If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ATTRITION

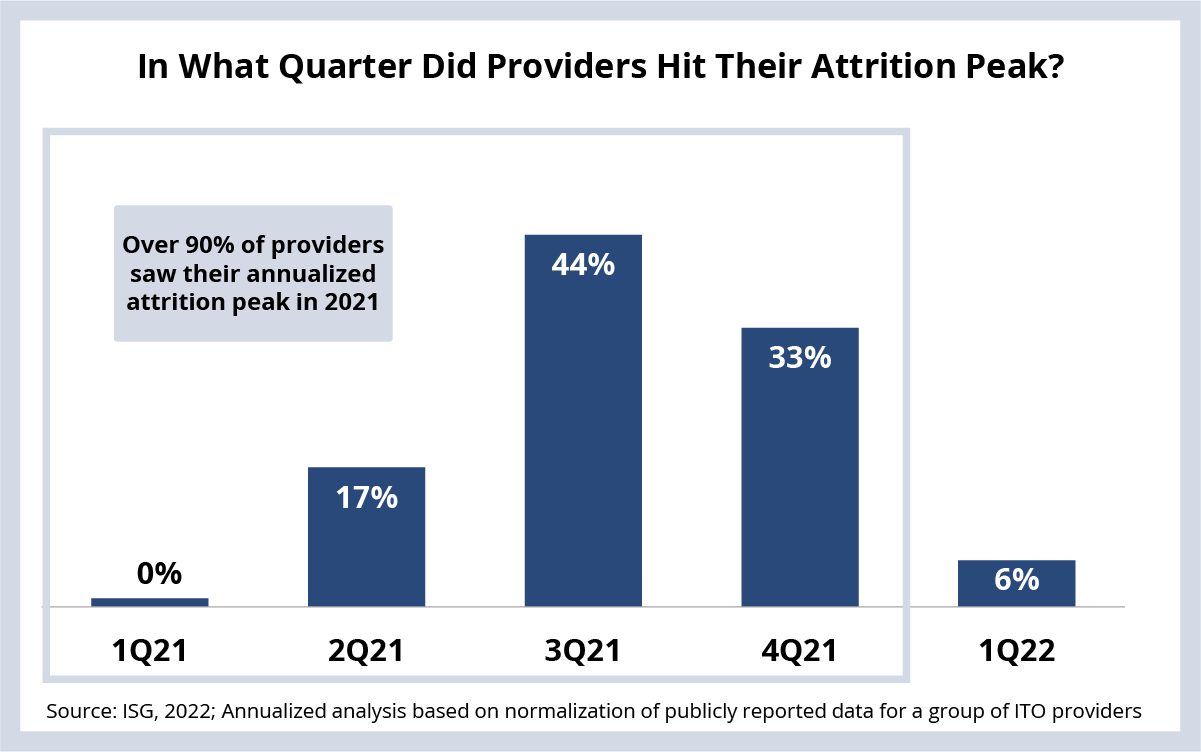

Attrition is declining from 2021 levels for most providers. As we discussed at the beginning of earnings season, we started to see some data points indicating that attrition may have peaked. Now that we are through earnings season, it’s clear that attrition is stabilizing at levels below 2021 peaks.

We looked at a group of providers across all revenue ranges. As you can see in this week’s Data Watch, more than 90% saw their attrition reach its highest point during 2021.

The key is to look at attrition through an annualized lens. Most providers report to the market using a last twelve months (LTM) metric. While LTM is valuable, it shows what happened over the past year. Annualized attrition is a better representation of what’s happening now.

What this data means is that providers are finding ways to manage attrition more effectively by adapting their operating models to manage growth in a high-attrition environment.

To be clear, we are not saying the attrition problem is solved. We continue to see both clients and providers struggling mightily to staff and backfill critical roles. And this is, of course, having a significant impact on service delivery for many enterprises.

And the challenge is unlikely to go away any time soon. Demand for IT services remains robust. ACV values are at all-time highs; it has remained above $8.5 billion for four consecutive quarters – a record for the industry. This means that competition for in-demand skills will stay fierce – putting pressure on both enterprises and providers to find and retain talent.

DATA WATCH