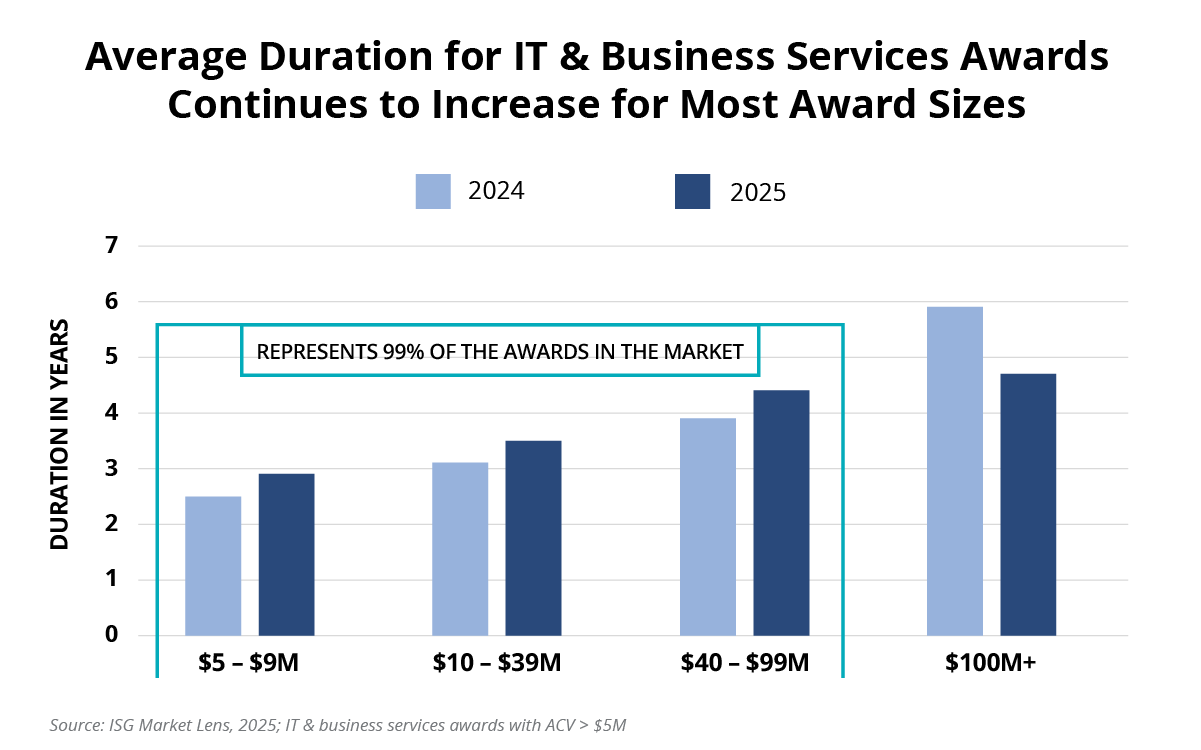

The average duration of IT and business services awards continues to lengthen as enterprises increasingly focus on cost optimization through technology and operating model transformation.

Data Watch

Background

As we flagged in July of 2025, durations for IT and business services deals had been steadily creeping up since 2023. That trend continued in the second half of 2025 with durations up across every award size except mega awards (see Data Watch).

The Details

- Durations are up 12% on average for 99% of awards in the market.

- Durations for mega awards, which represent about 1% of all awards, are down by nearly 30%, but still well above their five-year average.

What It Means

As we discussed in another brief from late in 2024, we believe this lengthening of durations is largely due to the continued focus on transformation-led cost optimization:

“… savings generated by cost optimization-focused agreements are not from process improvements and labor arbitrage alone. They are increasingly also coming from transformation … not just to the underlying technology, but to the operating model as well. These are enterprise-wide changes that often have very complex scopes and transitions.”

But there’s an interesting dynamic in the market right now. While durations are growing, ACV is largely flat. As we discussed on the 4Q Index Call last week, managed services annual contract value (ACV) was up just 1.3% in 2025. So even in an environment where ACV is flat, we can still see strong total contract value (TCV) growth as long as durations are increasing. And that’s what’s happening right now. TCV was up 8% in 2025, 19% in 2024 and 8% in 2023. That’s the best three years of TCV growth in over 15 years.

So the question as we move into 2026 is: will durations continue to increase? Possibly. In the late 2000s and early 2010s, durations were similar or longer across many of these award size bands. This was after the financial crisis, when cost optimization was a big priority. So today, deals could still get longer.

Our 2026 forecast shows modest ACV growth of 2.1%, so it’s possible that we will continue to see TCV growth, as long as deal durations keep increasing in order to optimize costs through technology and operating model transformation.